The Smart Money Moves You're Probably Not Making: Roth Strategies

Roth Conversions

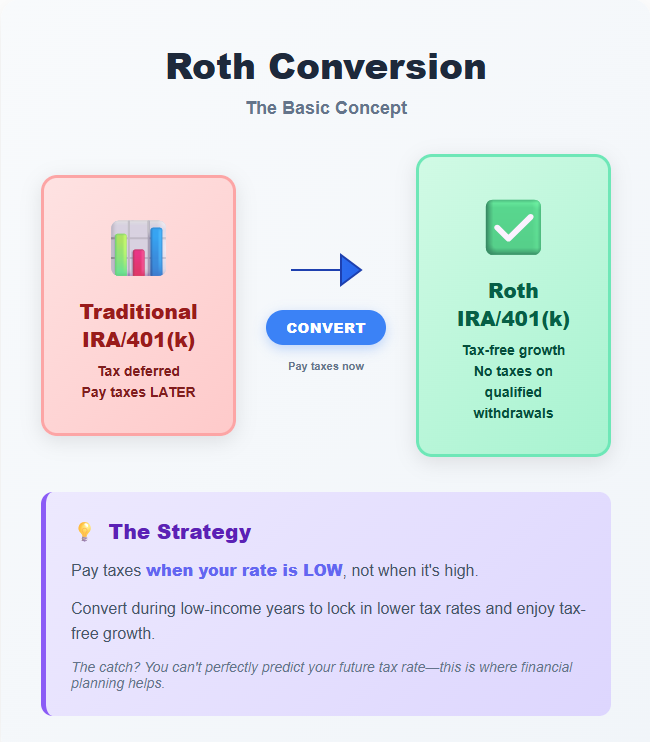

The first strategy I’m going to talk about is called a Roth conversion, and here's the simple version: you move money from your traditional retirement account (where you'll pay taxes later) into a Roth account (where qualified withdrawals may be tax-free). Yes, you pay taxes now when you convert, but you may pay less overall depending on your tax rates, timing, and other factors.

The idea is simple: pay taxes when your rate is low, not when it's high. The catch? You can't perfectly predict your future tax rate. (This is one area where doing a financial plan can shine).

The Basics: Two Types of Retirement Accounts

Traditional 401(k)/IRA: You get a tax break now, pay taxes later when you withdraw in retirement.

Roth 401(k)/IRA: No tax break now, but your money grows tax-free forever. Qualified withdrawals are generally tax-free (withdrawals on growth before you are 59½ are not tax-free).

Roth conversion: Moving money from traditional → Roth. You pay taxes on the amount you convert this year, but then it's tax-free as it grows in the Roth account.1

When NOT to Convert

Skip Roth conversions if:

You'll be in a lower tax bracket later. If retirement income will be much lower than now, wait and pay less tax later.

You need the money within 5 years. There's a 5-year waiting period to avoid penalties on the converted funds.5

You don't have cash to pay taxes. Don't use the retirement money itself to pay the increased tax bill; in part, this defeats the purpose (especially for those under 59½, where the tax withholding will be penalized as an early distribution).

Your health insurance costs are affected more than the tax benefit of the conversion. Conversions count as income and can reduce ACA subsidies, and may push you into a higher IRMAA bracket if you are on Medicare.6

Quick Action Steps

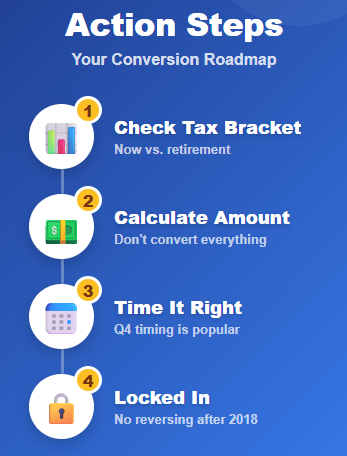

Check your current tax bracket. Will it be higher or lower in retirement?

Determine how much. You don't have to convert everything, and should base the amount you convert on your tax estimates.

Time it right. Many people wait until Q4 to see their full-year income before converting.

Remember: no take-backs. You can't reverse a Roth conversion after 2018 tax law changes.10 Make sure you're confident before doing it.

You can convert a little each year or a lot—whatever makes sense for your situation.2

There’s More: Mega Backdoor Roth

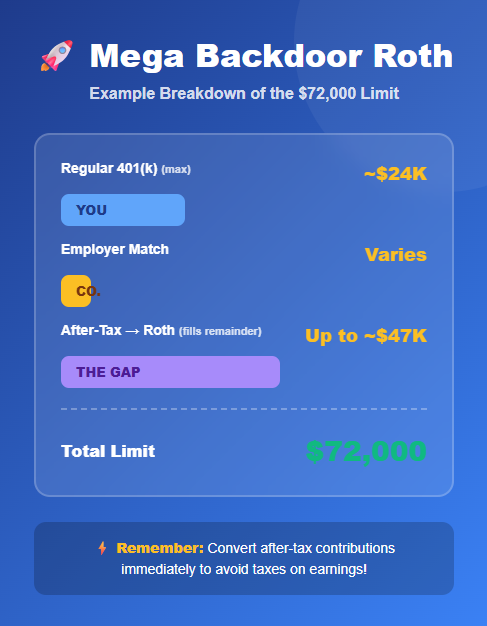

The second Roth strategy applies if you max out your 401(k) and want to save even more tax-free. The mega backdoor Roth lets you contribute up to $47,500 extra (in 2026) to a Roth account.11,12

