Recessions Aren't Always a Roadblock - Consider These Benefits

Defining a Recession

Let’s begin by clarifying what a recession entails. “Most commentators and analysts use, as a practical definition of recession, two consecutive quarters of decline in a country’s real inflation-adjusted gross domestic product (GDP)- the value of all goods and services a country produces.” (Source: International Monetary Fund; link below)

According to the National Bureau of Economic Research (NBER), it’s a broader concept involving, “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.” (Source: International Monetary Fund; link below)

Both definitions show the negative outcomes so let's dive deeper into what some of the positive outcomes could be.

Short-Term vs. Long-Term Views

Why would a decline in economic activity be considered a positive factor? The answer lies in the window of time you view it. In a free-market economy, businesses compete for customers. During a recession, consumers tend to spend their money more wisely, favoring businesses with lower prices or higher quality to make their money go further. While this may lead to short-term challenges such as job losses and business closures, it encourages efficiency. In the long run, recessions help eliminate less efficient companies from the market, allowing more efficient ones to thrive and take their place. In the long run, this helps improve the economy's overall strength.

How to Navigate a Recession by Being an Opportunist?

Instead of being scared of a recession, why not consider it an opportunity for growth and improvement?

Failed businesses can make way for new enterprises, offering better jobs, products, services, and prices.

Individuals facing job loss can use the opportunity to learn and grow new skills, making a more significant economic impact on society and for themselves.

Asset value declines can create opportunities for strategic financial moves like Roth conversions, portfolio rebalancing, or tax loss harvesting.

A recession could be a great time to invest in yourself. Warren Buffett famously said, “Whatever abilities you have can't be taken away from you. They can't actually be inflated away from you. The best investment by far is anything that develops yourself, and it's not taxed at all.”

Navigating Recessions with Confidence

When news of a recession emerges, it's vital to resist succumbing to fear. Much like weightlifters intentionally break down muscle fibers for greater strength or home renovators tear down outdated designs for improved homes, recessions play a role in eliminating inefficiencies within our economic system.

Avoiding the pitfalls of political rhetoric is equally crucial during these times. Recessions often trigger frustration and political finger-pointing so it can be beneficial to remember that the benefits of a recession could be better than the harm of government intervention trying to prevent the recession from happening. Echoing one of my favorite quotes by economist Thomas Sowell, "The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics."

While recessions may bring short-term challenges, they are pivotal for maintaining a robust and growing economy in the long term. A recession might not fulfill every immediate desire, but it acts as a catalyst, paving the way for efficient businesses to address more needs at lower prices over time.

Sources:

International Monetary Fund https://www.imf.org/external/pubs/ft/fandd/basics/recess.htm#:~:text=Calling%20a%20recession&text=Most%20commentators%20and%20analysts%20use,and%20services%20a%20country%20produces.

International Monetary Fund

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Invest Like a Sales Professional

Investing is confusing for many people. You are stuck trying to find the best strategies and performance, while still minimizing risk. On top of finding a strategy that is in line with your situation and goals, you have to be willing to ride the rollercoaster that is the stock market. If you work in sales, you have the added complexity of managing your variable income. Everyone has their opinions, but I firmly believe that there’s more than one way to achieve your financial goals. In this article, I aim to offer some principles that can simplify investing for sales professionals.

Employer Match

Many employers offer a contribution matching program, and taking advantage of it can feel like getting free money. For this reason, it is likely to be the first step in maximizing your investments. Nowadays, many plans even provide a Roth option, which can be a great perk to take advantage of. The employer contribution will be pre-tax, so putting your contribution into the Roth bucket allows for tax-free growth of your retirement assets. If you find yourself in a high-income position, make sure to keep your contribution below the annual limit, so that you can invest any additional money outside of your employer plan. The current employee contribution 401k limit for 2024 is $23,000 with a catch-up contribution of $1,000 if you are 50 or older, although the limit can change annually.

Tiered Approach

Once you’ve maximized the employer match, you should have a strategy for your next investment contributions. Your next step is likely to maximize your Roth or traditional IRA contributions. If you still have funds you want to invest, then this is where your options expand, depending on your financial goals and risk tolerance. Whether you plan to fund a taxable account or invest in real estate, this is the time to do it. There is no one-size-fits-all approach, so I highly recommend consulting a professional to walk you through the pros and cons of each option and help you find an approach that is aligned with your goal. One way to keep track of your tiered approach would be to follow the method I outlined in “End-of-Year Financial Checklist: 7 Steps for a solid Financial Plan”. This allows you to automate your plan and ensure everything is in order towards year-end.

Dollar Cost Averaging or Lump Sum

Most individuals enjoy the consistency that accompanies dollar cost averaging (DCA). This is an excellent approach for someone with a consistent income. During my time in sales, my income was never truly “consistent”, and I find that to be the case across the board for most sales professionals. Let me also be clear that the approach you should take is the one you will stick to. Research has shown that lump sum investing can be superior to DCA due to the time in the market, but DCA is still very effective and useful for risk-averse investors. Working in a heavily commissioned role will often result in using a lump-sum approach, and it is important to not shy away from it. Nobody has a crystal ball when it comes to the stock market and can know the best day to invest. With that being said, you are typically better off letting your money start working for you as soon as possible.

Tax Considerations

Tax-efficient strategies should be a key element of every sales professional's investment strategy. This could involve using a Roth IRA, doing backdoor Roth conversations, or tax loss harvesting. While being tax-conscious, you will still want to maximize investment performance. This is truly a balance and should be considered when deciding on an investment strategy. I recommend working closely with a certified public account (CPA) who works in tax preparation and can give advice on your tax efficiency.

