Yours, Mine, and Ours: A Field Guide to Combining Finances (Without the Headache)

It’s not about a magic net worth number; it’s about the complexity of your life. Discover why high-earning professionals and business owners are moving away from DIY management and how to distinguish between a salesperson and a true fiduciary partner who is legally bound to put your interests first.

There is no "right" way to merge money with a partner, but there are efficient ways to do it. Here is how couples with successful careers navigate the emotional and logistical transition from separate to fully joint.

Stop spending your valuable time on administration.

A quick, 30-minute intro to see if we're a good fit.

Key Takeaways From This Article:

Hiring an advisor makes sense when your financial success creates gaps that DIY management can no longer effectively or efficiently fill.

Mind Over Math:

The friction in combining finances is rarely about the math; it is about autonomy, control, and the fear of judgment.

The "Roommate" Trap:

Keeping finances strictly separate can create a transactional dynamic that feels unromantic and exhausting over time for couples.

The Executive Shift:

As careers peak and time becomes scarcer than money, couples often merge finances simply to reduce "cognitive load" and administrative fatigue.

Legal Reality:

Changing titling on assets (ownership) is a major legal event. Do not conflate "feeling married" with "commingling inheritance/pre-marital assets" without legal counsel.

Let’s just get this out of the way immediately: There is no single "correct" way to combine finances with your romantic partner. The right way differs from couple to couple, and frankly, it differs for the same couple depending on the season of life they are in.

I get asked about this constantly. Usually, the question isn't prompted by a banking issue; it's prompted by a feeling. Maybe one partner feels like they are "subsidizing" the other. Maybe one feels controlled. Or maybe you are just tired of Venmoing your spouse for half the electric bill like they are a college roommate.

For executives, the emotional stakes are higher because the numbers are bigger. When you have two high-performing individuals, you deal with:

Autonomy:

You are used to calling the shots in your professional life; asking permission to buy a new watch feels regressive.

Disparity:

Often, careers in a dual income household don’t follow the same trajectory, and one income accelerates faster than the other, creating a Primary Earner vs. Support dynamic that can breed quiet resentment if not managed.

Today, let's look at the plumbing: spending, bank accounts, and credit cards; but through the lens of how these systems actually feel.

Some Different Approaches You Can Choose From

Imagine a spectrum. On one end, Total Autonomy. On the other, Radical Transparency.

Separate Accounts Without Tracking

Keep all accounts separate and trust that expenses will even out.

This is the "you grab dinner, I'll grab the movie tickets" approach.

Why it works: It preserves maximum autonomy. You never have to justify a purchase.

The catch: It relies entirely on feelings, not facts. Over time, the partner who handles the lifestyle expenses (dinners, vacations) can lead to resentment against the partner who pays for the living expenses (groceries, utilities), feeling that the split isn't actually fair.

Separate Accounts With Account Balancing

Keep accounts separate and “invoice” each other.

You use a spreadsheet or app to track expenses, reconciling at the end of the month.

Why it works: It provides safety and fairness. You know exactly where you stand.

The catch: It can erode romance by introducing a transactional component to the relationship. A romantic relationship is a partnership, not a vendor contract. If you are calculating who ate more of the pizza, you are missing the point.

Hybrid Model: Separate Personal & Joint Operating Accounts

Maintain separate accounts for personal use, plus a joint checking account for shared bills.

You fund a joint account for the mortgage/utilities, but keep your own "fun money" separate.

Why it works: This is often the largest psychological hurdle to overcome, but can be highly rewarding for couples who value both shared structure and personal autonomy. It creates a "We" regarding the household, but preserves the "Me" for personal choices. You avoid the "why did you spend that much on golf/shoes?" argument entirely.

The catch: The friction here is usually about contributions. If one of you earns $500k and the other earns $100k, do you constrain your lifestyle so that a 50/50 split feels fair? Or do you live a lifestyle based off of the higher earner and figure out what is a fair contribution by each partner?

Fully Joint Accounts

All accounts are joint.

All income hits one bucket; all expenses leave that bucket.

Why it works: This requires "Financial Intimacy." There are no secrets. It fosters a sense of being a single economic unit, which can be incredibly bonding and daunting at the same time.

The catch: Loss of identity. Some people feel belittled if they have to "explain" a purchase from the joint pot. It also carries the highest liability: if the relationship sours, the money is accessible to both parties equally.

Different Seasons of Life (And Why You Will Likely Change)

You won't pick one system and stay there forever. As your life gets more complex, your need for efficiency usually overrides your desire for separation.

The Trust-Building Phase (Dating/Living Together)

The feeling: "I love you, but I don't know if you're good with money yet."

The behavior: You keep things separate because you are protecting yourself. This can be healthy. You are establishing trust and observing each other's habits without risking your own financial security.

The "Cognitive Load" Phase (Marriage & Kids)

The feeling: "I am too tired to do math."

The behavior: This is usually where the shift happens for many households. You are managing teams at work, and toddlers at home. You do not have the mental bandwidth to calculate pro-rata shares of a utility bill. You merge finances not because it's romantic, but because it reduces administrative fatigue. Efficiency becomes the ultimate currency.

The "Income Disparity" Phase (The Executive Leap)

The feeling: "Is this our money, or my money?"

The behavior: Often in your 40s or 50s, one partner’s income explodes (equity events, a sizable promotion) while the other may downshift to focus on the home or stay steady.

If you keep separate accounts here, the power dynamic can get weird. One person wants to fly business class; the other can only afford economy.

This is where moving to "Joint" or "Pro-Rata Hybrid" becomes more useful to preserve the emotional health of the marriage. It signals that the win for one is a win for the family.

A Personal Perspective

When my wife and I started out, we were strictly in the separate camp. We didn't track joint expenses; we simply took turns paying for things: I’d buy the dinner; she’d buy the ice cream. It wasn't a system, it was just a distinct lack of one.

As we moved into the Cognitive Load season, maintaining separate silos became a job neither of us wanted. We shifted to joint accounts out of sheer laziness and a need for speed and accessibility.

But the real emotional shift happened when we stopped viewing money as a scorecard and started viewing it as fuel for a shared vision. We treated the household as a single business entity. This became crucial when our careers shifted: I started my practice, she began working from home to spend more time with our kids, and "mine vs. yours" became a laughable concept compared to "ours."

A Word of Caution: The Legal Reality

While I encourage you to find an emotional rhythm that works, never ignore the legal reality.

Titling is Ownership: Changing an account from "Individual" to "Joint" isn't just a settings change; it's a gift. In many cases, it makes that money 50% theirs immediately.

Pre-Marital Assets: If you are coming into a relationship with significant executive compensation, inheritance, or property, keep it separate until you have spoken to an estate attorney. You can share the fruit of the tree (spend the income) without chopping down the tree and splitting the wood (changing ownership of the principal).

The Core Issue

Combining finances is 20% math and 80% psychology.

If you are fighting about the logistics, you are probably actually fighting about control or fairness. If your current system feels heavy, it’s time to move to the next season. Just make sure you talk to a professional before you sign the paperwork.

You deserve a partner whose incentives are 100% aligned with yours.

Speak directly with a fiduciary. No sales pressure.

Other Recent Articles By Andrew:

Recent Publications Featuring Andrew:

Podcasts Featuring Andrew:

Investment advisory services are offered through Fiduciary Financial Advisors, a registered investment advisor. This content is for informational and educational purposes only and is not individualized investment, tax, or legal advice. Consider your objectives and circumstances before acting and consult qualified professionals (including an attorney) regarding legal and titling decisions.