How it works:

Regular 401(k) limit (ignoring the additional ‘catch-up’ for those 50+): $24,500

Total contribution limit (including employer match): $72,000

The gap between these? You can fill it with "after-tax contributions"

Then immediately convert those to Roth

Requirements:

Your employer's 401(k) must allow after-tax contributions

Your plan must allow in-service conversions or withdrawals13,14

Common at big companies

Example: You contribute $24,500, your employer adds $4,500 match. That's $29,000 total. You can add another $43,000 as after-tax contributions and convert to Roth, giving you nearly $72,000 in retirement savings for the year.

Tax tip: Convert the after-tax contributions frequently to avoid taxes on earnings. Many plans do this automatically.15

Check with your HR department to see if your plan offers this option.

Benefits of Roth Accounts

Beyond saving on taxes, Roth accounts give you:

No forced withdrawals. Traditional IRAs have ‘Required Minimum Distributions’ (RMDs) which require you to start taking money out once you reach the required age.3 Roth accounts don't.

Flexible retirement planning. Roth withdrawals don't count as taxable income, so they won't increase your Medicare costs or affect Social Security taxes.4

Better for heirs. Your beneficiaries inherit Roth accounts tax-free.

Bottom Line

Using Roth accounts effectively may save you thousands in taxes over your lifetime, but the key is timing.

Best candidates for Roth Strategies:

Between jobs or careers

Early retirees (ideally before Social Security & RMDs)

Anyone in an unusually low tax year

High earners who can do a mega backdoor Roth

Now that you know these options exist, pay attention to your income each year. When you spot a low-income window, you may have an opportunity to convert at a lower rate if it aligns with your tax and planning considerations.

Next step: Talk to a financial planner with experience with software to see if a conversion makes sense for your situation this year, or in the near future.

This article is for educational purposes only and should not be considered tax or financial advice. Individual circumstances vary, and you should consult with a qualified financial planner or tax professional before making decisions about Roth conversions.

Sources and References

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Vanguard. "Is a Roth IRA conversion right for you?" Vanguard Investor Resources & Education. https://investor.vanguard.com/investor-resources-education/iras/ira-roth-conversion

Internal Revenue Service. "Retirement topics - Required minimum distributions (RMDs)." Updated January 29, 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

Charles Schwab. "Required Minimum Distributions: What's New in 2026." https://www.schwab.com/learn/story/required-minimum-distributions-what-you-should-know

Lord Abbett. "Quick Answers: The Five-Year Rule and Important Info on Roth IRA Conversions." August 7, 2024. https://www.lordabbett.com/en-us/financial-advisor/insights/retirement-planning/quick-answers-the-five-year-rule-and-important-info-on-roth-ira-.html

Vision Retirement. "Roth IRA Conversions: Rules, Restrictions, and Taxes." January 2026. https://www.visionretirement.com/articles/investing/basics-of-roth-ira-conversions

Fidelity. "Qualified Charitable Distributions (QCDs)." https://www.fidelity.com/retirement-ira/required-minimum-distributions-qcds

Internal Revenue Service. "IRS releases tax inflation adjustments for tax year 2026, including amendments from the One, Big, Beautiful Bill." October 9, 2025. https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2026-including-amendments-from-the-one-big-beautiful-bill

Tax Foundation. "2026 Tax Brackets and Federal Income Tax Rates." February 11, 2026. https://taxfoundation.org/data/all/federal/2026-tax-brackets/

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Internal Revenue Service. "Retirement topics - 401(k) and profit-sharing plan contribution limits." Updated January 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

Empower. "Mega Backdoor Roth: How It Works and Its Benefits." 2026. https://www.empower.com/the-currency/money/mega-backdoor-roth

Fidelity. "What is a mega backdoor Roth?" February 28, 2025. https://www.fidelity.com/learning-center/personal-finance/mega-backdoor-roth

NerdWallet. "Mega Backdoor Roths: How They Work, Limits." Updated February 2, 2026. https://www.nerdwallet.com/retirement/learn/mega-backdoor-roths-work

Internal Revenue Service. "Rollovers of after-tax contributions in retirement plans." https://www.irs.gov/retirement-plans/rollovers-of-after-tax-contributions-in-retirement-plans

Are Your Portfolio and Retirement Plan Up To Date?

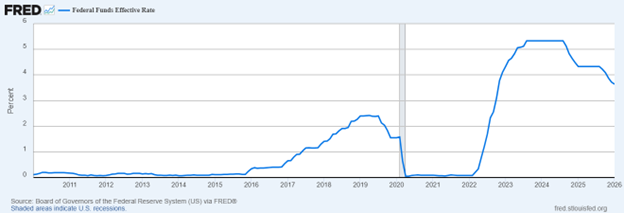

Markets have delivered strong gains in recent years. A strong equity run may have boosted your portfolio but it may also have increased your overall risk exposure. Interest rates remain elevated compared to the pre-2022 era, but have been on the decline since the last peak (shown in the FRED graphic below)¹.