While many investing principles are synonymous with most individuals, these are a few strategies to keep in mind for sales professionals who often have high, fluctuating incomes. These guidelines are intended to provide clarity to investing. If you want specific advice on investment strategies, consult a financial advisor that is willing to take your entire financial picture into account, and help you find an approach that is in your best interest.

References

https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

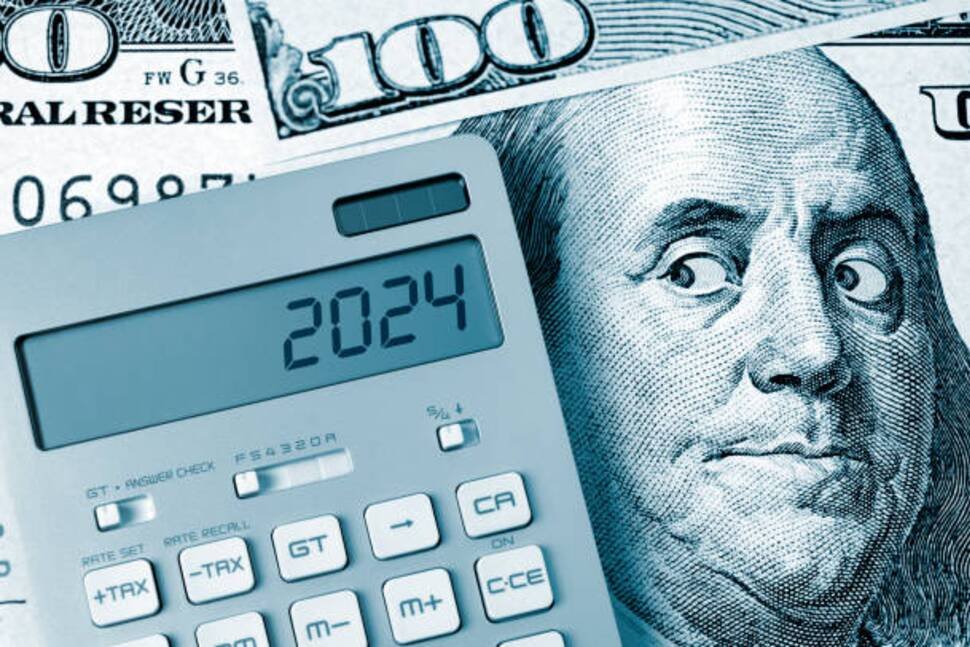

2024 Financial Outlook

Dive into the financial landscape of 2024 with this comprehensive guide. From economic stability to tax changes, our guide provides strategic insights. Navigate the evolving landscape with confidence and stay ahead in your financial journey.

2024 Financial Outlook

As we embark on the new year, hopefully, your financial journey will take center stage. Here's a quick overview of what awaits you in 2024:

Economic Outlook

Domestically, we're not anticipating a full-blown economic recession, but certain sectors may face challenges. Globally, Europe and Asia might experience some bumps, but most economies should end the year strong.

Election Concerns

With more than half the global population in an election cycle, there's a concern about regulatory uncertainty. Companies are likely to address this in their earnings calls, impacting sales and expense forecasts as well as supply chain predictions.

Optimizing Your Investment Strategy with ETFs

Exchange-Traded Funds (ETFs) offer an efficient way to manage core portfolio positions. By minimizing fees and potentially offering superior returns compared to mutual funds, they present an attractive option. Additionally, they enable capturing returns from more aggressive, smaller positions as the opportunities present themselves to capture additional returns.

Fixed Income ≠ Fixed Position

Quality of credit continues to be a focal point in selection, especially amidst decade-long highs in interest rates. Adjustments in portfolio duration for domestic holdings are likely as a response to potential rate changes from the Federal Reserve. Additionally, cooling inflation will yield positive effects on fixed-income positions within portfolios.

Exploring Alternative Investments

The pool of appealing alternative investments is narrowing down, emphasizing quality within this sleeve of a portfolio. These opportunities are best used as a counterbalance to market volatility and risk. However, it's essential to note that the inclusion of such investments should be case-specific, not a general recommendation as is the case with most investment strategies.

Key 2024 Tax Changes

Expect inflation adjustments impacting various tax aspects:

Marginal tax brackets for different income categories.

Increased contribution limits for retirement plans and Health Savings Accounts (HSAs).

Changes in gift and estate tax thresholds.

Notable provisions from the SECURE 2.0 Act, including Roth accounts in 401(k) plans and Qualified Charitable Distributions.

Social Security Withdrawal Do-Over

If you regret claiming Social Security early and are receiving reduced benefits, the Social Security Administration offers options. Within 12 months of your application, you can withdraw your benefits application, though repayment could be substantial. You can also suspend your benefits up to age 70 to receive additional credits. Just be aware that while you will be able to receive more income when you do start back up, it will still not be the maximum amount you would have received if you never started receiving benefits in the first place.

If you would like to speak further on any of these topics, or any other financial concerns you have, let’s schedule a time to chat.

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

West MI Woman Feature: Saving for Your Child’s Future

Leanne Rahn had the privilege to be featured in West Michigan Woman’s Magazine to talk to readers about “Saving for Your Child’s Future”.

Leanne dives into some of her favorite savings vehicles and the details parents need to know. Want to know how you can create a solid financial foundation for your children? You won’t want to miss this piece.

How to Budget on a Sales Income

How can I budget when my income is variable? If you’ve asked yourself this question, you are in good company. Most sales professionals experience the challenge of figuring out how to plan for their fluctuating income. Let’s walk through tips on the basics of budgeting off of a variable income.