The Smart Money Moves You're Probably Not Making: Roth Strategies

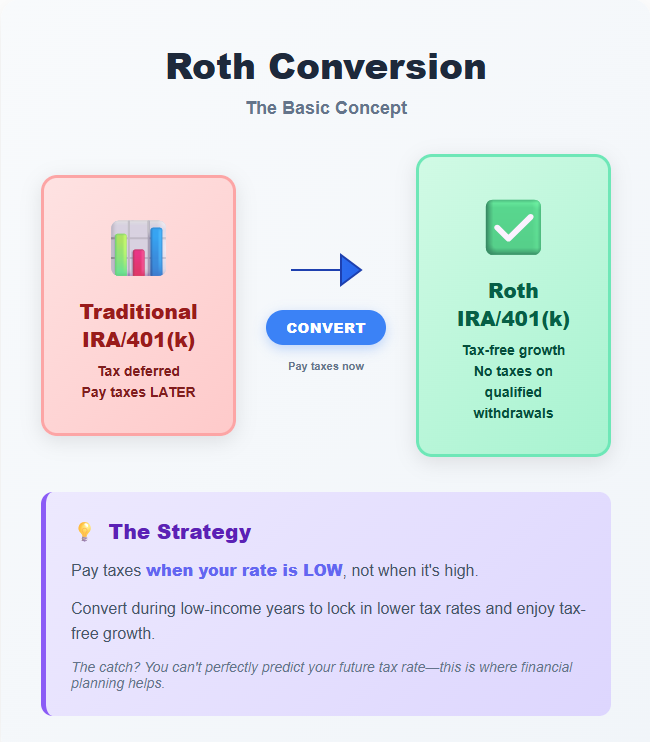

Roth Conversions

The first strategy I’m going to talk about is called a Roth conversion, and here's the simple version: you move money from your traditional retirement account (where you'll pay taxes later) into a Roth account (where qualified withdrawals may be tax-free). Yes, you pay taxes now when you convert, but you may pay less overall depending on your tax rates, timing, and other factors.

The idea is simple: pay taxes when your rate is low, not when it's high. The catch? You can't perfectly predict your future tax rate. (This is one area where doing a financial plan can shine).

The Basics: Two Types of Retirement Accounts

Traditional 401(k)/IRA: You get a tax break now, pay taxes later when you withdraw in retirement.

Roth 401(k)/IRA: No tax break now, but your money grows tax-free forever. Qualified withdrawals are generally tax-free (withdrawals on growth before you are 59½ are not tax-free).

Roth conversion: Moving money from traditional → Roth. You pay taxes on the amount you convert this year, but then it's tax-free as it grows in the Roth account.1

When NOT to Convert

Skip Roth conversions if:

You'll be in a lower tax bracket later. If retirement income will be much lower than now, wait and pay less tax later.

You need the money within 5 years. There's a 5-year waiting period to avoid penalties on the converted funds.5

You don't have cash to pay taxes. Don't use the retirement money itself to pay the increased tax bill; in part, this defeats the purpose (especially for those under 59½, where the tax withholding will be penalized as an early distribution).

Your health insurance costs are affected more than the tax benefit of the conversion. Conversions count as income and can reduce ACA subsidies, and may push you into a higher IRMAA bracket if you are on Medicare.6

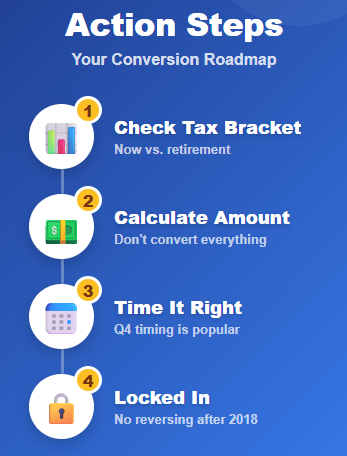

Quick Action Steps

Check your current tax bracket. Will it be higher or lower in retirement?

Determine how much. You don't have to convert everything, and should base the amount you convert on your tax estimates.

Time it right. Many people wait until Q4 to see their full-year income before converting.

Remember: no take-backs. You can't reverse a Roth conversion after 2018 tax law changes.10 Make sure you're confident before doing it.

You can convert a little each year or a lot—whatever makes sense for your situation.2

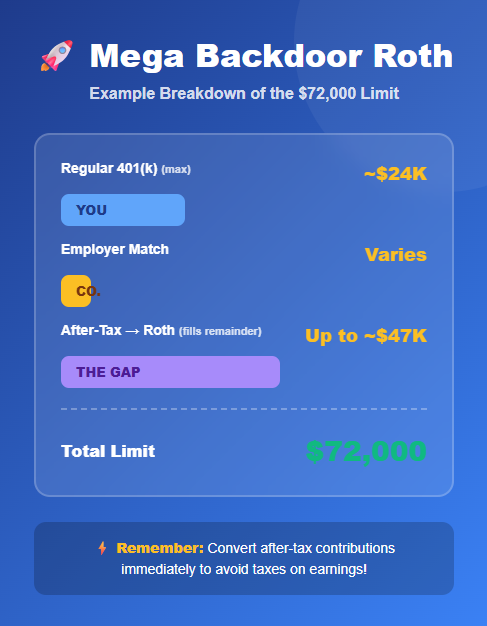

There’s More: Mega Backdoor Roth

The second Roth strategy applies if you max out your 401(k) and want to save even more tax-free. The mega backdoor Roth lets you contribute up to $47,500 extra (in 2026) to a Roth account.11,12

How it works:

Regular 401(k) limit (ignoring the additional ‘catch-up’ for those 50+): $24,500

Total contribution limit (including employer match): $72,000

The gap between these? You can fill it with "after-tax contributions"

Then immediately convert those to Roth

Requirements:

Your employer's 401(k) must allow after-tax contributions

Your plan must allow in-service conversions or withdrawals13,14

Common at big companies

Example: You contribute $24,500, your employer adds $4,500 match. That's $29,000 total. You can add another $43,000 as after-tax contributions and convert to Roth, giving you nearly $72,000 in retirement savings for the year.

Tax tip: Convert the after-tax contributions frequently to avoid taxes on earnings. Many plans do this automatically.15

Check with your HR department to see if your plan offers this option.

Benefits of Roth Accounts

Beyond saving on taxes, Roth accounts give you:

No forced withdrawals. Traditional IRAs have ‘Required Minimum Distributions’ (RMDs) which require you to start taking money out once you reach the required age.3 Roth accounts don't.

Flexible retirement planning. Roth withdrawals don't count as taxable income, so they won't increase your Medicare costs or affect Social Security taxes.4

Better for heirs. Your beneficiaries inherit Roth accounts tax-free.

Bottom Line

Using Roth accounts effectively may save you thousands in taxes over your lifetime, but the key is timing.

Best candidates for Roth Strategies:

Between jobs or careers

Early retirees (ideally before Social Security & RMDs)

Anyone in an unusually low tax year

High earners who can do a mega backdoor Roth

Now that you know these options exist, pay attention to your income each year. When you spot a low-income window, you may have an opportunity to convert at a lower rate if it aligns with your tax and planning considerations.

Next step: Talk to a financial planner with experience with software to see if a conversion makes sense for your situation this year, or in the near future.

This article is for educational purposes only and should not be considered tax or financial advice. Individual circumstances vary, and you should consult with a qualified financial planner or tax professional before making decisions about Roth conversions.

Sources and References

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Vanguard. "Is a Roth IRA conversion right for you?" Vanguard Investor Resources & Education. https://investor.vanguard.com/investor-resources-education/iras/ira-roth-conversion

Internal Revenue Service. "Retirement topics - Required minimum distributions (RMDs)." Updated January 29, 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

Charles Schwab. "Required Minimum Distributions: What's New in 2026." https://www.schwab.com/learn/story/required-minimum-distributions-what-you-should-know

Lord Abbett. "Quick Answers: The Five-Year Rule and Important Info on Roth IRA Conversions." August 7, 2024. https://www.lordabbett.com/en-us/financial-advisor/insights/retirement-planning/quick-answers-the-five-year-rule-and-important-info-on-roth-ira-.html

Vision Retirement. "Roth IRA Conversions: Rules, Restrictions, and Taxes." January 2026. https://www.visionretirement.com/articles/investing/basics-of-roth-ira-conversions

Fidelity. "Qualified Charitable Distributions (QCDs)." https://www.fidelity.com/retirement-ira/required-minimum-distributions-qcds

Internal Revenue Service. "IRS releases tax inflation adjustments for tax year 2026, including amendments from the One, Big, Beautiful Bill." October 9, 2025. https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2026-including-amendments-from-the-one-big-beautiful-bill

Tax Foundation. "2026 Tax Brackets and Federal Income Tax Rates." February 11, 2026. https://taxfoundation.org/data/all/federal/2026-tax-brackets/

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Internal Revenue Service. "Retirement topics - 401(k) and profit-sharing plan contribution limits." Updated January 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

Empower. "Mega Backdoor Roth: How It Works and Its Benefits." 2026. https://www.empower.com/the-currency/money/mega-backdoor-roth

Fidelity. "What is a mega backdoor Roth?" February 28, 2025. https://www.fidelity.com/learning-center/personal-finance/mega-backdoor-roth

NerdWallet. "Mega Backdoor Roths: How They Work, Limits." Updated February 2, 2026. https://www.nerdwallet.com/retirement/learn/mega-backdoor-roths-work

Internal Revenue Service. "Rollovers of after-tax contributions in retirement plans." https://www.irs.gov/retirement-plans/rollovers-of-after-tax-contributions-in-retirement-plans

Are Your Portfolio and Retirement Plan Up To Date?

