Are Your Portfolio and Retirement Plan Up To Date?

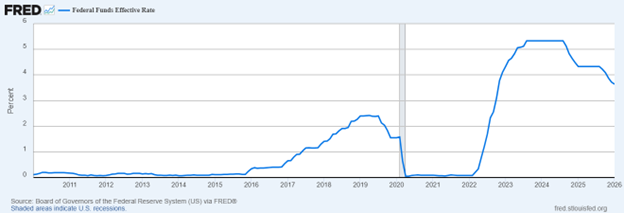

Markets have delivered strong gains in recent years. A strong equity run may have boosted your portfolio but it may also have increased your overall risk exposure. Interest rates remain elevated compared to the pre-2022 era, but have been on the decline since the last peak (shown in the FRED graphic below)¹.

As we move into 2026, it’s worth reviewing both your investment strategy and your retirement savings plan to ensure they remain aligned with your long-term goals.

Revisit Your Diversification

Consider the following:

Are you diversified across sectors and industries?

Do you include international exposure?

What is your balance among large-, mid-, and small-cap stocks?

What is your philosophy when it comes to growth and value stocks?

Has market performance caused your allocation to drift beyond your intended targets?

If equities now represent a larger share of your portfolio than planned, rebalancing may help realign risk.

Rebalancing and Tax Implications

Rebalancing restores your target allocation and can help manage portfolio risk. While doing so, consider tax efficiency:

Capital losses offset capital gains.²

Up to $3,000 in excess net losses may offset ordinary income annually.²

Selecting higher cost-basis shares when selling can improve after-tax outcomes. At the same time, you will need to pay attention to short-term vs. long-term capital gains.

If you have accounts with different tax types, you may also consider implementing an ‘asset location’ strategy.

The Role of Cash

Cash serves as a stability buffer, not a growth engine. Maintaining three to six months of living expenses in liquid savings can provide flexibility and a liquidity buffer for unexpected events.³

At the same time, holding excessive cash may hinder long-term growth. Ensuring your emergency funds are earning competitive yields while remaining accessible can improve overall efficiency.

If you have more cash than what’s needed for your emergency fund, you don’t have to get it invested all at once. Dollar-cost averaging, investing gradually over time, can reduce the risk of poor timing decisions during volatile periods.

Retirement Savings: 2026 Contribution Limits

The IRS has increased retirement plan contribution limits for 2026.⁴

2026 Limits

401(k), 403(b), 457(b), TSP: $24,500⁴

Catch-up (age 50+): $8,000⁴

Enhanced catch-up (ages 60–63): $11,250⁵

IRA contribution limit: $7,500⁴

IRA catch-up (age 50+): $1,100⁴

Individuals age 50 or older may contribute up to $32,500 to a 401(k), while those ages 60–63 may contribute up to $35,750, before employer matching.

Additionally, under SECURE Act 2.0, certain higher-income earners are required to make catch-up contributions on a Roth (after-tax) basis beginning in 2026.⁵

If your income has increased, consider raising your contribution percentage. Incremental increases can have a significant long-term impact due to compounding.

Saving by Career Stage

Early Career:

Start early and contribute at least enough to receive your employer match. With decades ahead, a higher equity allocation may be appropriate depending on risk tolerance.

Mid-Career:

Maximize tax-advantaged contributions as income grows to enhance tax efficiency and accelerate savings. Monitor employer stock exposure to avoid concentration risk.

Approaching Retirement:

Take full advantage of catch-up provisions. Gradually adjusting risk exposure may make sense, but maintaining some growth allocation remains important for long retirements.

The Big Picture

Preparing for 2026 isn’t about predicting markets. It’s about maintaining discipline:

Diversify thoughtfully.

Rebalance regularly.

Use tax-efficient strategies.

Maximize retirement contributions.

Adjust your plan as your goals change.

Strong markets can build wealth. Consistent, informed planning helps preserve it.

Notes

Taken from https://fred.stlouisfed.org/series/FEDFUNDS#, using a date range from January 1st 2010 thru January 1st 2026

Internal Revenue Service. Topic No. 409 Capital Gains and Losses. IRS, 2024.

Consumer Financial Protection Bureau. Emergency Savings and Financial Stability. CFPB, 2023.

Internal Revenue Service. “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” IRS Newsroom, 2025.

U.S. Congress. SECURE 2.0 Act of 2022, Pub. L. No. 117-328, 2022.

Market Commentary: Q1 2026 Looking At 2025

2026 Q1 Market Commentary

From Shutdown to New Year: Staying Focused in a Changing Market

In the final months of the year A prolonged government shutdown delayed key data, interest rate expectations evolved, and global events added to the news flow. Even so, markets continued to function, and long-term investors were once again reminded of the value of staying the course rather than focusing on headlines.

As we move from the fourth quarter into the start of 2026, the environment highlights an important truth: markets adapt, and a disciplined, diversified approach remains a reliable investment approach.

Limited Data, But a Functioning Economy

The government shutdown temporarily paused many official economic reports. As a result, some data for September, October, and November arrived at different times than normally expected. In the meantime, private-sector sources such as ADP provided alternative insights into employment trends.

According to the ADP National Employment Report, U.S. private-sector employment declined by 32,000 jobs in November 2025, with most losses coming from businesses with fewer than 50 employees.¹ While notable, this represents a single data point within an economy that continues to adjust.

Interest Rates and the Federal Reserve

The Federal Reserve continued to move cautiously. In late October, it lowered its key interest rate to a range of 3.75%–4%. Then A further 0.25% cut followed in December, which markets had largely anticipated.

Importantly, the Fed signaled that it is not in a hurry to cut rates further. Inflation has eased, and the labor market, while slower, continues to grow. This deliberate approach reflects an effort to balance economic support with long-term stability.