I’ve had the joy of working in sales and experiencing this firsthand, and now working with sales professionals as their financial advisor. Variable income will present itself in one of two ways; employees will be compensated with full commission on sales or a mixture of base salary plus commission. These principles will pertain to both individuals, with an added emphasis on those with fully commissioned roles.

Step 1: Estimate Minimum Expenses

Start by listing your monthly expenses, distinguishing between necessary and discretionary expenses. Necessary expenses would include housing, utilities, insurance, food (groceries, not eating out), and transportation. You can do this on paper, excel, or through an app. This will give you a budget that is broken down by normal expenses and bare minimum expenses. Understanding your bare minimum expenses is crucial when developing a safety net.

Step 2: Establish Safety Net

This amount will be different for everyone but ultimately is based on the security of your job, income, and lifestyle. If you feel like you have a very secure job and a lower-cost lifestyle, you could stretch this amount to a low end of 3-4 months' worth of expenses. If your job is highly competitive and your company has been known to frequently replace underperformers, it might be a good idea to have closer to 6 months' worth of expenses.

The other piece of this safety net revolves around how easily you can find another job, should you leave or be let go from your current role. If you have confidence in your ability to get a new job within a month, then we can stretch to the lower end. If you work in a specialty sales market with a longer timeline to hire. I always recommend that you take whatever you think makes sense for your current situation and add a 1-2 month buffer. This safety net is in place so that you have options in case of job loss.

Step 3: How to Budget

You should have already created a complete budget in step one. If not, add the rest of your non-essential expenses to your bare minimum budget. This is what you can plan to live off of once your safety net is established. If you have a base salary as part of your compensation structure, I recommend making sure your salary covers your entire budget. This way you won’t depend on sales commissions and will have massive financial flexibility.

This can be a bit more challenging if you’re someone who is in a 100% commission role. First things first, I would attempt to have a 6-9 month safety net. Sales can be a rollercoaster of a profession, and the compensation tends to follow. Even if it rarely comes, you need to be prepared for the worst-case scenario. To create a budget off an entirely fluctuating income can be done in two ways. The first way is to take your previous year's income and budget off of that. This can be a useful strategy, especially if your previous year was more of an “average” year. The method I prefer to use is based on forecasting. To do this, you need to have a good understanding of your company's payout structure and project forecast. Take your projected sales target and assume you will hit exactly 100%, or 90% if you want to be conservative. Multiply the amount of sales by your commission percentage to get your yearly income, and don't forget to take taxes off of that number. Either way, it's crucial to add some extra room when making these estimations.

Step 4: How to Manage When You Get Off Track

While I wouldn’t wish this on anyone, I understand that volatility of sales doesn’t play favorites. On the rare occasion that you hit a major dry spell with your commission, don't panic and remember the safety net you established. Although it can be challenging, temporarily reducing your expenses to cover only the essentials might be necessary. This will ideally be a short-term adjustment, and that is why it is important to have your bare minimum budget.

Balancing a variable sales income can be challenging as every year is different. However, utilizing this approach will provide the necessary safeguards to protect you and your family. Along with financial protection, implementing these suggestions will come with a level of stress reduction that can often be associated with a fluctuating income.

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Is Your Financial Plan Overlooking This Vital Element — Your Health?

The Dalai Lama, when asked what surprised him most about humanity, answered "Man! Because he sacrifices his health in order to make money. Then he sacrifices money to recuperate his health. And then he is so anxious about the future that he does not enjoy the present; the result being that he does not live in the present or the future; he lives as if he is never going to die, and then dies having never really lived.”

What Your Financial Plan Might be Missing

Your financial plan encompasses numerous facets of your life, covering emergency funds, income, debt, savings, budgeting, financial goals, risk tolerance, investment allocation, retirement, and tax planning. However, there's one critical aspect often missing from financial plans that can significantly impact your economic well-being – your health.

Understanding the Link Between Health and Finance

Health influences nearly every dimension of your financial plan in distinctive ways. For instance:

Income and Productivity: Poor health or frequent illnesses can lead to reduced overall income due to missed workdays. Maintaining good health can help you keep a stable income.

Emergency Fund: Health status affects the size of your emergency fund. Individuals with health challenges may require a larger fund to mitigate increased risks associated with medical expenses.

Budget and Savings Rate: Increased healthcare expenses can strain your budget and potentially result in a lower savings rate. Prioritizing health can positively impact your budget and allow a higher savings rate.

Retirement Planning: Planning for potential healthcare costs during retirement becomes crucial. An unhealthy lifestyle now may require a larger nest egg for future medical needs.

The Cost of Ignoring Health in Your Financial Plan

Neglecting health can have significant financial consequences, especially in the United States where lifestyle-related conditions like obesity, high blood pressure, high blood sugar, and high cholesterol are prevalent. Metabolic syndrome, characterized by the coexistence of three or more of these conditions, increases the risk of expensive health issues such as heart disease, stroke, diabetes, and other serious health problems. (Source: National Heart, Lung, and Blood Institute, link below)

Average cost per year in the United States

Heart Disease & Stroke $19,110

Diabetes $8,837

Obesity $1,405

Considering that 1 in 3 American adults has metabolic syndrome, the financial implications are substantial. However, the good news is obesity, high blood pressure, high blood sugar, and high cholesterol are all modifiable risk factors. That means, if You change Your lifestyle You can reduce or eliminate these conditions. (Source: Centers for Disease Control and Prevention, link below)

Taking Action for a Healthier Lifestyle

Recognizing the integral role of health in financial planning, here are actionable steps to improve both your health and financial future:

Nutrition: Eat more whole foods, fruits, and vegetables. Cooking at home and avoiding processed foods can contribute to better health and financial savings. You cannot out-exercise a poor diet.