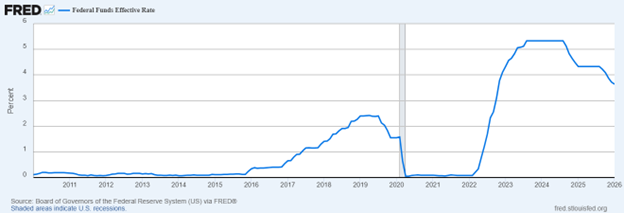

Markets have delivered strong gains in recent years. A strong equity run may have boosted your portfolio but it may also have increased your overall risk exposure. Interest rates remain elevated compared to the pre-2022 era, but have been on the decline since the last peak (shown in the FRED graphic below)¹.

As we move into 2026, it’s worth reviewing both your investment strategy and your retirement savings plan to ensure they remain aligned with your long-term goals.

Revisit Your Diversification

Consider the following:

Are you diversified across sectors and industries?

Do you include international exposure?

What is your balance among large-, mid-, and small-cap stocks?

What is your philosophy when it comes to growth and value stocks?

Has market performance caused your allocation to drift beyond your intended targets?

If equities now represent a larger share of your portfolio than planned, rebalancing may help realign risk.

Rebalancing and Tax Implications

Rebalancing restores your target allocation and can help manage portfolio risk. While doing so, consider tax efficiency:

Capital losses offset capital gains.²

Up to $3,000 in excess net losses may offset ordinary income annually.²

Selecting higher cost-basis shares when selling can improve after-tax outcomes. At the same time, you will need to pay attention to short-term vs. long-term capital gains.

If you have accounts with different tax types, you may also consider implementing an ‘asset location’ strategy.

The Role of Cash

Cash serves as a stability buffer, not a growth engine. Maintaining three to six months of living expenses in liquid savings can provide flexibility and a liquidity buffer for unexpected events.³

At the same time, holding excessive cash may hinder long-term growth. Ensuring your emergency funds are earning competitive yields while remaining accessible can improve overall efficiency.

If you have more cash than what’s needed for your emergency fund, you don’t have to get it invested all at once. Dollar-cost averaging, investing gradually over time, can reduce the risk of poor timing decisions during volatile periods.

Retirement Savings: 2026 Contribution Limits

The IRS has increased retirement plan contribution limits for 2026.⁴

2026 Limits

401(k), 403(b), 457(b), TSP: $24,500⁴

Catch-up (age 50+): $8,000⁴

Enhanced catch-up (ages 60–63): $11,250⁵

IRA contribution limit: $7,500⁴

IRA catch-up (age 50+): $1,100⁴

Individuals age 50 or older may contribute up to $32,500 to a 401(k), while those ages 60–63 may contribute up to $35,750, before employer matching.

Additionally, under SECURE Act 2.0, certain higher-income earners are required to make catch-up contributions on a Roth (after-tax) basis beginning in 2026.⁵

If your income has increased, consider raising your contribution percentage. Incremental increases can have a significant long-term impact due to compounding.

Saving by Career Stage

Early Career:

Start early and contribute at least enough to receive your employer match. With decades ahead, a higher equity allocation may be appropriate depending on risk tolerance.

Mid-Career:

Maximize tax-advantaged contributions as income grows to enhance tax efficiency and accelerate savings. Monitor employer stock exposure to avoid concentration risk.

Approaching Retirement:

Take full advantage of catch-up provisions. Gradually adjusting risk exposure may make sense, but maintaining some growth allocation remains important for long retirements.

The Big Picture

Preparing for 2026 isn’t about predicting markets. It’s about maintaining discipline:

Diversify thoughtfully.

Rebalance regularly.

Use tax-efficient strategies.

Maximize retirement contributions.

Adjust your plan as your goals change.

Strong markets can build wealth. Consistent, informed planning helps preserve it.

Notes

Taken from https://fred.stlouisfed.org/series/FEDFUNDS#, using a date range from January 1st 2010 thru January 1st 2026

Internal Revenue Service. Topic No. 409 Capital Gains and Losses. IRS, 2024.

Consumer Financial Protection Bureau. Emergency Savings and Financial Stability. CFPB, 2023.

Internal Revenue Service. “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” IRS Newsroom, 2025.

U.S. Congress. SECURE 2.0 Act of 2022, Pub. L. No. 117-328, 2022.

Moving Across the Country: From For Sale to Fully Settled

Moving is one of life’s bigger transitions—emotionally, logistically, and financially. Whether you’re relocating for a new job, upsizing for a growing family, downsizing into retirement, or chasing a new lifestyle, the ripple effects of a move go far beyond the moving truck.

Since my husband and I were married almost 12 years ago, we’ve moved quite a bit. We’ve lived in Indiana, Florida, Michigan, California, South Carolina, and Idaho all within that time frame. It’s been a gift to chase career dreams and adventure as a family, but it doesn’t come without difficulty.

Most recently, we made a move that reshaped my family’s life: relocating from Charleston, South Carolina to Boise, Idaho. On paper, it might have looked straightforward. In reality, it held financial decisions, emotional transitions, and logistical implications — all at once.

As a financial planner and someone who has lived this personally, I want to share both the practical money considerations and the less-discussed emotional and community impacts of moving. With the right strategy, a relocation can become an opportunity to strengthen—not derail—your financial foundation.

1. Understand the True Cost of Moving

Many people underestimate how expensive relocating really is. Beyond movers or truck rentals, total costs often include:

Realtor commissions and closing costs

Home repairs, staging, or cleaning

Storage fees

Travel and lodging

Temporary housing

Utility deposits and installation fees

New furniture or appliances

Overlapping rent or mortgage payments

Pro Tip:

Build a full moving budget before committing. Add a 10–20% buffer for surprises. If your move is job-related, confirm which expenses are reimbursed—and understand the tax treatment of those benefits. (Pro tip: not all states consider reimbursement of moving expenses nontaxable!)

2. Cash Flow Is King During a Move

Relocations tend to compress expenses into a short period of time. Even financially positive moves can feel stressful if cash flow gets tight.

Common pressure points include:

Carrying two housing payments at once

Paying for a move before a home sale closes

Delayed security deposit refunds

Employer reimbursement delays

Pro Tip:

Stress-test your emergency fund. Timeline planning with your cash flow can become critical.

3. The Housing Decision Has Long-Term Impact

Housing affects far more than your monthly payment. Property taxes, insurance, HOA dues, utilities, maintenance, and commuting costs all shape long-term cash flow.

Key questions to ask:

Is this payment sustainable if income changes?

Are property taxes materially different from my current state?

Will utilities or insurance costs increase?

How long do I realistically plan to stay?

4. State Taxes Can Make a Big Difference

Crossing state lines can dramatically alter your tax picture. Differences may include:

State income taxes

Capital gains treatment

Property and sales taxes

Estate or inheritance taxes

A move from a low-tax state to a higher-tax state (or vice versa) can meaningfully impact your ability to save, invest, or spend.

Pro Tip:

Run a side-by-side comparison of your current and future tax burden before moving—especially if you’re a high earner, business owner, retiree, or receive equity compensation. Taxes usually don’t decide the move for you, but they can’t be overlooked!

