What to do with RSUs?

As an employee of a public tech company, navigating your equity compensation package can be complex. Should you hold onto your shares for the long term, or is selling sooner a better

option? And if you sell, how much and when? Let's explore a common scenario:

I'm a public tech company employee, and my vested RSUs account for 40% of my net worth. I'm halfway to saving a down payment for my dream home and also aim to retire

early in 15 years. How can I optimize my stock compensation?

A 40% concentration in a single stock presents significant risk. While your company’s stock could perform very well, it could also decline substantially, even to zero in extreme cases.

Consider gradually selling down your RSUs in a tax-efficient manner until they represent 10% or less of your net worth. Here’s how you can achieve this:

Strategically sell specific share lots: Prioritize selling shares with the least unrealized gains or the most unrealized losses. This frees up cash for short-term goals and diversifies your concentrated stock position tax-efficiently.

Leverage tax loss harvesting: Utilize any tax loss harvesting opportunities within your brokerage account to offset capital gains or income.

Immediately sell future quarterly RSU vests: These are already taxed as ordinary income upon vesting, offering minimal tax advantages if held. Selling them immediately also provides cash to cover tax liabilities that exceed the flat withholding rate.

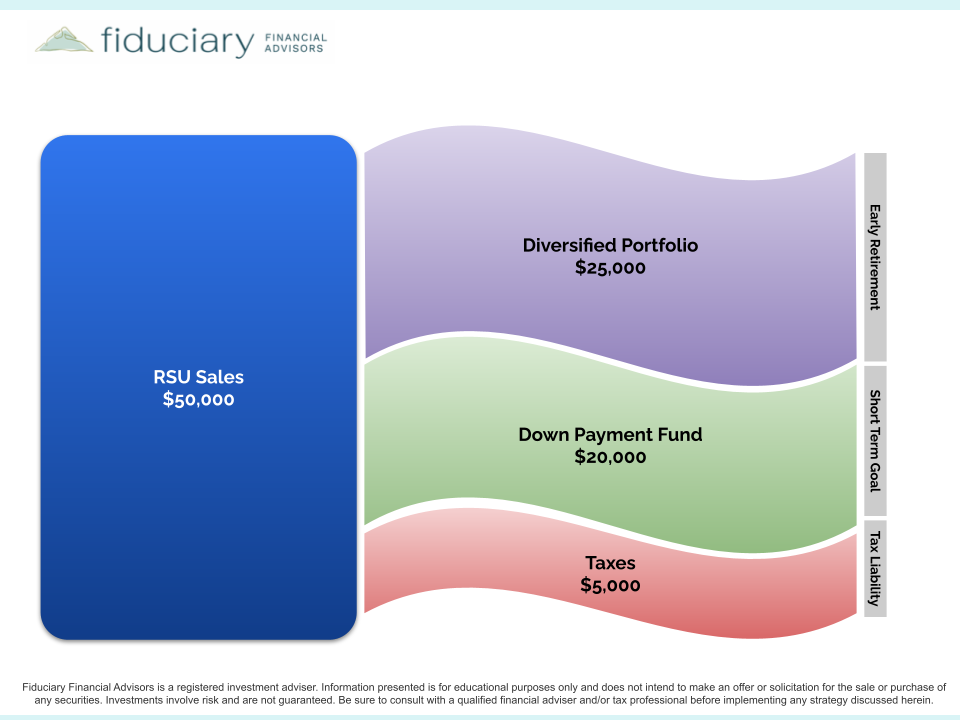

The proceeds from your RSU sales can be used to:

Contribute to a diversified portfolio: This can help reduce concentration risk and support your long-term financial goals, including early retirement if market and personal factors align.

Add to your down payment fund: For short-term goals, keeping funds in a high-yield savings account can help preserve liquidity and reduce exposure to market fluctuations.

Make quarterly estimated tax payments: This covers your current tax liability and helps avoid penalties and interest. Consult with a tax professional and/or financial advisor for a tax projection.