Physical Activity: Find a sport you enjoy and exercise regularly. Try to meet the recommended 150 minutes of moderate exercise or 75 minutes of vigorous exercise per week.

Quit Smoking: Smoking is a leading cause of preventable death. Quitting not only improves health but also saves money that can be directed toward financial goals.

Quality Sleep: Prioritize 7-9 hours of sleep per night. Good sleep promotes overall well-being and reduces the risk of chronic diseases.

Hydration: Opt for water over sugary drinks and alcohol. This simple choice positively impacts both your health and your budget.

Mental Stimulation: Challenge your mind by continuously learning new skills. A sharp mind contributes to overall health and longevity.

(Source: American Heart Association, link below)

Advice from Warren Buffett

Warren Buffett once told a story about what he would do if a Genie appeared and granted him a wish for a brand-new car. Being a wise man, Warren knew there would be a catch, so he asked the Genie what it was. The Genie responded that this would be the only car he would have for his entire life. Warren said he would accept that stipulation to get the car. Knowing that it would be the only car he would have for his entire life though, he would take very good care of it. He would read the entire manual front to back. He would get the oil changed on time or early. He would get the recommended preventative maintenance completed. He would fix any dents to prevent rusting. He would keep it clean inside and out.

Then he broadens the analogy by equating our mind and body as the one vehicle that has to last our entire lives. Our minds and bodies are much more important than vehicles, yet we do not always treat them as such. The decisions we make today will determine how well our minds and bodies operate many years from now.

Your health is a vital component of your financial well-being. By prioritizing your health, you can secure not only a healthier and more fulfilling life but also a more robust and resilient financial future. If you have any specific questions on this topic, feel free to reach out.

Sources:

National Heart, Lung, and Blood Institute https://www.nhlbi.nih.gov/health/metabolic-syndrome#:~:text=About%201%20in%203%20adults,that%20it%20is%20largely%20preventable.

Centers for Disease Control and Prevention https://www.cdc.gov/chronicdisease/about/costs/index.htm

American Heart Association https://www.heart.org/en/healthy-living/healthy-lifestyle/lifes-essential-8

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Home for the Holidays Magazine - Seeking Peace with Leanne Rahn

Leanne Rahn had the privilege to be featured in Real Estate By Aubree’s Home for the Holidays Magazine to talk to readers about “Seeking Peace”.

With a Christmas twist, Leanne emphasizes the importance of initiating peace within your financial life and the costly price that can result without it. Leave feeling encouraged, motivated, and driven to seek peace and to stop procrastinating. Turn the corner into 2024 with peace at the top of your mind.

Leanne, Aubree, along with many other West Michigan businesses are wishing you a very Merry Christmas!

A Beginner’s Guide to Investing

If you’ve ever felt that the world of investing is confusing and intimidating, you’re not alone. There is a lot of information, but it can be a challenge to know where to start. Let’s explore the steps necessary to begin investing, simplify your approach, and figure out what is going to work for you.

Investor Types

There are three main types of investors. The first is someone who prefers to be hands-off and hires an advisor to manage their entire financial picture, like a personal CFO. The second person likes to take the DIY approach to financial management. The third individual falls somewhere in between, opting to hire a financial advisor for their investment management while staying informed on the strategy and approach being used. Each of these approaches has its pros and cons, but it is important to know that all can be effective at different times.

Establish an Emergency Fund

Regardless of your approach, before you start investing, it is wise to establish an emergency fund that will protect you and your family in case of… well, an emergency! Having this fund in place will allow you to start investing and stay consistent, even if you have major expenses arise. Once your emergency fund is established, you can sort out the remaining information needed to begin investing.

Goals and Risk

The first step to investing is to understand your individual goals and risk tolerance. This is entirely custom to your financial situation, so it is important to not take a blanket approach. Examples of financial goals might include saving for your child’s college education, retirement planning, or vacation. Each of these goals will come with its own timeline and risk tolerance. It is important to select accounts that will line up with your savings goals. For instance, if you are saving for a college education, you might choose to invest in a 529 plan since it is an education-specific account.

Once the account is established, you can determine the timeline of your investment, and what risk you are willing to absorb. You will often see longer investments placed into a more aggressive allocation because you have more time to absorb the fluctuations of the stock market. If your timeline is short, however, you may prefer to use a more conservative investment approach. It is important to continually adjust your risk tolerance over time, and if you are not confident in your ability to manage this, don’t hesitate to seek out a professional.

Investment Capacity

In this example, we will assume that you are already contributing to an employer plan to get the employee match, which can often be a great starting point for investing. Beyond that, you have to decide how much money you are willing to invest consistently, based on your current budget. I discuss this in my post, “Mastering Your Money: Budgeting Essentials and When You Need Them”. I am a fan of incorporating investment contributions into your monthly budget if possible, and automating those contributions. This eliminates the concern of “timing the market” and allows you to take advantage of time in the market.

Pick a Strategy

Now that you have your emergency fund, established goals, risk tolerance, and your investment capacity, you can now decide on your approach to investing. For the DIY investor, it is important to do your research and find a strategy that has historically performed consistently well. This is not the time to dump all your money into the newest investing “fad”. Find a good balance of investments that aligns with your goals and risk tolerance. The balance that you want to see here is called diversification. This means that you are intentional in picking funds that give you broad exposure to the stock market, as opposed to putting all of your eggs in one basket.

If the thought of picking investments, or even doing the research is intimidating, it might be time to seek out a certified investment advisor who can help guide you through everything I’ve outlined here. When doing so, make sure to find a fiduciary advisor who is not going to make commissions on your investment selection.