As we move into 2026, it’s worth reviewing both your investment strategy and your retirement savings plan to ensure they remain aligned with your long-term goals.

Revisit Your Diversification

Consider the following:

Are you diversified across sectors and industries?

Do you include international exposure?

What is your balance among large-, mid-, and small-cap stocks?

What is your philosophy when it comes to growth and value stocks?

Has market performance caused your allocation to drift beyond your intended targets?

If equities now represent a larger share of your portfolio than planned, rebalancing may help realign risk.

Rebalancing and Tax Implications

Rebalancing restores your target allocation and can help manage portfolio risk. While doing so, consider tax efficiency:

Capital losses offset capital gains.²

Up to $3,000 in excess net losses may offset ordinary income annually.²

Selecting higher cost-basis shares when selling can improve after-tax outcomes. At the same time, you will need to pay attention to short-term vs. long-term capital gains.

If you have accounts with different tax types, you may also consider implementing an ‘asset location’ strategy.

The Role of Cash

Cash serves as a stability buffer, not a growth engine. Maintaining three to six months of living expenses in liquid savings can provide flexibility and a liquidity buffer for unexpected events.³

At the same time, holding excessive cash may hinder long-term growth. Ensuring your emergency funds are earning competitive yields while remaining accessible can improve overall efficiency.

If you have more cash than what’s needed for your emergency fund, you don’t have to get it invested all at once. Dollar-cost averaging, investing gradually over time, can reduce the risk of poor timing decisions during volatile periods.

Retirement Savings: 2026 Contribution Limits

The IRS has increased retirement plan contribution limits for 2026.⁴

2026 Limits

401(k), 403(b), 457(b), TSP: $24,500⁴

Catch-up (age 50+): $8,000⁴

Enhanced catch-up (ages 60–63): $11,250⁵

IRA contribution limit: $7,500⁴

IRA catch-up (age 50+): $1,100⁴

Individuals age 50 or older may contribute up to $32,500 to a 401(k), while those ages 60–63 may contribute up to $35,750, before employer matching.

Additionally, under SECURE Act 2.0, certain higher-income earners are required to make catch-up contributions on a Roth (after-tax) basis beginning in 2026.⁵

If your income has increased, consider raising your contribution percentage. Incremental increases can have a significant long-term impact due to compounding.

Saving by Career Stage

Early Career:

Start early and contribute at least enough to receive your employer match. With decades ahead, a higher equity allocation may be appropriate depending on risk tolerance.

Mid-Career:

Maximize tax-advantaged contributions as income grows to enhance tax efficiency and accelerate savings. Monitor employer stock exposure to avoid concentration risk.

Approaching Retirement:

Take full advantage of catch-up provisions. Gradually adjusting risk exposure may make sense, but maintaining some growth allocation remains important for long retirements.

The Big Picture

Preparing for 2026 isn’t about predicting markets. It’s about maintaining discipline:

Diversify thoughtfully.

Rebalance regularly.

Use tax-efficient strategies.

Maximize retirement contributions.

Adjust your plan as your goals change.

Strong markets can build wealth. Consistent, informed planning helps preserve it.

Notes

Taken from https://fred.stlouisfed.org/series/FEDFUNDS#, using a date range from January 1st 2010 thru January 1st 2026

Internal Revenue Service. Topic No. 409 Capital Gains and Losses. IRS, 2024.

Consumer Financial Protection Bureau. Emergency Savings and Financial Stability. CFPB, 2023.

Internal Revenue Service. “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” IRS Newsroom, 2025.

U.S. Congress. SECURE 2.0 Act of 2022, Pub. L. No. 117-328, 2022.

Moving Across the Country: From For Sale to Fully Settled

Moving is one of life’s bigger transitions—emotionally, logistically, and financially. Whether you’re relocating for a new job, upsizing for a growing family, downsizing into retirement, or chasing a new lifestyle, the ripple effects of a move go far beyond the moving truck.

Since my husband and I were married almost 12 years ago, we’ve moved quite a bit. We’ve lived in Indiana, Florida, Michigan, California, South Carolina, and Idaho all within that time frame. It’s been a gift to chase career dreams and adventure as a family, but it doesn’t come without difficulty.

Most recently, we made a move that reshaped my family’s life: relocating from Charleston, South Carolina to Boise, Idaho. On paper, it might have looked straightforward. In reality, it held financial decisions, emotional transitions, and logistical implications — all at once.

As a financial planner and someone who has lived this personally, I want to share both the practical money considerations and the less-discussed emotional and community impacts of moving. With the right strategy, a relocation can become an opportunity to strengthen—not derail—your financial foundation.

1. Understand the True Cost of Moving

Many people underestimate how expensive relocating really is. Beyond movers or truck rentals, total costs often include:

Realtor commissions and closing costs

Home repairs, staging, or cleaning

Storage fees

Travel and lodging

Temporary housing

Utility deposits and installation fees

New furniture or appliances

Overlapping rent or mortgage payments

Pro Tip:

Build a full moving budget before committing. Add a 10–20% buffer for surprises. If your move is job-related, confirm which expenses are reimbursed—and understand the tax treatment of those benefits. (Pro tip: not all states consider reimbursement of moving expenses nontaxable!)

