Are Your Portfolio and Retirement Plan Up To Date?

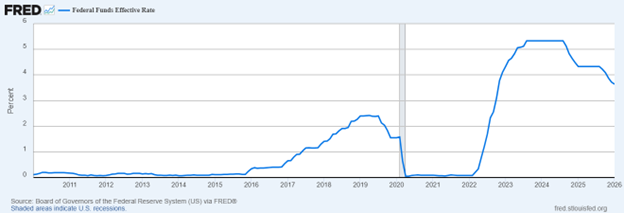

Markets have delivered strong gains in recent years. A strong equity run may have boosted your portfolio but it may also have increased your overall risk exposure. Interest rates remain elevated compared to the pre-2022 era, but have been on the decline since the last peak (shown in the FRED graphic below)¹.

As we move into 2026, it’s worth reviewing both your investment strategy and your retirement savings plan to ensure they remain aligned with your long-term goals.

Revisit Your Diversification

Consider the following:

Are you diversified across sectors and industries?

Do you include international exposure?

What is your balance among large-, mid-, and small-cap stocks?

What is your philosophy when it comes to growth and value stocks?

Has market performance caused your allocation to drift beyond your intended targets?

If equities now represent a larger share of your portfolio than planned, rebalancing may help realign risk.

Rebalancing and Tax Implications

Rebalancing restores your target allocation and can help manage portfolio risk. While doing so, consider tax efficiency:

Capital losses offset capital gains.²

Up to $3,000 in excess net losses may offset ordinary income annually.²

Selecting higher cost-basis shares when selling can improve after-tax outcomes. At the same time, you will need to pay attention to short-term vs. long-term capital gains.

If you have accounts with different tax types, you may also consider implementing an ‘asset location’ strategy.

The Role of Cash

Cash serves as a stability buffer, not a growth engine. Maintaining three to six months of living expenses in liquid savings can provide flexibility and a liquidity buffer for unexpected events.³

At the same time, holding excessive cash may hinder long-term growth. Ensuring your emergency funds are earning competitive yields while remaining accessible can improve overall efficiency.

If you have more cash than what’s needed for your emergency fund, you don’t have to get it invested all at once. Dollar-cost averaging, investing gradually over time, can reduce the risk of poor timing decisions during volatile periods.

Retirement Savings: 2026 Contribution Limits

The IRS has increased retirement plan contribution limits for 2026.⁴

2026 Limits

401(k), 403(b), 457(b), TSP: $24,500⁴

Catch-up (age 50+): $8,000⁴

Enhanced catch-up (ages 60–63): $11,250⁵

IRA contribution limit: $7,500⁴

IRA catch-up (age 50+): $1,100⁴

Individuals age 50 or older may contribute up to $32,500 to a 401(k), while those ages 60–63 may contribute up to $35,750, before employer matching.

Additionally, under SECURE Act 2.0, certain higher-income earners are required to make catch-up contributions on a Roth (after-tax) basis beginning in 2026.⁵

If your income has increased, consider raising your contribution percentage. Incremental increases can have a significant long-term impact due to compounding.

Saving by Career Stage

Early Career:

Start early and contribute at least enough to receive your employer match. With decades ahead, a higher equity allocation may be appropriate depending on risk tolerance.

Mid-Career:

Maximize tax-advantaged contributions as income grows to enhance tax efficiency and accelerate savings. Monitor employer stock exposure to avoid concentration risk.

Approaching Retirement:

Take full advantage of catch-up provisions. Gradually adjusting risk exposure may make sense, but maintaining some growth allocation remains important for long retirements.

The Big Picture

Preparing for 2026 isn’t about predicting markets. It’s about maintaining discipline:

Diversify thoughtfully.

Rebalance regularly.

Use tax-efficient strategies.

Maximize retirement contributions.

Adjust your plan as your goals change.

Strong markets can build wealth. Consistent, informed planning helps preserve it.

Notes

Taken from https://fred.stlouisfed.org/series/FEDFUNDS#, using a date range from January 1st 2010 thru January 1st 2026

Internal Revenue Service. Topic No. 409 Capital Gains and Losses. IRS, 2024.

Consumer Financial Protection Bureau. Emergency Savings and Financial Stability. CFPB, 2023.

Internal Revenue Service. “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” IRS Newsroom, 2025.

U.S. Congress. SECURE 2.0 Act of 2022, Pub. L. No. 117-328, 2022.