Stay the Course

The final piece, and perhaps the most important is to stay the course. Investing is a long-term play that will have fluctuations over time. Some people handle this fluctuation better than others. If you struggle with the fluidity of the market, try not to view investments on a weekly or monthly basis, but on a yearly basis or longer. As we saw in the graph above, avoiding the market is not the answer.

Keep in mind that there is no one-size-fits-all approach to investing, and what worked for someone may not be what is best for you. Have confidence in your approach, and stay the course.

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

A Tale of Two Doctors: Wise Money vs. Lavish Lifestyle

After completing medical school, you face a crucial crossroads regarding how you are going to manage your finances as a high-income earner. Here is a quick story contrasting how Dr. Wise and Dr. Lavish dealt with money during their careers. As you read through their experiences, consider which one you want to emulate for your life.

Meet Dr. Wise

Dr. Wise and Dr. Lavish were both young doctors who just finished their residency programs and began their first job as an attending. Dr. Wise immediately started managing her finances wisely. She created a budget and lived within her means, even though she had a significant amount of student loan debt. She prioritized paying off her loans quickly, and with disciplined monthly payments, she managed to become debt-free in just a few years.

After becoming debt-free, Dr. Wise continued her financially responsible journey. She started contributing a significant portion of her income to retirement accounts such as a 401(k)/403(b), a Backdoor Roth IRA, and a Health Savings Account. She diversified her investments and regularly reviewed her portfolio to ensure it was aligned with her long-term goals. Over the years, her investments grew steadily, and she built a substantial nest egg for retirement.

Meet Dr. Lavish

On the other hand, Dr. Lavish had a different approach to managing his finances. He immediately purchased a luxurious house and an expensive sports car right after getting his first attending paycheck. He wasn't very concerned about his student loans so he made only minimum payments. He believed that his high income as a doctor would take care of everything.

As the years went by, Dr. Lavish found himself struggling to make ends meet. He was burdened by high mortgage payments, car maintenance costs, and growing student loan interest. He didn't have much of an emergency fund and when it came to retirement, he had very little saved.

Results After Decades of Financial Decisions

Fast forward a couple of decades, and the two doctors had vastly different financial situations. Dr. Wise had not only paid off her student loans but had also built substantial wealth through disciplined saving and investing. She was financially secure, and her retirement was looking to be quite comfortable. She continued to work as a healthcare professional because she enjoyed it, not because she had to.

In contrast, Dr. Lavish was still working long hours to maintain his expensive lifestyle and living above his means. He had only a fraction of the retirement savings and investments that Dr. Wise had. The stress of financial insecurity and the burden of debt had taken a toll on his well-being. He started regretting not being more financially responsible when he was younger.

The story of Dr. Wise and Dr. Lavish illustrates the importance of taking control of your financial life early, especially for healthcare professionals who often face significant student loan debt. Wise financial decisions, like paying off loans and investing for the future, can lead to a secure and comfortable life, while lavish spending can lead to financial stress and insecurity.

You need to choose if you are going to be a Dr. Wise or a Dr. Lavish during your life. I think it is safe to assume which one I think is the better choice. If you have questions or feel that you need help building out your financial plan, please reach out as I would be happy to meet for a Free Consult.

References:

ChatGPT was used to assist with this story creation: OpenAI. (2023). ChatGPT (September 25 Version) [Large language model]. https://chat.openai.com

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Maximizing Tax-Smart Charitable Giving: 4 Strategies to Consider

If you are passionate about supporting your favorite charities while optimizing your tax liabilities, this blog post is tailored for you. We will explore four tax-smart strategies that could help you maximize your charitable giving. It's essential to consult your tax professional before implementing these strategies, as everyone's financial situation is unique.

1. Bunching Your Contributions

The standard deduction for 2023 varies depending on your filing status: $13,850 for Single Filers, $27,700 for Married, and $20,800 for Head of Household. To benefit from itemizing your tax return, your total deductions should exceed the standard deduction. Otherwise, choosing the standard deduction might be more straightforward.

For example, if you are married and plan to donate $15,000 annually to your preferred charity, and your standard deduction is $27,700, donating $15,000 alone wouldn't surpass the standard deduction. In this case, opting for the standard deduction makes more sense.

However, consider an alternative approach: accumulate $15,000 in year 1, year 2, and year 3, totaling $45,000. During the first two years, take the standard deduction, and in year 3 donate the $45,000 and itemize your tax return to deduct the charitable donations. This three-year "bunching" strategy could help minimize your overall tax burden.

"In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income…" (Source: IRS; link below)

2. Using a Donor Advised Fund (DAF)

A Donor Advised Fund (DAF) is a specialized account designed for charitable donations. When you make an irrevocable donation to a DAF, you become eligible for a tax deduction in that year. The funds in the account can be invested and directed to specific charities in the future.

You can combine the bunching strategy with a DAF, which can be especially useful if you donate to multiple charities. It simplifies tax recordkeeping and may be appreciated by your CPA.

3. Giving Appreciated Investments Instead of Cash

Donating appreciated investments from a taxable brokerage account directly to a charity can be advantageous. When you sell an investment in such an account, you typically incur capital gains taxes. However, donating the investment directly to a charity may allow you to avoid capital gains tax. Ensure you've held the investment for at least one year to qualify for long-term capital gains treatment and claim the deduction if itemizing. (Source: Fidelity; link below)

The cash you initially intended to donate can be used to repurchase the investments, effectively resetting your cost basis. This can lead to lower capital gains when you eventually sell the investments, resulting in reduced future tax obligations.

4. Qualified Charitable Distribution (QCD)

As you approach retirement, you'll be required to take Required Minimum Distributions (RMDs) from your traditional retirement accounts, typically starting between 70.5 and 75 years old, depending on your birth year.