2. Cash Flow Is King During a Move

Relocations tend to compress expenses into a short period of time. Even financially positive moves can feel stressful if cash flow gets tight.

Common pressure points include:

Carrying two housing payments at once

Paying for a move before a home sale closes

Delayed security deposit refunds

Employer reimbursement delays

Pro Tip:

Stress-test your emergency fund. Timeline planning with your cash flow can become critical.

3. The Housing Decision Has Long-Term Impact

Housing affects far more than your monthly payment. Property taxes, insurance, HOA dues, utilities, maintenance, and commuting costs all shape long-term cash flow.

Key questions to ask:

Is this payment sustainable if income changes?

Are property taxes materially different from my current state?

Will utilities or insurance costs increase?

How long do I realistically plan to stay?

4. State Taxes Can Make a Big Difference

Crossing state lines can dramatically alter your tax picture. Differences may include:

State income taxes

Capital gains treatment

Property and sales taxes

Estate or inheritance taxes

A move from a low-tax state to a higher-tax state (or vice versa) can meaningfully impact your ability to save, invest, or spend.

Pro Tip:

Run a side-by-side comparison of your current and future tax burden before moving—especially if you’re a high earner, business owner, retiree, or receive equity compensation. Taxes usually don’t decide the move for you, but they can’t be overlooked!

5. Job Changes and Benefits Transitions Add Complexity

If your move involves a new employer, benefits may change more than expected:

Health insurance plans and networks

Retirement plans and vesting schedules

Bonuses, equity, or compensation structure

6. Insurance Needs Shift When You Relocate

Relocating should trigger a full insurance review:

Homeowners or renters insurance

Auto insurance (rates vary widely by zip code)

Umbrella liability coverage

Health insurance provider networks

Pro Tip:

Always re-shop auto and home insurance within 30 days of a move—premiums can change dramatically based on location.

7. The Emotional Cost Is Real—and Often Underestimated

This part never shows up in spreadsheets.

Leaving Charleston meant leaving familiar routines, close friendships, and a place that felt like home. Even when a move is intentional and exciting, there’s often a quiet grief that comes with it.

What helped:

Giving ourselves permission to feel unsettled

Maintaining old relationships intentionally

Remembering that hard is not the same thing as bad.

Major transitions take time—emotionally and financially.

8. Rebuilding Community Is Part of the Plan

Community doesn’t magically appear—it’s built.

Let your financial planner concentrate on the numbers. You’ll be spending energy getting plugged in and finding your people.

Community may not show up on a balance sheet, but it’s what makes a city feel like home.

Pro Tip:

Keep a list of the wins, the prayers answered, and the ways that your move came together. You’ll be grateful for the written reminder of the good when you have a hard day.

A move is more than a change of address—it’s a financial and personal reset point. When planned carefully, relocation can align your lifestyle, values, and long-term goals. Without planning, it can quietly create financial drift.

If you’re preparing for a move or have recently relocated, this is one of the best times to revisit your income, expenses, savings, insurance, tax strategy, and overall financial plan.

If you’d like help integrating a move into your broader financial plan, let’s connect. Working with a fiduciary financial planner can bring clarity, strategy, and peace of mind during one of life’s biggest transitions.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Dear 2025: Progress, Perspective, and Planning for What Matters

Dear 2025,

As you come to a close, I find myself reflecting not just on the numbers, the charts, or the goals we set back in January—but on the lessons, the people, and the quiet moments of growth in between. You were a year that stretched me, surprised me, and deeply blessed me.

You reminded me that financial planning is never really about money.

It’s about the new baby that turned a spreadsheet into a story about protection and possibility.

It’s about the brave career change that required a leap of faith—and a solid financial plan to back it.

It’s about the families who downsized, upsized, relocated, rebuilt, and reimagined what “home” means.

It’s about the widow who learned, with courage and grace, how to take control of her finances for the first time.

It’s about the clients who finally said, “I’m ready,” and chose progress over perfection.

You displayed that behind every account balance is a human being doing their very best.

This year, I saw firsthand that peace of mind is often a far more powerful motivator than maximizing returns. That simplicity can feel like success. That boundaries matter just as much in life as they do in money. That steady and consistent doesn’t make headlines—but it builds lives.

I learned (again) that control is an illusion—but preparation is a gift.

Markets moved. Rates shifted. Headlines changed daily. And yet, the clients who stayed grounded in their plan slept better. They didn’t panic at every dip. They didn’t chase every trend. They trusted the process—and themselves. And that is something no market downturn can ever take away.

2025, you also reminded me how deeply grateful I am.

Grateful for the trust my clients place in me with their dreams, their worries, their “what-ifs,” and their very real fears. Grateful for the conversations that go far beyond investments—about aging parents, growing families, burnout, purpose, and what “enough” really looks like. Grateful for the reminder, again and again, that this work is not transactional—it’s relational.

I am grateful for the clients I’ve had the privilege of working with for years, and just as grateful for the new clients who are newly organizing their financial lives with me.

2025, you reinforced that resilience isn’t loud. It shows up quietly: in automatic contributions, in sticking to the plan when the news reports are screaming for doomsday reactions, in choosing to invest even when the future feels uncertain, in asking for help when doing it alone no longer works.

And as I look ahead, I carry your lessons forward with intention.

Into 2026, I carry:

— A deeper commitment to clarity over complexity.

