Pre-IPO Incentive Stock Options (ISOs) Tradeoffs

Deciding when and how to manage your stock options, especially with a potential IPO on the horizon, can be daunting. You're likely wondering: Should I exercise my Incentive Stock Options (ISOs) before the IPO? How can I leverage these ISOs to reach my financial goals while still benefiting from its potential growth?

Before exercising your ISOs pre-IPO, consider these benefits and drawbacks that come with this decision. These factors can help you evaluate potential impacts on your taxes, risk profile, and overall financial situation.

Advantages:

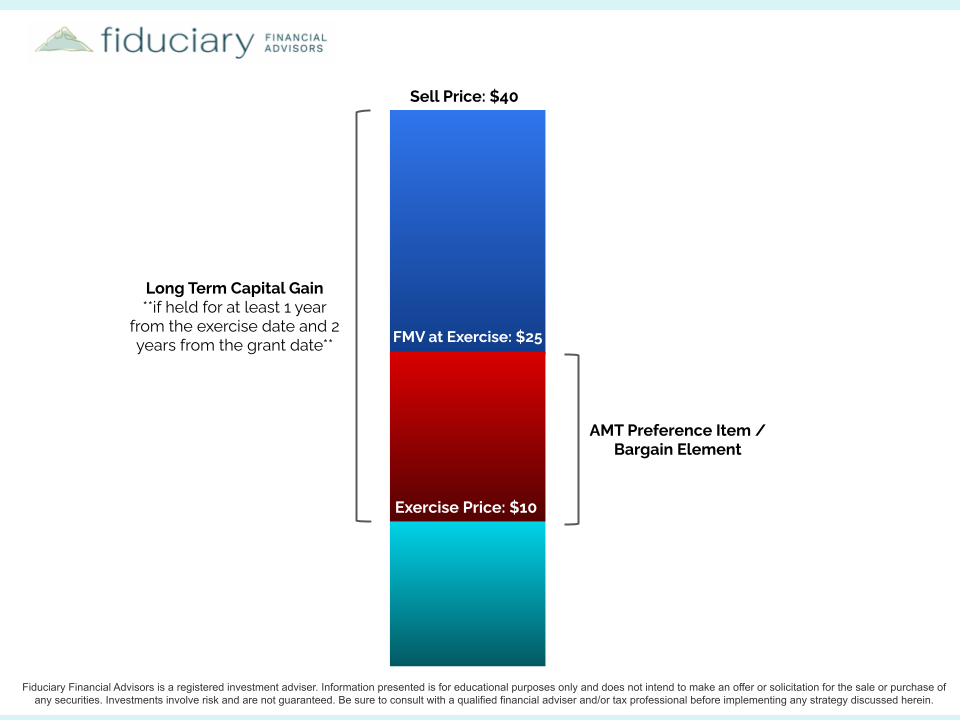

Favorable Tax Treatment Sooner: ISOs qualify for long-term capital gains if held for at least one year from the exercise date and two years from the grant date before selling. Exercising pre-IPO accelerates you towards this favorable tax status.

Potential for Lower Alternative Minimum Tax (AMT) Bill: If the Fair Market Value (FMV) of your shares pre-IPO is lower than post-IPO, your AMT liability may be reduced if you exercise before the company goes public.

Disadvantages:

Cash Requirement: Exercising ISOs requires a substantial amount of cash, not just for the exercise itself, but also for any potential AMT obligations.

Company and Illiquidity Risk: There's a risk that your company's IPO may be delayed or not happen at all. This means your cash is tied up in illiquid shares. Even with an IPO, you'll likely face a lock-up period (90-180 days) during which you can’t sell your shares.

In summary, if you have readily available cash you're comfortable deploying and believe strongly in your company's long-term value and growth, exercising ISOs pre-IPO can be one potential strategy for those comfortable with the associated risks and liquidity considerations. However, be mindful that immediate liquidity may not be an option due to the factors mentioned above. If your primary goal for exercising pre-IPO is to fund short-term needs, this strategy carries significant risks. But if you have flexibility regarding when you'll need access to your cash, pre-IPO exercise is a viable consideration.