If you wish to allocate some or all of your RMDs to charity to avoid paying taxes on them, consider a Qualified Charitable Distribution (QCD). You can direct your RMD to your chosen charity, provided it's the first withdrawal of the year. This strategy is beneficial if you are already planning on being charitable while facing RMD requirements.

Utilizing these strategies for charitable giving can significantly reduce your tax liability. Supporting charitable causes is admirable, and doing so while optimizing your tax situation is even better.

Jurgen Longnecker

Action Tax & Accounting, PC 616.422.3297 actiontaxandaccounting.com

I'd like to extend my thanks to Jurgen Longnecker for his contributions to this blog post. Having insights from a CPA regarding charitable contributions and taxes is always incredibly valuable.

References:

https://www.fidelity.com/viewpoints/personal-finance/charitable-tax-strategies

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Waiting To Start Investing Until 40 Could Cost You Over $4 Million?

Albert Einstein has been credited with saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.” (Source: Goodreads; link below) I want to review a few scenarios to show you how powerful compounding interest can be when you start early and are consistent with investing. Hopefully, this will help you be the person who earns it throughout your life instead of the person who pays it!

Disclaimer: All these scenarios are calculated to earn the same interest rate every year. Your actual numbers in real life will be different since some years it might be higher, lower, or even negative. The average stock market return over the long term has been around 10% per year. (Source: Forbes; link below)

The Early Investor

Source: Calculator.net; link below

Iron Man has read Heath’s blog posts and knows that starting to invest early is very important so he starts investing right after high school. He starts with $0 and begins investing $6,500/year into his Roth IRA from age 18 until he retires at 67. He earns a 9% interest rate per year. The total contributions that he deposited into the account would be $318,500. The total interest earned over those 49 years would be $4,973,043. Iron Man’s total balance when he turns 67 would be $5,291,543. That means 94% of the money inside the account is from compounding interest!

Investing A Decade Later

Source: Calculator.net; link below

Loki wants to have fun in his 20s. He goes on fancy vacations, drives fancy cars, and lives his best life. When he turns 30 he decides to start investing for retirement. He starts with $0 and begins investing $6,500/year into his Roth IRA from age 30 until he retires at 67. He earns a 9% interest rate per year. The total contributions that he deposited into the account would be $240,500. The total interest earned over those 37 years would be $1,590,093. Loki’s total balance when he turns 67 would be $1,830,593. That means 87% of the money inside the account is from compounding interest! Still good, but $3,460,950 less than Iron Man. Those 12 years of additional investing were very powerful.

The Mid-Life Investor

Source: Calculator.net; link below

Captain America was unfortunately in cryosleep for many years so he wasn’t able to start investing until he turned 40. He starts with $0 and begins investing $6,500/year into his Roth IRA from age 40 until he retires at 67. He earns a 9% interest rate per year. The total contributions that he deposited into the account would be $175,500. The total interest earned over those 27 years would be $552,293. His total balance when he turns 67 would be $727,793. That means 76% of the money inside the account is from compounding interest! That is still good but again $4,563,750 less than Iron Man who started 22 years sooner.

Which superhero do you want to be?

It takes discipline to start investing early like Iron Man at 18 years old but the rewards down the road can be tremendous

If you look at the graphs in all three scenarios you will notice that compounding interest doesn’t really start to ramp up until after the first 10-20 years. Don’t get discouraged in the first 5 years if you don’t see your money growing dramatically yet

There’s a Chinese proverb that the best time to plant a tree was 20 years ago but the second best time is now

If you would like help to harness the power of compound interest schedule a time when we can discuss your particular situation.

Sources:

https://www.goodreads.com/quotes/76863-compound-interest-is-the-eighth-wonder-of-the-world-he

https://www.forbes.com/advisor/investing/average-stock-market-return/

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

MoneyGeek Feature: Women’s Guide to Making Financial Moves After College

Leanne Rahn had the privilege to be featured in MoneyGeek to talk to readers about “Women’s Guide to Making Financial Moves After College”.

Leanne discusses challenges women face as they begin their financial journey after college and what they can do to set themselves up for a fruitful financial life.

Fiduciary Financial Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Is a Financial Advisor Worth It?

If you have extra time, are interested in finances, and are willing to research the actions needed to become successful financially; then you might not need a financial advisor. There are a lot of great free resources available if you are willing and able to put in the time and effort. That being said, there are also many reasons why you might choose to work with a financial advisor.

You might:

Be too busy with work/life to complete research on your own

Deal with analysis paralysis and need some guidance on how or where to invest

Get nervous during periods of market volatility and need someone to give you reassurance and prevent you from making an emotional investing decision that could cost you a lot of money

Need someone to help keep you accountable and consistent with investing

Not be interested in finances/investing and would rather pay someone to help so you can spend more time on things that you enjoy

Whether you are currently working with a financial advisor or looking to work with a financial advisor, here is a review of some ways financial advisors could add value to your investing plan according to Vanguard. If you do not need/want a financial advisor you may still want to focus on these areas as you manage your own financial plan. (Source: Vanguard Advisor’s Alpha; link below)

Value a Financial Advisor Could Bring

As I review the seven modules that Vanguard presents, please keep these quotes from the paper in mind.

“Paying a fee to a professional who follows Vanguard’s Advisor’s Alpha Framework described here can add value in comparison to the average investor experience, currently advised or not. We are in no way suggesting that every advisor—charging any fee—can add value. Advisors can add value if they understand how they can best help Investors.”

“We do not believe this potential 3% improvement can be expected annually; rather, it is likely to be very irregular.”