Looking ahead, interest rate decisions in 2026 remain uncertain, particularly as Federal Reserve leadership changes later in the year, along with mounting pressure from the current administration to cut rates. For long-term investors, this reinforces the importance of building portfolios that are not dependent on predicting short-term policy decisions.

Productivity: A Positive Trend

One encouraging development has been stronger productivity. In the third quarter of 2025, U.S. worker productivity rose 4.9%, driven by higher output without a corresponding increase in hours worked.²

These gains likely reflect a combination of factors, including technology adoption, automation investments made in recent years, and possibly workers staying in their roles longer. While productivity data can fluctuate quarter to quarter, this trend is constructive for long-term economic health.

Markets and Volatility

U.S. stock markets delivered solid returns over the year, even though the path was uneven. Volatility was higher at times, particularly earlier in the year, as investors reacted to trade policy changes and other uncertainties around tariffs. When viewed over the full year, however, market performance appeared far less dramatic than daily headlines suggested.

This serves as a reminder that short-term market swings often feel more stressful in real time than they appear in hindsight — and that long-term investors are generally better served by staying invested rather than reacting to market swings.

A Global Perspective: Diversification at Work

One of the most interesting stories of the year came from outside the U.S. In contrast to recent years, international stocks outperformed U.S. stocks. Developed international markets rose 31.9%, emerging markets gained 33.6%, and global stocks increased 22.3% for the year.³

These results highlight the benefits of global diversification. Market leadership shifts over time, often unexpectedly. In 2025, investors with exposure beyond the U.S. experienced higher returns in certain international markets than investors concentrated solely in the U.S.

Performance also varied by investment style. Value stocks performed well outside the U.S., while growth stocks continued to lead in the U.S. Large-company stocks outperformed smaller companies overall, though international small-cap value stocks were among the strongest performers. Over longer periods, U.S. small-cap value has also delivered competitive returns, even during extended periods of large-cap dominance.

The takeaway is not to chase what performed best this year, but to maintain broad diversification across regions, company sizes, and investment styles.

Bonds and Other Assets

Bonds played an important role in 2025. U.S. Treasury bonds returned 6.3%, and the broader U.S. bond market posted its best annual gain since 2020. Global bonds also delivered positive returns.⁴ For diversified portfolios, bonds provided income for some investors and, in some periods, helped moderate portfolio volatility, though bond prices and yields can fluctuate.

Gold also attracted attention as prices rose sharply during the year. While some investors tout gold as a hedge, history shows that its price movements have often been volatile and have not consistently tracked inflation or economic growth.⁵ As with any asset, its usefulness depends on how it fits within a broader, diversified portfolio rather than on short-term price movements.

The Long-Term Investor’s Checklist

Lets revisit the basics:

Are your goals still clear or have they changed?

Is your portfolio aligned with your comfort level for risk, and in alignment with your goals?

Does your financial plan help you stay disciplined during market ups and downs?

A sound financial plan is built around long-term goals. It evolves as life changes, but it does not require constant adjustments in response to headlines.

There were also practical planning opportunities. Investors aged 60 to 63 were eligible for enhanced “super catch-up” retirement contributions, allowing higher savings before new rules take effect in 2026. Year-end tax planning — including charitable giving and tax-loss harvesting — also offered ways to support long-term outcomes. A new Senior deduction for those age 65+ may also offer additional planning opportunities thru 2028.

Looking Ahead

As the new year begins, uncertainty remains — as it always does. Interest rates may continue to shift, markets will rotate, and headlines will come and go. None of this changes the core principles of successful long-term investing.

Over time, diversification, cost awareness, and patience may help support long-term investing goals, though outcomes vary and losses are possible. Rather than trying to predict what comes next, focusing on factors within your control—allocation, savings, and discipline—can be constructive.

2025 Market Returns

Equities

The Dow Jones Industrial Average 14.92%

S&P 500 Index (US Large Caps) 17.88%

Russell 2000 Index (US Small Caps) 12.81%

MSCI All Country World ex USA IMI Index (net div.) (International) 31.96%

MSCI Emerging Markets Index (net div.) 33.57%

Dow Jones Global Select REIT Index 8.59%

Fixed Income

Bloomberg U.S. Aggregate Bond Index 7.30%

Bloomberg Municipal Bond Index 4.25%

3 Month US Treasury Bill 4.40%

Bloomberg U.S. Treasury Bond Index 7-10 Years 8.40%

Footnotes

¹ According to the ADP National Employment Report, U.S. private-sector employment declined by 32,000 jobs in November 2025, with job losses concentrated among businesses with fewer than 50 employees.

² The U.S. Bureau of Labor Statistics reported that nonfarm business sector labor productivity increased 4.9% in the third quarter of 2025, with output rising 5.4% while hours worked increased 0.5% on an annualized basis.

³ International equity performance data is based on MSCI indices. In 2025, the MSCI World ex USA Index gained 31.9%, the MSCI Emerging Markets Index rose 33.6%, and the MSCI All Country World Index increased 22.3%. MSCI indices are not available for direct investment.

⁴ Bond market returns reflect widely used benchmarks. In 2025, U.S. Treasuries returned 6.3%, the Bloomberg U.S. Aggregate Bond Index rose 7.3%, and the Bloomberg Global Aggregate Bond Index (hedged to U.S. dollars) gained 4.9%. Data sourced from the U.S. Department of the Treasury and Bloomberg Finance LP.

⁵ Gold prices rose above $4,000 per ounce in 2025. Historical analysis shows that gold prices have experienced significant volatility and have shown limited long-term correlation with inflation or U.S. economic growth.