5. Job Changes and Benefits Transitions Add Complexity

If your move involves a new employer, benefits may change more than expected:

Health insurance plans and networks

Retirement plans and vesting schedules

Bonuses, equity, or compensation structure

6. Insurance Needs Shift When You Relocate

Relocating should trigger a full insurance review:

Homeowners or renters insurance

Auto insurance (rates vary widely by zip code)

Umbrella liability coverage

Health insurance provider networks

Pro Tip:

Always re-shop auto and home insurance within 30 days of a move—premiums can change dramatically based on location.

7. The Emotional Cost Is Real—and Often Underestimated

This part never shows up in spreadsheets.

Leaving Charleston meant leaving familiar routines, close friendships, and a place that felt like home. Even when a move is intentional and exciting, there’s often a quiet grief that comes with it.

What helped:

Giving ourselves permission to feel unsettled

Maintaining old relationships intentionally

Remembering that hard is not the same thing as bad.

Major transitions take time—emotionally and financially.

8. Rebuilding Community Is Part of the Plan

Community doesn’t magically appear—it’s built.

Let your financial planner concentrate on the numbers. You’ll be spending energy getting plugged in and finding your people.

Community may not show up on a balance sheet, but it’s what makes a city feel like home.

Pro Tip:

Keep a list of the wins, the prayers answered, and the ways that your move came together. You’ll be grateful for the written reminder of the good when you have a hard day.

A move is more than a change of address—it’s a financial and personal reset point. When planned carefully, relocation can align your lifestyle, values, and long-term goals. Without planning, it can quietly create financial drift.

If you’re preparing for a move or have recently relocated, this is one of the best times to revisit your income, expenses, savings, insurance, tax strategy, and overall financial plan.

If you’d like help integrating a move into your broader financial plan, let’s connect. Working with a fiduciary financial planner can bring clarity, strategy, and peace of mind during one of life’s biggest transitions.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Dear 2025: Progress, Perspective, and Planning for What Matters

Dear 2025,

As you come to a close, I find myself reflecting not just on the numbers, the charts, or the goals we set back in January—but on the lessons, the people, and the quiet moments of growth in between. You were a year that stretched me, surprised me, and deeply blessed me.

You reminded me that financial planning is never really about money.

It’s about the new baby that turned a spreadsheet into a story about protection and possibility.

It’s about the brave career change that required a leap of faith—and a solid financial plan to back it.

It’s about the families who downsized, upsized, relocated, rebuilt, and reimagined what “home” means.

It’s about the widow who learned, with courage and grace, how to take control of her finances for the first time.

It’s about the clients who finally said, “I’m ready,” and chose progress over perfection.

You displayed that behind every account balance is a human being doing their very best.

This year, I saw firsthand that peace of mind is often a far more powerful motivator than maximizing returns. That simplicity can feel like success. That boundaries matter just as much in life as they do in money. That steady and consistent doesn’t make headlines—but it builds lives.

I learned (again) that control is an illusion—but preparation is a gift.

Markets moved. Rates shifted. Headlines changed daily. And yet, the clients who stayed grounded in their plan slept better. They didn’t panic at every dip. They didn’t chase every trend. They trusted the process—and themselves. And that is something no market downturn can ever take away.

2025, you also reminded me how deeply grateful I am.

Grateful for the trust my clients place in me with their dreams, their worries, their “what-ifs,” and their very real fears. Grateful for the conversations that go far beyond investments—about aging parents, growing families, burnout, purpose, and what “enough” really looks like. Grateful for the reminder, again and again, that this work is not transactional—it’s relational.

I am grateful for the clients I’ve had the privilege of working with for years, and just as grateful for the new clients who are newly organizing their financial lives with me.

2025, you reinforced that resilience isn’t loud. It shows up quietly: in automatic contributions, in sticking to the plan when the news reports are screaming for doomsday reactions, in choosing to invest even when the future feels uncertain, in asking for help when doing it alone no longer works.

And as I look ahead, I carry your lessons forward with intention.

Into 2026, I carry:

— A deeper commitment to clarity over complexity.

— A continued focus on values before numbers.

— A strong belief that financial planning should feel empowering, not overwhelming.

— A promise to continue showing up with honesty, education, and heart.

To my clients: thank you for letting me walk alongside you this year. Thank you for the emails, the questions, the check-ins, and the trust. Thank you for allowing me into your lives during some of your biggest transitions. It is a responsibility I never take lightly.

If 2025 taught us anything, it’s this: life doesn’t move in straight lines—but progress still happens. Often quietly. Often imperfectly. Always meaningfully.

Here’s to the lessons we keep.

Here’s to the growth we didn’t see coming.

Here’s to what’s next.

With deep gratitude,

Kristiana

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

DACFP Feature: A Tale of Two Bitcoins – Making Sense of Bitcoin’s Weird 2025 Split Personality

Jeffrey Janson had the privilege of being featured by Digital Assets Council of Financial Professionals (DACFP) where he shares a deep dive on how Bitcoin is being pulled in two opposite directions—by long-time holders cashing out and new institutional investors pouring in.

Fiduciary Financial Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Recent Articles Written by Jeffrey:

When Does Hiring a Financial Advisor Actually Make Sense?

It’s not about a magic net worth number; it’s about the complexity of your life. Discover why high-earning professionals and business owners are moving away from DIY management and how to distinguish between a salesperson and a true fiduciary partner who is legally bound to put your interests first.

A fact-based guide to identifying the inflection point between doing it yourself and a professional partnership.

Stop spending your valuable time on administration.

A quick, 30-minute intro to see if we're a good fit.

For many successful professionals and business owners, "Do-It-Yourself" investing is a point of pride. You're smart, you're capable, and you've managed well to get to this point.

But success creates complexity.

The "when" for hiring an advisor isn't a magic number. It's an inflection point where the complexity of your assets, taxes, and legacy goals exceeds the time and specialized knowledge you have available.

This isn't about intelligence; it's about specialization. You’ve proven that you’re an expert in your field. The question now is whether you also have the time and desire to become a part-time expert in tax law, estate planning, and global markets.

If your financial life includes any of the following facts, you may have crossed the threshold where hiring an advisor now makes sense.

Key Takeaways From This Article:

Hiring an advisor makes sense when your financial success creates gaps that DIY management can no longer effectively or efficiently fill.

The Competence Gap:

Your finances now involve complex issues (like RSUs, business ownership, or multi-year tax strategies) that may benefit from a specialist with tax, equity-comp, or business-owner planning experience.

The Convenience Gap:

Your time has a higher, measurable ROI when spent on your profession or business, rather than on the second job of managing your own portfolio.

The Coaching Gap:

You recognize that disciplined, objective guidance is essential to help reduce the likelihood of costly, emotion-driven decisions such as ‘performance chasing’, with an understanding that no approach can fully prevent losses or investor mistakes.

The Continuity Gap:

You need a formal, structural plan: not just a will - to protect your family and ensure your legacy transfers efficiently across generations.

Your Compensation and Tax Picture Is No Longer 'Standard'

The first sign is that your tax return no longer resembles a "simple" filing. You've graduated from a straightforward W-2 to a mix of complex equity and business income.

It's time to seek specialized competence when your balance sheet includes:

Executive Compensation: You're managing a schedule of Restricted Stock Units (RSUs), Incentive Stock Options (ISOs), Non-Qualified Stock Options (NQSOs), or Employee Stock Purchase Plans (ESPPs), each with different tax treatments and grant dates.

Concentrated Equity: More than 10-15% of your net worth is tied up in a single company stock; or worse yet, the stock is that of the company you work at or own. This creates a significant, undiversified risk.

Business Ownership: You're dealing with K-1 distributions, buy-sell agreements, succession planning, or structuring a tax-efficient exit.

Complex Tax Liabilities: You are subject to the Alternative Minimum Tax (AMT), pay state taxes in multiple states, or are looking for advanced, multi-year tax-optimization strategies; not just minimizing a single year’s tax bill.

Alternative Investments: You're vetting private equity, venture capital, or real estate syndications and need to understand their risks, tax implications, and role in your portfolio.

These aren't "DIY" problems; they are sophisticated legal and tax strategies. This is also where an advisor's philosophy is critical. When solving these problems, is their incentive to a cost-aware and suitable solution for you? Or is it to sell you a specific, high-fee product (like a complex insurance vehicle or proprietary fund) that their firm incentivizes? A fiduciary is legally bound to the first approach; a broker-dealer is not.