“Some of the best opportunities to add value occur during periods of market duress or euphoria when clients are tempted to abandon their well-thought-out investment plans.”

1. Suitable Asset Allocation Using Broadly Diversified Funds/ETFs Value: >0.00%

Asset allocation is the percentage of investments you have in stocks, bonds, cash, and alternative investments. Factors to help determine your asset allocation are your risk tolerance, risk capacity, and the goals you have for that particular sum of money. Having the right mix of investments for your specific situation and goals is very important. Vanguard found this value add to be significant but stated it was too unique to quantify.

2. Cost-Effective Implementation (expense ratios) Value: 0.30%

After determining your asset allocation, the next step would be to decide what investments to invest in. One thing that you have a lot of control over is how much you pay to be invested in the stock market. The difference between the returns you achieve and the cost you pay is your net return. Vanguard recommends keeping your expense ratios low, and I agree. A high expense ratio for a fund could be greater than 1% whereas a low-cost index fund could be as low as 0.04%. Vanguard found this value add to be 0.30%.

3. Rebalancing Value: 0.14%

Your asset allocation can drift over time. Let’s say you originally invested 80% in stocks and 20% in bonds. One year later if stocks perform better than bonds, you might now be 90% stocks and 10% bonds. If you want to control your risk and stick within your risk tolerance, then rebalancing back to the original 80% stocks and 20% bonds may make sense for you. Rebalancing can also help you buy low and sell high. It forces you to buy the investment that underperformed and sell the investment that overperformed. This is easier said than done. If you had an investment that did really well, emotionally you may not want to sell some of it and buy the investment that underperformed. A financial advisor could do this automatically for you. Vanguard found this value add to be 0.14%.

4. Behavioral Coaching Value: 0.00%-2.00%

As human beings, we all have emotions. During periods of market volatility and downturns, having an advisor to help prevent you from changing your investment strategy could be very valuable. When COVID initially started, the market took a huge dive as the economy shut down. I know a few people who sold completely out of the stock market because of fear. Then when the market recovered they missed out on the huge gains that followed. They let their emotions get the best of them and ended up locking in their losses by selling. If they would have had an advisor to help them stick to a financial plan they might be in a better position today. Vanguard found this value add to be 0.00%-2.00%.

5. Asset Location Value: 0.00%-0.60%

There are three main types of accounts where you can keep invested assets: Tax-deferred accounts, Tax-free accounts, and Taxable accounts. Having the right investments inside of the correct accounts could help you pay less in taxes, which would leave more money left over for you. Here is a figure from the Bogle Heads forum which reviews which funds might be better for the three different account types. A financial advisor could help you decide which investments should be inside which accounts. Vanguard found this value add to be 0.00%-0.60%.

(Source: Bogleheads Wiki; link below)

6. Spending Strategy (withdrawal order) Value: 0.00%-1.20%

If you only have investments inside of one account type then this module wouldn’t bring any value to you. On the other hand, if you have some investments inside of a 401(k), a Roth IRA, a Health Savings Account, and a taxable brokerage account then which account you withdraw money from first could add a lot of value and help you save on taxes.

You might withdraw from your 401(k) for your required minimum distributions for that year first, then you might consider taking money out of your taxable brokerage account, after that you might decide to withdraw money from your Roth IRA, saving your HSA for later. Having money invested in different account types can allow you to adjust how much tax you pay during your retirement years. Withdrawing money in a sub-optimal order could cause you to pay more taxes! Vanguard found this value add to be 0.00%-1.20%.

(Source: Vanguard Advisor’s Alpha; link below)

7. Total Return Versus Income Investing Value: >0%

This includes helping investors decide what kind of bonds to include in their portfolio such as short-term, long-term, and high-yield. Guiding investors to not focus solely on retirement income with bonds but to also consider capital appreciation that could add value over the long term. This could also help decrease risk and increase tax efficiency. Vanguard found this value add to be significant but stated it was too unique to quantify.

So Is Having a Financial Advisor Worth It?

That is a value judgment, so only you can decide if having a financial advisor is worth it. Vanguard has shown that advisors can add up to, or exceed, 3% in net returns by following their Advisor’s Alpha framework. Over a long period that could add tremendous value to your financial plan. That’s if you are being charged reasonable fees for the services provided. This figure shows the median advisory fees based on account size.

If you want to do it on your own, make sure to do your research so that you can invest well

If you currently work with a financial advisor, make sure you what they are charging you and evaluate if they are following Vanguard’s best practices in wealth management

If you want to work with an advisor then feel free to reach out to as I would happily meet with you to explain how I would be able to help you with your financial plan

(Source: Kitces Blog; link below)

Sources: https://advisors.vanguard.com/content/dam/fas/pdfs/IARCQAA.pdf

https://www.bogleheads.org/wiki/Tax-efficient_fund_placement

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

The Power of the Roth IRA

5 benefits the Roth IRA provides that you won’t want to miss out on.

Ah, the Roth IRA. A wonderful, magical, beautiful savings vehicle. Ok, maybe not really magical but pretty darn close. I’m going to share with you, undoubtfully, some powerful benefits the Roth IRA has to offer and why you might consider contributing to one. Everyone’s situation is different and it may not be the best vehicle for all - but that’s why I’m here (wink-wink). My contact info is down at the bottom so you know where to find me. Alright, let’s jump into the world of Roth.

Let’s start with what is a Roth IRA anyway.

A Roth IRA is a savings vehicle designed for retirement. The main difference between a Roth and your traditional retirement account is that this vehicle is funded with after-tax dollars. You’ve already paid taxes on the dollars you contribute to the Roth account. In return, when you go to pull the money out in retirement (more on that to come), you won’t pay taxes because you already have. Your traditional retirement account works the exact opposite: you contribute with pre-tax dollars and pay taxes when you withdraw in retirement.