— A continued focus on values before numbers.

— A strong belief that financial planning should feel empowering, not overwhelming.

— A promise to continue showing up with honesty, education, and heart.

To my clients: thank you for letting me walk alongside you this year. Thank you for the emails, the questions, the check-ins, and the trust. Thank you for allowing me into your lives during some of your biggest transitions. It is a responsibility I never take lightly.

If 2025 taught us anything, it’s this: life doesn’t move in straight lines—but progress still happens. Often quietly. Often imperfectly. Always meaningfully.

Here’s to the lessons we keep.

Here’s to the growth we didn’t see coming.

Here’s to what’s next.

With deep gratitude,

Kristiana

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

5 Money Habits That Separate Wealth Builders from Wealth Drainers

In 2025, financial success looks different. The world is changing quickly, and there’s always a new shiny object trying to grab our attention. With the cost of living rising—and with AI-driven investing, digital banking, and new remote income streams—the gap between wealth builders and wealth drainers is wider than ever.

The good news? You still have control.

Millionaires aren’t made by the income they earn—they’re made by intentionality and the ability to consistently live below their means. Your daily money habits, not your salary, determine whether your finances grow or shrink.

Here are five money habits that separate people who build wealth from those who unknowingly drain it.

1. Automate Your Finances Instead of “Winging It”

Wealth builders use automation to make smart decisions effortless. Automatic transfers for savings, investments, and bills ensure their money goes where it should before they’re tempted to spend it.

When we review your cash-flow plan, we identify opportunities to automate your savings and investing in a tax-efficient way. This “backwards budgeting” gives you spending freedom while still keeping your long-term goals on track.

Wealth drainers, on the other hand, rely on memory or motivation. They move money “when they remember,” often missing savings opportunities. Keeping excess cash in your checking account makes lifestyle creep all too easy. Don’t let short-term spending derail long-term wealth.

2. Invest Consistently—Don’t Wait for the “Perfect Time”

A core wealth-building habit is consistency.

Wealth builders know that time in the market beats timing the market.

Wealth drainers wait for “the right moment,” losing years of compounding potential.

Do what you can now. Start somewhere—small steps taken today can turn into miles of progress later.

3. Track Your Net Worth — Not Just Your Income

Making more money is great—but using that money to move closer to your goals is what determines success.

Wealth builders track their net worth (assets minus debts) to measure real financial progress. I track my clients’ net worth each year so we can see whether they’re on course or need a strategic adjustment.

Wealth drainers focus only on income, celebrating raises while their expenses (and debt) grow even faster. A higher salary doesn’t hold as much value towards impacting your financial freedom if your net worth isn’t moving in the right direction.

4. Buy Time, Don’t Waste It

Time is the most valuable currency in 2025.

Wealth builders invest in tools, systems, or support that buy them time for higher-value activities—learning, strategizing, planning, or generating income.

Wealth drainers trade their time for temporary comfort, losing hours to busywork or endless scrolling.

Wealth grows where time compounds.

5. Live Below Your Means—Not for Appearances

In a world full of digital flexing and influencer lifestyles, restraint is rare—and powerful.

Wealth builders prioritize financial freedom over image. They practice intentional spending, save aggressively, and invest the difference.

Wealth drainers fall into lifestyle inflation, mistaking looking rich for being rich.

Define what “enough” looks like for your lifestyle, and invest anything above that threshold.

Build Habits, Not Just Income

Wealth isn’t about luck or even income—it’s about discipline, consistency, and systems that support intentional choices. Technology can help, but your habits ultimately determine your long-term financial independence.

Ask yourself: “Are my habits making my money work for me—or keeping me working for money?”

Start small. Automate one bill. Track your net worth. Set up a transfer to your investment account, even if it’s modest.

The gap between wealth builders and wealth drainers isn’t about opportunity—it’s about the daily choices that shape your future.

And remember: wealth is more than a bank account balance. It’s the ability to make your money work as efficiently as possible so you can design your life intentionally—reflecting your priorities, values, and goals. Small habits today create long-term flexibility and freedom.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Welcoming a New Family Member: A Personal and Financial Journey

As many of you know, my family just grew in exponential joy and also chaos — we welcomed Lucy Joy Daniels into our lives earlier this month. It’s an incredible, joyful milestone, full of excitement. Beyond the diapers and sleepless nights, though, I’ve been reflecting on the reality of the importance of thoughtful financial planning to protect and provide for our expanding family.

Having helped many clients through similar life transitions, I want to share some important steps I’m taking personally — and that you might consider if you’re welcoming a new child or family member yourself.

1. Open a 529 College Savings Plan

Education costs can feel overwhelming, and starting early is one of the best ways to ease that burden. Opening a 529 plan for your child is a smart, tax-advantaged way to save for future college expenses — and it can be used for K-12 tuition or educational credentials as well. Even small, consistent contributions over time can make a meaningful difference down the road. Each state has its own plan - let’s talk about which one makes the most sense for you.

2. Update Beneficiaries

One of the most common oversights when expanding your family is forgetting to update beneficiary designations on retirement accounts, life insurance policies, and other financial accounts. Ensuring your new child is included where appropriate helps guarantee your assets go to the right people without unnecessary complications.