Your Time Has a Higher and Better ROI Elsewhere

This is a straightforward, mathematical calculation of convenience. Your most valuable asset is no longer your investment portfolio; it's your time and your ability to earn in your own profession or business.

Calculate the hours you spend per month on:

Investment research, analysis, and rebalancing.

Coordinating phone calls and emails between your tax preparer, and your estate attorney.

Tracking cost-basis, managing cash flow, and reviewing insurance policies.

Understanding and executing your equity compensation.

Now, multiply those hours by your effective hourly rate. In most cases, the cost of the time you spend doing this work often exceeds the fee for delegating it. Consider comparing your hourly value with an advisor’s fee to see if delegation makes sense for you.

But this calculation only works if you can trust the person you're delegating to. True convenience isn't just offloading tasks; it's offloading the mental energy and worry. That's only possible when you know your advisor is a fiduciary, legally bound to act 100% in your best interest. If you have to spend mental energy wondering if their advice is conflicted by a commission, you haven't truly bought back your time.

You Are Trying to Outsmart Yourself (And Failing)

This is the most painful sign because it’s not about a lack of intelligence; it's about human nature.

The greatest risk to your portfolio isn't a bad market; it's your own behavior in a bad market.

The most famous case study in this is Peter Lynch's Fidelity Magellan Fund. From 1977 to 1990, Lynch was arguably the greatest fund managers, posting an astounding 29% average annual return* (past performance does not guarantee future results). It would seem that anyone invested in that fund would have become incredibly wealthy.

But they didn't.

A study by Fidelity on its own fund revealed a shocking fact: the average investor in the Magellan Fund actually lost money during that same period.*

How is this possible? The data shows a classic example of what is commonly referred to as a "behavior gap." Investors, excited by the stellar returns, would buy into the fund after a period of strong performance. Then, when the fund hit an inevitable rough patch or a market correction, they would panic and sell at a low point.

They were chasing performance instead of practicing discipline. This is the coaching component, and it's a crucial philosophical test of an advisor: Is your advisor paid to help you stick to a plan, or are they paid by transaction? A fiduciary's incentive is 100% aligned with your long-term success. A non-fiduciary advisor’s incentive may be to encourage you to make a move, even if it's the wrong one, because trading is a component of how they get paid.

Your Legacy Plan Lacks Structural Continuity

If your entire financial strategy exists primarily in your head or a personal spreadsheet, you have a single-point-of-failure risk. This is the continuity component.

Your plan lacks continuity if:

Your spouse is not actively involved in the financial plan or prepared to take over if you are unable.

Your estate plan is a set of "what if I die" documents, rather than a "how-to" guide for your family.

Your children's engagement with the family’s wealth is undefined; risking conflict, mismanagement, and misunderstanding.

You have no formal plan to efficiently transfer assets, minimize estate taxes, or align your wealth with your philanthropic goals.

History is filled with case studies of significant wealth evaporating in 2-3 generations (the "shirtsleeves to shirtsleeves" phenomenon). The failure is almost always one of continuity. As you build this structure, be mindful of how it's being built. Is the plan centered around objective, flexible strategies, or is it built around high-commission products with long lock-up periods that may or may not be the most efficient way to achieve your goals? A fiduciary's incentive is to design the best plan for your needs; one that can pivot as new information is presented.

From DIY Manager to CEO of Your Wealth

Hiring an advisor is not an admission of failure. It’s a decision of practicality; to delegate a specialized function so you can focus on your highest-value work.

You want to find a professional partner whose incentives are 100% aligned with yours. This frees you to focus on what you do best: building your business, excelling in your career, and living your life.

If you've checked the boxes on any of these points, it's likely time to have a conversation.

You deserve a partner whose incentives are 100% aligned with yours.

Speak directly with a fiduciary. No sales pressure.

Other Recent Articles By Andrew:

Recent Publications Featuring Andrew:

Podcasts Featuring Andrew:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

The Oracle’s Exit: Warren Buffett’s Final 20 Lessons on Wealth, Legacy, and Dodging Banana Peels

Warren Buffett, the man who’s made 'boring' investments into billions, just delivered his final address. In his latest—and likely final—letter to Berkshire Hathaway shareholders, the 95-year-old 'Oracle of Omaha' announced he’s “going quiet.”

But before he fades out, he offered a candid peek at his own playbook—one that focuses less on quarterly earnings and more on life, legacy, and dodging metaphorical banana peels.

As a busy healthcare professional or business owner, you might think a letter from a guy reminiscing about his 1938 appendectomy has nothing to do with your practice or your portfolio. You’d be wrong. I’ve sifted through the nostalgic anecdotes to pull out the 20 best insights that apply directly to your financial strategy, your career, and the legacy you’re building.

💰 Money, Management, and The Market

1. The 65-Year-Old Finish Line is a Myth (Longevity Requires Purpose)

If you’re a physician or business owner, you likely didn’t spend years earning advanced degrees just to clock out the moment you hit Social Security age. Buffett, still at his office five days a week at 95, confirms this. His point isn't that you must work forever, but that the goal isn't necessarily to retire at 65.

Instead, it is to have financial independence, which grants you choices, options, and freedom. The biggest secret to his longevity? Work is beneficial. Your career offers a structure, a community, and a sense of purpose that contribute deeply to a long, engaged life. Find your purpose and keep showing up.

2. Thrift is the Original Life Hack

Buffett mentions how Charlie Munger worked at his grandfather’s grocery store for $2 for a 10-hour day, noting that "Thrift runs deep in Buffett blood". This isn't just a fun fact; it's a foundational financial principle. Before you chase complex investments, make sure you have the basics down: live below your means. If it works for the Oracle, it can work for the rest of us.

3. Regulatory Reform Can Backfire (The Law of Unintended Envy)

Ever think regulations sometimes miss the mark? Buffett noted that reforms intended to embarrass CEOs by comparing their pay to the average employee's salary completely backfired. Instead of promoting moderation, it created massive envy.

The result? CEO pay (and board pay) skyrocketed because everyone wanted to be "worth more" than their competitor. Lesson: Good intentions don't always equal good outcomes. Be wary of unintended consequences in policy and in your own financial strategy.

4. Envy is the Wealth Killer

Expanding on the point above: "Envy and greed walk hand in hand". The thing that often bothers wealthy CEOs is that other CEOs are getting even richer. As a busy professional, focus on your own lane. Comparing your success to a colleague or competitor is a dangerous game that leads to chasing bad returns or making rash decisions.

5. Size Kills Speed

Buffett admits that Berkshire’s massive size takes its toll, and that a decade or two from now, many smaller, nimbler companies will likely have done better. As a business owner or employee, this is a friendly reminder that efficiency and being nimble can be a huge competitive edge over large corporations. Don't worry about being the biggest; focus on being the best and most effective in your niche.

6. Don't Despair If the Stock Market Tanks

This is a must-know for any investor: Buffett warns that Berkshire's stock price will move unpredictable at time, "occasionally falling 50% or so as has happened three times in 60 years under present management". The market gets emotional. If you own a fundamentally sound company with good management, don’t panic-sell. This is a powerful antidote to market fear.

7. Admit Your Mistakes (and Change Direction Fast)

Remember "New Coke" in 1985? Don Keough, then President of Coca-Cola, made a famous speech apologizing to the public and reinstating "Old" Coke after mail addressed to "Supreme Idiot" was delivered to his desk. The simple lesson: If a project or strategy isn't working, course-correct. Fast. The public (or your staff) ultimately owns the product, not you.

8. Rule from the Present, Not the Grave. (Accelerate Your Legacy)

Buffett is accelerating his gifts to his children’s foundations because he wants them to have the maturity and energy to disburse the fortune before alternate trustees replace them.

He states: "Ruling from the grave does not have a great record, and I have never had an urge to do so." Action Item: For high-net-worth individuals, this is a clear sign to prioritize estate planning and consider the benefits of lifetime giving while you can guide the process and enjoy the impact.

9. The Power of Proximity (And Old Friends)

Buffett recounts countless successful people he worked with—Charlie Munger, Stan Lipse, Don Keough, Greg Abel—all of whom lived blocks from him in Omaha, often without him realizing it for years. Lesson: Your network and community are often right under your nose. Building deep, long-term relationships with the people around you can profoundly influence your life, financially and personally.

👨👩👧👦 Legacy, Luck, and Leadership

10. Don't Hoard Your Luck

Buffett is explicit: he drew a "ridiculously long straw at birth," being born healthy, reasonably intelligent, and in America in 1930. He states that many leaders and the rich receive far more than their share of luck, which they often prefer not to acknowledge. The takeaway: As your wealth increases, so should your generosity to those less fortunate. He sets the example by increasing his lifetime gifts to his family foundations.

11. Thank America (It Maximized Your Opportunities)

Even while acknowledging its capricious distribution of rewards, Buffett reminds us to thank America for maximizing our opportunities. It’s a nuanced view: be grateful for the foundational environment that allowed you to succeed, but also be aware that the system isn't perfect. Keep perspective, especially in moments of great financial achievement.

12. Focus on Being a Good Example

When discussing his children's success in philanthropy, Buffett jokes that they received a "dominant dosage of their genes from their mother". But he also mentions he became a better model for their thinking and behavior as the decades passed. Lesson for raising your own: Genetic lottery aside, your modeling of behavior matters more over time. The best way to "raise your children well" is to live the values you want them to adopt.

13. Be Grateful for Your Health

The Oracle is grateful and surprised by his luck in being alive. He notes how others, can be born into less fortunate circumstances or have disabling infirmities.

As a healthcare professional, you see this disparity daily. His core message: Be thankful for being alive and the sheer amount of good luck that paved your path.

14. Today's Idol May Be Tomorrow's Disgrace

This is one of the wittier, more cynical lessons. As a child, Buffett revered J. Edgar Hoover. He later realized that he should have "fingerprinted J. Edgar himself" as Hoover became disgraced for misusing his post. Don't idolize blindly. People who are praised currently may end up not being praised in the future.

15. Marry Well (Seriously)

Though not a direct lesson, Buffett casually speaks of his first wife, Susie, and her positive influence on his children. When you're building a dynasty (even a small, family one), choosing your spouse wisely is perhaps the most important decision you'll ever make.

16. Get the Right Heroes and Copy Them

Expanding on the previous point, Buffett advises: "Get the right heroes and copy them". He specifically calls out Tom Murphy: "he was the best". You can't choose your family, but you can choose who you emulate. Find mentors and friends—like Charlie Munger or Don Keough—who make you better and avoid those who are toxic.

17. The Second Half of Your Life Should Be Better

A surprisingly optimistic view from a 95-year-old: "I'm happy to say I feel better about the second half of my life than the first". His advice is simple: "Don't beat yourself up over past mistakes—learn at least a little from them and move on". It is never too late to improve.

18. Decide Your Obituary Today

Buffett brings up Alfred Nobel, who reportedly read his own mistaken obituary and was horrified, realizing he needed to change his behavior.

Don't wait for a newsroom mix-up. Decide what you would like your obituary to say and live the life to deserve it. Time can sneak up on you.

19. Greatness is Costless Kindness

This is a profound capstone to his life lessons. "Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government". Instead, when you help someone, you help the world. Kindness is costless yet priceless. Whether you're religious or not, it's hard to beat The Golden Rule as a guide to behavior.

20. Pick a Base and Build

Buffett recounts buying his first and only home in 1958, just miles from where he grew up. His children were raised there, and he felt Berkshire and he "did better because of our base in Omaha than if I had resided anywhere else". While moving might seem necessary for career growth, Buffett suggests that putting down deep roots in one place—socially, professionally, and personally—can be an underappreciated key to long-term success.

The Final Word: Be Better

Buffett is "going quiet," but his lessons are shouting at us. His final thoughts, delivered with his signature humility and wit, remind us that the biggest returns aren't found in the stock market; they're found in the impact we have on our people and our principles.

You can choose your heroes carefully and emulate them. You will never be perfect, but you can always be better. The Oracle has spoken. The question is: Are you ready to implement the playbook?

Buffett knows that life—and the market—is full of unexpected pitfalls. From unexpected market drops to mismanaged estate plans, there are too many predictable, avoidable mistakes.

Do you want a financial strategy built to withstand the market volatility and time’s relentless advance? Contact me below to discuss how to build a financial plan for stability and longevity that will help you dodge the financial banana peels. 🍌

Here is the link to Buffett’s full letter to the shareholders if you would like to read it. https://berkshirehathaway.com/news/nov1025.pdf

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

5 Money Habits That Separate Wealth Builders from Wealth Drainers

In 2025, financial success looks different. The world is changing quickly, and there’s always a new shiny object trying to grab our attention. With the cost of living rising—and with AI-driven investing, digital banking, and new remote income streams—the gap between wealth builders and wealth drainers is wider than ever.

The good news? You still have control.

Millionaires aren’t made by the income they earn—they’re made by intentionality and the ability to consistently live below their means. Your daily money habits, not your salary, determine whether your finances grow or shrink.

Here are five money habits that separate people who build wealth from those who unknowingly drain it.

1. Automate Your Finances Instead of “Winging It”

Wealth builders use automation to make smart decisions effortless. Automatic transfers for savings, investments, and bills ensure their money goes where it should before they’re tempted to spend it.

When we review your cash-flow plan, we identify opportunities to automate your savings and investing in a tax-efficient way. This “backwards budgeting” gives you spending freedom while still keeping your long-term goals on track.

Wealth drainers, on the other hand, rely on memory or motivation. They move money “when they remember,” often missing savings opportunities. Keeping excess cash in your checking account makes lifestyle creep all too easy. Don’t let short-term spending derail long-term wealth.

2. Invest Consistently—Don’t Wait for the “Perfect Time”

A core wealth-building habit is consistency.

Wealth builders know that time in the market beats timing the market.

Wealth drainers wait for “the right moment,” losing years of compounding potential.

Do what you can now. Start somewhere—small steps taken today can turn into miles of progress later.

3. Track Your Net Worth — Not Just Your Income

Making more money is great—but using that money to move closer to your goals is what determines success.

Wealth builders track their net worth (assets minus debts) to measure real financial progress. I track my clients’ net worth each year so we can see whether they’re on course or need a strategic adjustment.

Wealth drainers focus only on income, celebrating raises while their expenses (and debt) grow even faster. A higher salary doesn’t hold as much value towards impacting your financial freedom if your net worth isn’t moving in the right direction.

4. Buy Time, Don’t Waste It

Time is the most valuable currency in 2025.

Wealth builders invest in tools, systems, or support that buy them time for higher-value activities—learning, strategizing, planning, or generating income.

Wealth drainers trade their time for temporary comfort, losing hours to busywork or endless scrolling.

Wealth grows where time compounds.

5. Live Below Your Means—Not for Appearances

In a world full of digital flexing and influencer lifestyles, restraint is rare—and powerful.

Wealth builders prioritize financial freedom over image. They practice intentional spending, save aggressively, and invest the difference.

Wealth drainers fall into lifestyle inflation, mistaking looking rich for being rich.

Define what “enough” looks like for your lifestyle, and invest anything above that threshold.

Build Habits, Not Just Income

Wealth isn’t about luck or even income—it’s about discipline, consistency, and systems that support intentional choices. Technology can help, but your habits ultimately determine your long-term financial independence.

Ask yourself: “Are my habits making my money work for me—or keeping me working for money?”

Start small. Automate one bill. Track your net worth. Set up a transfer to your investment account, even if it’s modest.

The gap between wealth builders and wealth drainers isn’t about opportunity—it’s about the daily choices that shape your future.

And remember: wealth is more than a bank account balance. It’s the ability to make your money work as efficiently as possible so you can design your life intentionally—reflecting your priorities, values, and goals. Small habits today create long-term flexibility and freedom.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

DACFP Feature: Stablecoins as the Institutional On-Ramp: Advisory Best Practices

Jeffrey Janson had the privilege of being featured by Digital Assets Council of Financial Professionals (DACFP) where he shares his perspective on how stablecoins have emerged as a cornerstone for bridging traditional finance and blockchain technology.