3. Consider a Trust or Detailed Estate Plan

As our family grows, so does the complexity of protecting our legacy. A basic will might not be enough to cover everything you want for your child’s future. Establishing a trust or updating your estate plan can provide clear instructions on guardianship, asset management, and distribution — offering peace of mind that your child will be cared for as you intend.

4. Review Your Life Insurance Coverage

Welcoming a child often means reevaluating your life insurance needs. If something were to happen to you, would your current policy provide enough to maintain your family’s lifestyle and meet future expenses? It’s worth reviewing your coverage, potentially increasing your policy, or adding new policies to ensure your family is financially protected.

5. Review Employee Benefits

Don’t forget to take a close look at your employer's benefits as well. With a new family member, you might be eligible to make changes or enroll in plans such as:

Health Coverage: Add your new child to your health insurance plan to ensure their medical needs are covered.

Dependent Day Care Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax dollars for child care expenses, helping reduce your taxable income.

Hospital Indemnity Plans: These supplemental insurance plans can provide cash benefits for hospital stays and related expenses, offering an extra layer of financial protection. **This is often an overlooked benefit when you know you’ll be giving birth in the future year. If you are pregnant, this is a way to help put a few thousand dollars into your pocket**

6. Other Important Financial Updates

Emergency Fund: Reevaluate your emergency savings to ensure it can handle new expenses.

Budget Adjustments: Review your monthly budget to accommodate new costs and savings goals.

Aligning Your Financial Plan With Your Goals

A new family member often means your goals and priorities might shift—or, in some cases, become even more clearly defined. It’s essential to take a moment to reflect on whether your financial goals are changing or staying the same, and to make sure your financial plan is singing the same song.

Your plan should be thoughtfully designed and properly implemented to support your evolving needs, providing both flexibility and security as your family grows.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Are You Leaving Money on the Table? Hidden Employer Benefits You Might Be Missing

When most people think about employer benefits, the usual suspects come to mind: health insurance, 401(k) matching, and paid time off. But dig a little deeper and you might be surprised by what your employer actually offers—and what you could be missing out on.

Many companies offer a suite of lesser-known benefits that can boost your financial well-being, improve your work-life balance, or simply make life a little easier. The catch? They’re often buried in your onboarding documents or HR portal, and easy to overlook.

Here’s a rundown of commonly missed or hidden employer benefits worth checking out:

1. Student Loan Repayment Assistance

More companies are stepping up to help employees tackle student debt. Under current tax law, employers can contribute up to $5,250 per year toward your student loans tax-free through 2025 (thanks to a CARES Act provision). Yet many employees don’t realize their company offers it.

What to do: Ask your HR department if they participate in a student loan repayment program or offer any partnerships with refinancing providers.

2. Tuition Reimbursement or Continuing Education

Even if you’re not pursuing a degree, your company might reimburse you for professional development courses, certifications, or even conferences. These benefits often have annual limits, but can save you thousands—and boost your career.

What to do: Look for policies on tuition or education reimbursement in your employee handbook or HR site. You may need to get courses pre-approved.

3. Legal Services

Some employers offer access to legal services as part of their benefits package—often at no cost to you. This can include estate planning, will preparation, tax consultations, and even identity theft protection.

If your financial situation isn’t complicated, this is often the cheapest and easiest way to address these important documents like wills, durable power of attorney, living wills, and even trusts!

What to do: Check your benefits to see what it would cost you to sign up for the services for a year and get it all done! Make sure to do the research on how much those documents cost you in addition to the employee benefit service.

4. Dependent Care FSAs & Backup Childcare

Dependent Care Flexible Spending Accounts (FSAs) let you set aside pre-tax dollars for childcare, after-school programs, and summer camps. Some employers also provide emergency or subsidized backup childcare—a lifesaver when your regular care falls through.

What to do: Check your benefits portal during open enrollment and keep an eye out for family support programs.

5. Adoption, Fertility, and Surrogacy Benefits

Many larger employers now offer financial support for fertility treatments, IVF, egg freezing, or adoption assistance. These benefits can be worth thousands of dollars—and are often available regardless of marital status.

What to do: Ask HR if your benefits plan includes any reproductive health or family-building support.

6. Sabbaticals or Paid Volunteer Time

Some companies offer paid sabbaticals after a certain number of years or paid volunteer days each year to give back to your community. These benefits don’t always show up in your standard time-off policy.

What to do: Ask about long-term tenure perks or community involvement policies.

7. HSA Contributions and Wellness Incentives

If you have a high-deductible health plan, you may be eligible for an HSA (Health Savings Account)—and your employer might contribute to it. Some companies also offer cash or gift card incentives for completing wellness activities, like health screenings or fitness challenges.

Let’s go even further and discuss the benefits of investing your HSA and what tax savings that means for your family!

What to do: Log into your benefits portal and review your wellness or HSA sections—you might already have free money waiting.

8. Commuter Benefits or Travel Reimbursements

If you commute or travel for work, you may be eligible for pre-tax transit benefits or reimbursement for work-related travel expenses (including bike maintenance in some cities!). These can be easy to miss if you’re remote but occasionally go into the office.

What to do: Look for a transportation or commuter section in your benefits site—or ask your HR rep directly.