Jeff demystifies stablecoins – contrasting traditional plain vanilla options from yield-bearing variants – and explores fresh bank partnerships like Citi-Coinbase as catalysts for broader adoption. He also delves into best practices for integrating them responsibly in a post-FIT21 regulatory landscape.

Fiduciary Financial Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Recent Articles Written by Jeffrey:

Healthcare Costs Threatening Your Retirement?

Healthcare expenses are a critical and often unpredictable component of any financial plan. As a successful professional, you can't afford to let surprise medical bills compromise your long-term goals for asset growth and legacy preservation. Our strategic framework outlines eight actionable steps to help you move from reactive expense management to proactive financial control. We'll show you how to leverage tax-advantaged accounts, optimize your insurance coverage, and integrate long-term care planning to safeguard your wealth against the rising cost of health.

Plan Now to Protect Your Wealth (And Sanity)

For successful professionals and thriving business owners, achieving financial freedom is a journey mapped with investments, tax optimization, and legacy planning. You're not in retirement yet, but you're wisely looking ahead. However, a less-talked-about, yet potentially devastating, financial drain often lurks in the shadows, with the power to unravel even the best-laid plans: how healthcare costs impact retirement. These expenses, vital for ensuring the longevity to enjoy your carefully crafted financial plan, can be both unpredictable and substantial, presenting a unique challenge to your long-term financial goals and overall peace of mind.

You've dedicated years to building your wealth with diligence and foresight. Our objective now is to ensure that medical expenses, whether anticipated or a sudden surprise, never compromise your ability to grow assets or secure your family's future when you do reach retirement. With proactive planning for healthcare costs in retirement, these potential drains can be effectively managed, becoming a predictable component of your comprehensive financial picture rather than an unexpected and sanity-gutting threat to your future.

As a financial advisor specializing in integrating healthcare cost planning into broader financial strategies for clients like you, who are actively planning for retirement, I've compiled eight practical approaches. This guide will help you confidently manage these potential expenses now, keeping your financial progress steady and your future wealth secure.

Key Takeaways From This Article:

● Understand your current medical spending

● Plan ahead for expenses when possible

● Make sure your health plan works for you

● Take full advantage of your health benefits

● Comparison shop for medical services

● Maximize HSAs and FSAs

● Consider medical expense tax deductions

● Explore long-term care insurance

Understanding Your Current Medical Spending: A Baseline for Future Planning

Effective management of future healthcare needs begins with clear data. Take stock of your current healthcare expenditures to identify where your money is going. Reviewing past bills, bank statements, or patient portals can provide a comprehensive overview of your medical spending habits. This baseline is critical when you're planning for healthcare costs in retirement. Some key data to collect are items such as:

● Monthly health insurance premiums

● Copays and Coinsurance

● Prescription costs

● Vision and dental expenses

● OTC drugs and medical devices

Proactive Planning for Anticipated Medical Expenses: Don't Get Caught Off Guard

While medical emergencies are unforeseen, many healthcare costs can be planned for well in advance. Treating these expenses as a predictable part of your financial landscape allows for strategic preparation, safeguarding your retirement savings from medical costs. Some to consider are:

● Ongoing treatments for chronic conditions

● Maternity expenses or costs related to family expansion

● Elective procedures

● Genetic/hereditary conditions that will need to be addressed

Considering your family's health needs with a long-term perspective can help determine appropriate coverage and potential savings. Establishing a dedicated fund; such as an HSA, FSA, or even a cash reserve can ensure you're prepared without impacting your long-term strategy or incurring debt as you save for healthcare in retirement.

Optimize Your Health Plan: Is Your Coverage Aligned with Your Future Needs?

It's a common misconception that more extensive health coverage automatically equates to the best value, especially when planning for healthcare costs in retirement. Periodically assessing your health plan is crucial to ensure it aligns with your actual usage and your long-term financial objectives. Are you paying for benefits you rarely utilize, or are out-of-pocket costs becoming a burden?

● Low-Deductible Health Plans (LDHPs): These plans typically feature higher monthly premiums but lower out-of-pocket costs for medical services. They may be suitable for individuals with chronic health conditions or regular medical needs, providing immediate financial predictability.

● High-Deductible Health Plans (HDHPs): Characterized by lower monthly premiums and higher deductibles, these plans often offer eligibility for a Health Savings Account (HSA), which offers significant tax advantages for saving for future medical expenses. HDHPs can be an effective choice for healthy individuals with fewer anticipated medical expenses, particularly those focused on building substantial HSA for retirement planning.

Andrew's Insight: For many of my clients, an HDHP combined with an HSA proves to be a fiscally sound strategy. The blend of lower premiums and a tax-advantaged savings vehicle for future medical costs offers both immediate and long-term benefits, helping you fortify your retirement planning against medical costs.

Maximize Available Health Benefits: Don't Overlook Valuable Resources for Future Wellness

Your health plan often includes more than just coverage for illness or injury. Utilizing preventive care and wellness programs now can lead to both health improvements and financial savings by addressing issues before they become more complex or expensive, thereby reducing medical expenses in retirement.

● Annual physicals and routine screenings: These are an investment in your long-term health, helping to prevent more significant health issues down the road.

● Mental health services, fitness discounts, and wellness initiatives: Many plans offer these, contributing to overall well-being and potentially reducing your future healthcare needs.

Andrew's Insight: If a claim is denied, investigate. Errors occur, and a simple inquiry can often resolve coverage issues, saving you from unnecessary expenses. It’s a small effort now that can yield tangible financial returns later, protecting your retirement savings from medical costs.

Comparison Shop for Medical Services and Prescriptions: Smart Spending for Today and Tomorrow

When you can plan ahead for medical expenses, use the time to shop around for better pricing. Collaborate with your healthcare provider and insurer to obtain accurate cost estimates. Compare costs for prescriptions, procedures, and medical appointments (without sacrificing quality, of course). Generic medications, for instance, are often a cost-effective alternative to brand-name drugs, helping you stretch your healthcare budget as you plan for healthcare costs in retirement.

Leverage HSAs and FSAs: Powerful Tools for Saving for Healthcare in Retirement

If eligible through an HDHP, a Health Savings Account (HSA) is an invaluable tool for saving for healthcare in retirement. Similarly, Flexible Spending Accounts (FSAs), if offered by your employer, can provide significant tax advantages for common medical expenses such as copays, dental work, prescriptions, and vision care. These accounts are crucial for optimally planning for medical expenses in retirement.

Be aware, however, that there is a variation in utility between HSAs and FSAs, especially regarding their long-term potential for retirement planning:

● HSAs: These accounts offer a triple tax advantage: pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. This translates into substantial tax efficiency for your healthcare spending. These accounts can accumulate value year after year and are portable, meaning they are not tied to a specific employer, making them ideal for long-term medical expenses retirement savings.

● FSAs: Funded with pre-tax dollars, these accounts typically operate on a "use it or lose it" basis within the plan year, though some employers offer limited grace periods. This account is employer-sponsored, meaning if you are to leave your employer, any funds in the account are forfeited. While useful for current expenses, they lack the long-term retirement savings benefits of an HSA.

Andrew's Insight: Beyond immediate expenses, an HSA can serve as a potent long-term savings vehicle. Funds roll over annually and can be invested, growing tax-free. Consider covering future medical needs in retirement with an account that has compounded tax-free for decades. This is a powerful component of comprehensive financial planning for healthcare and a key strategy to mitigate how healthcare costs impact retirement.

Consider the Medical Expense Tax Deduction for Significant Costs: A Potential Relief Valve

For years with unusually high medical expenditures, you may be eligible for a tax deduction. If your qualified unreimbursed medical expenses exceed 7.5% of your Adjusted Gross Income (AGI) and you itemize deductions, this can provide notable tax relief, helping to alleviate the burden of significant medical expenses on your retirement savings.

Eligible expenses can include:

● Fees for doctors, specialists, and mental health professionals

● Inpatient hospital care

● Prescription medications

The IRS has a complete list of medical expenses which are eligible for deducting.