Don’t Assume, Ask

Many of these benefits go unused simply because employees don’t know they exist. If you're not sure what's available, don’t hesitate to ask. You might be sitting on free money, extra perks, or valuable resources that can support your financial and personal goals.

Taking full advantage of your employer’s benefits is one of the easiest ways to improve your financial life—without needing to earn another dollar.

As a client of mine, I review employee benefits on an annual basis. I’d be happy to review your benefits on a complimentary basis. The little details and decisions matter to the health and well-being of your full financial plan. Let’s connect!

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

How to Use 529 Plans (and What’s New with the OBBBA)

When it comes to saving for education, 529 plans remain one of the most powerful tools available. They offer tax advantages, flexibility, and now—thanks to recent updates from the Opportunity to Build a Better Budget Act (OBBBA)—even more options for how families can put that money to use. Whether you’re a parent, grandparent, or just someone planning ahead, it’s worth understanding how these accounts work and what’s changed.

What Is a 529 Plan?

A 529 plan is a tax-advantaged investment account designed to help pay for education expenses. You contribute after-tax dollars, the investments grow tax-free, and withdrawals are also tax-free—as long as they’re used for qualified education expenses.

There are two main types of 529 plans:

Savings Plans: Investment accounts for future education costs.

Prepaid Tuition Plans: Lock in current tuition rates at eligible public colleges.

Most people use the savings version, which offers more flexibility and broader investment choices.

What Can 529 Funds Be Used For?

Historically, 529s could only be used for college tuition and fees, but in recent years the rules have expanded. Here's what they now cover:

Tuition and fees for college, graduate, and vocational schools

Room and board (for students enrolled at least half-time)

Books, supplies, and equipment

Computers and internet access if required for school

K–12 tuition (up to $20,000 per year per student starting in 2026)

Student loan repayment (up to $10,000 per beneficiary)

What’s New Under the OBBBA?

The Opportunity to Build a Better Budget Act (OBBBA), passed in 2025, made several updates to how 529 accounts can be used—expanding their appeal and usefulness.

Here are the key changes:

1. 529s Can Now Cover Certain Educational Support Services

The OBBBA expands qualified expenses to include services like:

Educational therapy

Behavioral support

Specialized tutoring

This is a big win for families with neurodivergent learners or students with learning differences.

2. More Flexibility for Career & Technical Education

Vocational and trade school expenses have always been eligible, but the OBBBA clarified and expanded this to include:

Apprenticeship programs

Credentialing and licensure prep

Tools and equipment required for training

This change recognizes that not all paths require a traditional four-year degree.

3. Rollovers to Roth IRAs – Final Clarifications

While the SECURE 2.0 Act allowed limited rollovers from 529 plans to Roth IRAs starting in 2024, the OBBBA clarified some rules:

Maximum lifetime rollover: $35,000

Account must be open for 15+ years

Contributions (and earnings on those contributions) made in the last 5 years don’t count

This gives account owners another backup use for leftover funds—but it’s not a free-for-all.

Pro Tips for Using a 529 Plan Wisely

Start early. The earlier you begin saving, the more time your money has to grow.

Name yourself as the owner. This gives you control, even if the beneficiary changes.

Overfunding? Consider using excess funds for:

Another child or relative - creating a legacy education account for generations to come!

Your own continuing education

A Roth IRA rollover (if eligible)

Watch for state tax perks. Many states offer deductions or credits for in-state 529 contributions.

Coordinate with other aid. 529 withdrawals can impact financial aid calculations—timing matters.

529 plans were already a smart way to save for education. With the updates from the OBBBA, they’re now more versatile and inclusive than ever before. Whether you’re funding college, trade school, or supporting a child with unique educational needs, your 529 can be a powerful piece of your financial strategy.

Need help setting one up—or making sure you’re using it efficiently? Let’s talk.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Why Your Financial Plan Should Include More Than Just Investments

When most people think about financial planning, their minds often jump straight to stocks, bonds, and other investment vehicles. While investing is undeniably a critical component of building wealth, a truly robust financial plan encompasses much more than just your portfolio. To build lasting financial security and peace of mind, it’s important to consider several other vital elements that support and protect your financial future.

Here’s why your financial plan should include much more than just investments:

1. Tax Planning: Keep More of What You Earn

Taxes can significantly impact your net returns, and smart tax planning helps reduce your liabilities. This means more of your hard-earned money stays in your pocket instead of going to the government. Tax planning involves strategies like timing income and deductions, maximizing tax-advantaged accounts, tax diversification, asset location, and understanding how different investments are taxed. Without attention to taxes, even the best investment returns can be diminished by unnecessary tax burdens.

2. Estate Planning: Protect Your Loved Ones and Your Wishes

Estate planning isn’t just for the wealthy or elderly—it’s for anyone who wants to ensure their wishes are honored and their loved ones are cared for. Important documents like wills, trusts, powers of attorney, and healthcare directives lay out how your assets should be handled, who will make decisions if you’re unable, and how your family will be supported. Having these plans in place helps avoid confusion, legal battles, and delays during difficult times. Also, you’d be shocked at how many estate plans go unfunded and are incomplete! Your advisor should help ensure that your beneficiaries align and your trust is funded.