Long-Term Care Insurance: Safeguarding Your Legacy

While Medicare provides crucial support once you reach retirement, its coverage for long-term care needs, such as in-home care, assisted living, or nursing facilities, is limited. Long-term care insurance fills this critical gap, helping to protect your accumulated assets and ensuring that future care costs do not erode your legacy plans or retirement savings.

Exploring this option earlier can lead to more favorable premiums. For example, acquiring a policy in your 40s when in good health typically results in lower costs than waiting until later in life when health issues may arise. This proactive step is a key part of planning for healthcare costs in retirement and securing your financial future.

Ready to Integrate Healthcare Planning into Your Financial Strategy?

Managing healthcare costs doesn't have to be a source of stress as you plan for retirement. As part of your holistic financial plan, we can help you strategically address these expenses. Our objective is to ensure that medical costs are a managed component of your financial journey, allowing you to focus on achieving financial freedom and securing the legacy you envision for your family.

Questions we can solve together:

● How can I plan for the costs of a future medical procedure?

● I don't have access to an HSA; where should I save money for future medical expenses that might arise?

● How much should I contribute to my HSA to maximize its benefits for my financial future and retirement planning?

● What are the best strategies for saving for healthcare in retirement given my specific financial situation?

● How can long-term care insurance fit into my overall retirement plan?

Recent Articles Written By Andrew:

Recent Publications Featuring Andrew:

Podcasts Featuring Andrew:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

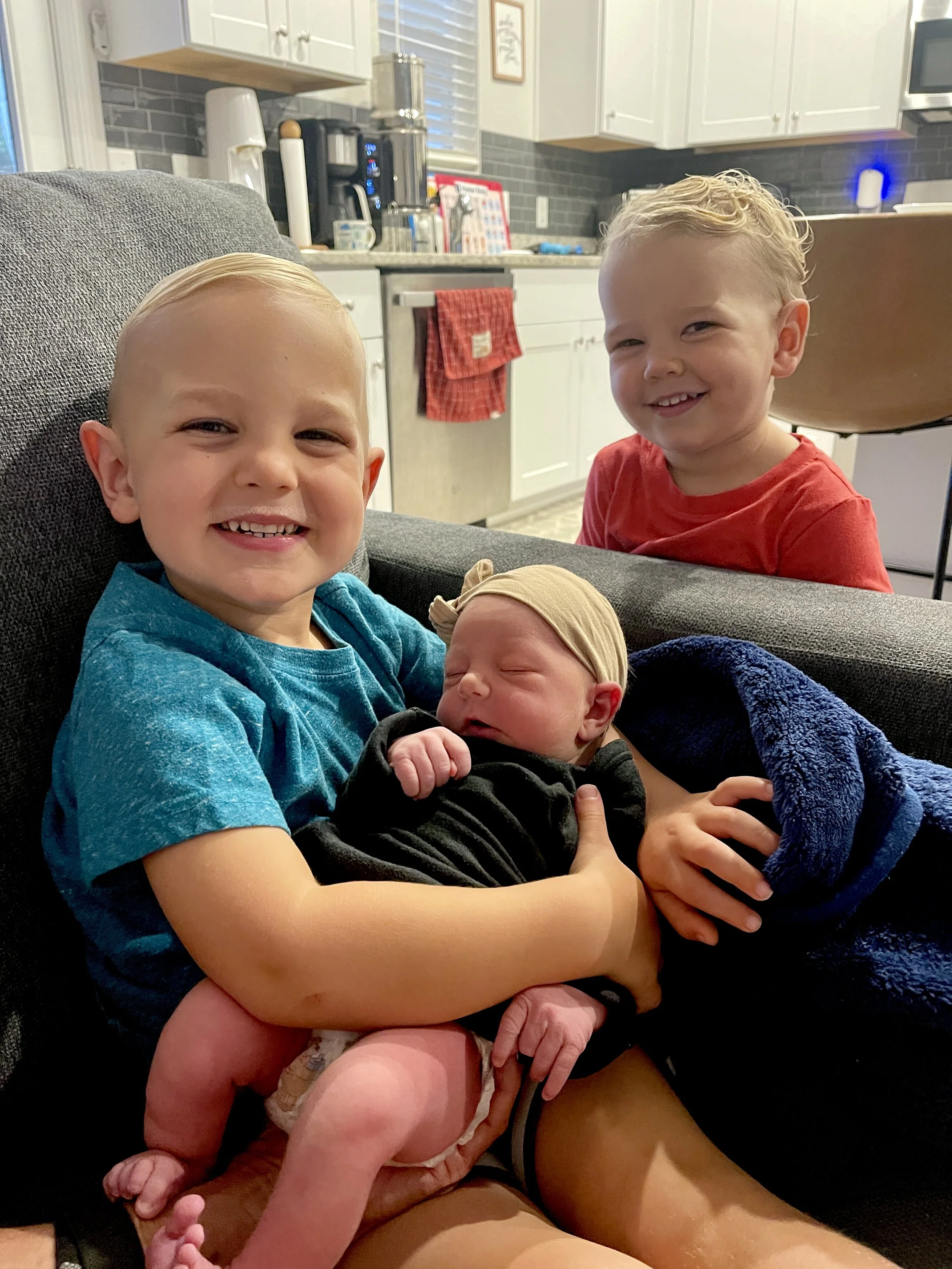

Welcoming a New Family Member: A Personal and Financial Journey

As many of you know, my family just grew in exponential joy and also chaos — we welcomed Lucy Joy Daniels into our lives earlier this month. It’s an incredible, joyful milestone, full of excitement. Beyond the diapers and sleepless nights, though, I’ve been reflecting on the reality of the importance of thoughtful financial planning to protect and provide for our expanding family.

Having helped many clients through similar life transitions, I want to share some important steps I’m taking personally — and that you might consider if you’re welcoming a new child or family member yourself.

1. Open a 529 College Savings Plan

Education costs can feel overwhelming, and starting early is one of the best ways to ease that burden. Opening a 529 plan for your child is a smart, tax-advantaged way to save for future college expenses — and it can be used for K-12 tuition or educational credentials as well. Even small, consistent contributions over time can make a meaningful difference down the road. Each state has its own plan - let’s talk about which one makes the most sense for you.

2. Update Beneficiaries

One of the most common oversights when expanding your family is forgetting to update beneficiary designations on retirement accounts, life insurance policies, and other financial accounts. Ensuring your new child is included where appropriate helps guarantee your assets go to the right people without unnecessary complications.

3. Consider a Trust or Detailed Estate Plan

As our family grows, so does the complexity of protecting our legacy. A basic will might not be enough to cover everything you want for your child’s future. Establishing a trust or updating your estate plan can provide clear instructions on guardianship, asset management, and distribution — offering peace of mind that your child will be cared for as you intend.

4. Review Your Life Insurance Coverage

Welcoming a child often means reevaluating your life insurance needs. If something were to happen to you, would your current policy provide enough to maintain your family’s lifestyle and meet future expenses? It’s worth reviewing your coverage, potentially increasing your policy, or adding new policies to ensure your family is financially protected.

5. Review Employee Benefits

Don’t forget to take a close look at your employer's benefits as well. With a new family member, you might be eligible to make changes or enroll in plans such as:

Health Coverage: Add your new child to your health insurance plan to ensure their medical needs are covered.

Dependent Day Care Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax dollars for child care expenses, helping reduce your taxable income.

Hospital Indemnity Plans: These supplemental insurance plans can provide cash benefits for hospital stays and related expenses, offering an extra layer of financial protection. **This is often an overlooked benefit when you know you’ll be giving birth in the future year. If you are pregnant, this is a way to help put a few thousand dollars into your pocket**

6. Other Important Financial Updates

Emergency Fund: Reevaluate your emergency savings to ensure it can handle new expenses.

Budget Adjustments: Review your monthly budget to accommodate new costs and savings goals.

Aligning Your Financial Plan With Your Goals

A new family member often means your goals and priorities might shift—or, in some cases, become even more clearly defined. It’s essential to take a moment to reflect on whether your financial goals are changing or staying the same, and to make sure your financial plan is singing the same song.

Your plan should be thoughtfully designed and properly implemented to support your evolving needs, providing both flexibility and security as your family grows.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.