3. Insurance: Guarding Against Life’s Unexpected Setbacks

Life is unpredictable, and setbacks can quickly derail your financial progress. Insurance products—such as life insurance, disability insurance, and health insurance—are essential safety nets. They protect your income, cover medical expenses, and provide financial support to your family if something happens to you. Integrating insurance into your financial plan ensures that you’re not left vulnerable to risks that could otherwise cause significant financial hardship.

4. Charitable Giving: Align Your Values with Your Financial Goals

For many, financial planning is not just about accumulating wealth but also about making a positive impact. Charitable giving is a powerful way to align your values with your finances. Strategic giving can provide tax benefits while supporting causes you care about, creating a legacy that reflects your priorities. Including philanthropy in your plan can bring deeper satisfaction and purpose to your financial journey. With strategic planning, your dollars can make the biggest and most efficient impact.

Why Summer Is a Great Time to Revisit Your Full Financial Plan

Summer often brings a natural pause in the busyness of life—a perfect opportunity to step back and review your financial picture. While it’s easy to focus solely on investments during check-ins, make sure to take time to evaluate your tax strategies, estate documents, insurance coverage, and charitable goals as well. Revisiting these components ensures your plan is comprehensive and resilient to life’s changes.

Is Your Financial Plan All-Inclusive?

Investing wisely is only one piece of the financial planning puzzle. By expanding your focus to include tax planning, estate considerations, insurance protection, and charitable giving, you create a more holistic and effective plan. This approach not only builds wealth but also provides security, peace of mind, and purpose.

If you haven’t reviewed these areas recently, consider making it a priority this summer. If you’d like help crafting a complete financial plan tailored to your unique needs, I’d love to start you on the process of financial organization and freedom.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Summer Paychecks & Smart Money Moves: A Parent’s Guide for Teens with Jobs

Summer jobs are more than just a way for teens to earn extra spending money — they’re valuable opportunities to build financial responsibility and independence. But while the paycheck can be exciting, it’s important for parents and teens alike to understand the tax implications and savings opportunities that come with earning income.

Here’s what every parent should know to help their teen make the most of a summer job:

Income and Taxes: What You Need to Know

Any income your teen earns from a summer job is considered taxable income by the IRS. This means it counts toward their annual income and may require them to file a tax return if it exceeds certain thresholds.

Additionally, if your teen’s income becomes substantial, it could potentially affect their dependent status on your tax return. It’s important to keep track of their earnings and consult tax guidelines or a professional to ensure compliance.

Help Your Teen Understand Tax Filing

Many teens are working and earning for the first time, which can be confusing when tax season rolls around. As a parent, help your teen collect and organize important tax documents like W-2 forms from their employer.

You can also take this opportunity to explain basic tax concepts, such as withholding, filing deadlines, and the importance of keeping good records. Especially if they are still a dependent of yours, keep an eye on how much they are making and withholding - they might be required to file a tax return of their own if their income is above certain limits!

Encourage Saving and Investing Early

A summer job is an ideal time to teach teens the value of saving. Encourage them to set aside a portion of their earnings for future goals—whether that’s college, a big purchase, or simply building an emergency fund. I love to talk to my clients' kids about the bucket strategy. It helps build financial knowledge in a manageable way.

One powerful option to consider is having your teen open a Roth IRA. Because contributions come from earned income, teens can start saving for retirement decades earlier than most adults. The growth potential over time is enormous, and starting young helps build great financial habits.

Financial Independence Starts Here

Working a summer job is often a teen’s first real taste of financial independence. Beyond the paycheck, it’s a chance to learn about budgeting, taxes, giving, saving, and the value of hard work.

By guiding your teen through the tax and savings side of summer earnings, you’re helping them build a strong foundation for a healthy financial future. With a bit of preparation and guidance, your teen’s summer paycheck can become much more than spending money — it can be the start of a lifelong journey toward financial responsibility and security.

Here’s a simple Summer Job Tax & Savings Checklist for parents and teens to use together.

Summer Job Tax & Savings Checklist for Teens and Parents

Before the Job Starts:

Discuss job expectations, pay rate, and work schedule.

Talk about the purpose of money (savings, giving, spending, goal setting, etc.)

Open a separate savings account.

During Employment:

Keep records of hours worked and pay received.

Save all pay stubs and tax forms (W-2).

Set aside a percentage of earnings for savings (aim for 10–20%).

Tax Season Preparation:

Collect W-2 form(s) from employer(s).

Determine if teen needs to file a tax return (IRS rules vary by income).

Understand how earnings affect dependent status on your tax return.

Consider using tax software or consult a tax professional if unsure.

Savings & Investing:

Open a Roth IRA if teen has earned income and is ready to save long-term.

Discuss budgeting basics and the importance of emergency savings.

Encourage regular contributions to savings, even small amounts.

Financial Education:

Talk about paycheck deductions (taxes, Social Security, etc.).

Explain basic tax concepts and filing deadlines.

Use the summer job as an opportunity to build lifelong money habits.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Why re-brand after 6 successful years of business with a perfectly fine name?

In 2020, we re-branded from Action Point Financial to Fiduciary Financial Advisors. Our old name worked fine. So why disrupt? As Fiduciaries, it is important to put our fee-only approach to financial planning & investment management front and center.

Watch this video to learn more about why we changed and why being a Fiduciary Advisor is so important to us (and you!). To learn more visit: https://forfiduciary.com/