There are some things to note about who can contribute to a Roth IRA. First, not everyone is eligible to contribute to a Roth IRA. The IRS has certain income limits you must take into consideration before you can start dumping money into your account. Secondly, the max you can contribute for 2023 is $6,500. This amount does change based on where you fall within the IRS income limits. If you are 50 years or older, the IRS so generously allows you to make an additional $1,000 contribution for 2023. You can find the IRS’s income limits and respective contribution amounts here.

You will benefit from tax-free growth (yes, you read that correctly).

Remember how I said you put dollars in that have already been taxed? Well, those same dollars will be sowed into the market and grow into a luscious, fruitful nest egg free of tax on your earnings. This is what I was talking about when I said Roth IRAs are pretty close to magical. Don’t skim over that sentence lightly. Think about this for a second. If you start investing and watch your savings grow over the next twenty, thirty, forty years, can you begin to see how much growth is in the picture? If not, I’ll fill you in - it’s a lot (assuming you are in a growth-oriented portfolio, keeping investment fees low, maintaining a long-term mindset, and so on). All that growth is tax-free. Yours to keep - not the government’s. As I said, it’s beautiful.

You will benefit from tax-free withdrawals.

As I mentioned, when you withdraw funds from your Roth IRA, you will not be paying taxes on them. Now, there are some rules that go along with that. You must be 59 ½ years old when you withdraw your earnings and the account must be opened for at least 5 years to avoid any penalties and taxes. If those two boxes are checked, then you are in the clear.

What if you are younger than 59 ½? What if your account hasn’t been opened for at least 5 years? You can do more of a deep dive into all the specific withdrawal rules here.

Now let’s talk about this thing called RMDs.

RMD stands for Required Minimum Distribution. This is an amount that the IRS requires you to withdraw each year from your qualified retirement accounts. So what does this have to do with a Roth IRA? You are not required to take an RMD from a Roth IRA. In other words, you get to decide if, when, and how much you want to withdraw from your Roth. More power to you.

Speaking of more power to you, you have withdrawal power over your contributions - at any time.

Yep, any contributions you make to your Roth IRA are 100% available to you to withdraw, free of tax and penalties, at any time. Notice, I said contributions - not contributions and earnings. Any earnings within your account will follow the rules we talked about earlier. However, your contributions are fair game. (This doesn’t mean it’s always wise to treat this as available cash at all times. However, it does allow more flexibility, freedom, and control over the money you set aside).

There are benefits for your kiddos too.

Did you know that there is no age limit to who can open a Roth IRA as long as they have earned income? Earned income includes both formal employment income and self-employment income. So yes, that means those babysitting dollars can be put to work. Just note that contribution amounts can’t be more than the annual IRS contribution amount or the amount of the child’s earned income (whichever is less).

Thanks to the new Secure 2.0 Act, unused 529 Plan funds can be rolled over into a Roth IRA for your child. As you’d expect, there are rules that apply to this new offering, but this could be a great way to not let those unused education savings go to waste by redirecting them to a Roth IRA. If you’re curious about the rules, let’s connect.

Do you believe me now that the Roth IRA can be a very powerful tool in your financial life? With benefits ranging from taxes, more control, all the way down to your kids, I sure hope you believe me. Let’s chat to determine if this vehicle can play a role in your growth journey. And just because you are over the income limits doesn’t mean there isn’t opportunity for you (hint: backdoor Roths, Roth 401ks, Roth self-employed plans). If you aren’t excited about a Roth IRA, go back and read this again (you’re welcome).

Fiduciary Financial Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Fiduciary Financial Advisors LLC does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned. Past performance is not a guarantee or representation of future results.

About Leanne…

Leanne Rahn is a Fiduciary Financial Advisor working with clients all over the US. If you don’t know what a Fiduciary is, Leanne encourages you to look it up (or even better - check out her website!). She swears you won’t regret it. Women entrepreneurs, newlyweds & engaged couples, and families who have special needs children are Leanne's specialties.

She loves a good glass of merlot, spending time with her hubs and baby boy, and all things Lake Michigan. She could listen to the band Elevation Worship all day long and is a sucker for live music.

Here, at Fiduciary Financial Advisors, we take our fiduciary oath seriously. We hold these five principles:

I will always put your best interests first

I will avoid conflicts of interest

I will act with prudence; that is, with the skill, care, diligence, and good judgment of a professional

I will not mislead you, and I will provide conspicuous, full, and fair disclosure of all important facts.

I will fully disclose, and fairly manage, in your favor, any unavoidable conflicts

MoneyGeek Feature: How to Start Saving and Investing

Leanne Rahn had the privilege to be featured in MoneyGeek to talk to readers about “How to Start Saving and Investing”.

Leanne answers the questions of how much should you invest, how you choose the best stocks and bonds, how to start investing while living paycheck to paycheck, and her take on investment apps.

Fiduciary Financial Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

529 to Roth IRA Conversions Under New Cares Act 2.0 Rules

Under the Cares Act 2.0 passed in December, savings from 529 education savings accounts can now be rolled over to a Roth IRA (starting in 2024).

This is an important update for parents or grandparents saving for their children or grandchildren’s future. A major concern with 529 accounts has always been “what if my child/grandchild doesn’t end up going to college”? Previously this would have triggered income tax and a 10% penalty to distribute that unused money. Under these new rules, the balance could now be rolled over to a Roth IRA for the beneficiary of the 529 (in this example the child/grandchild).

Under the Cares Act 2.0 passed in December, savings from 529 education savings accounts can now be rolled over to a Roth IRA (starting in 2024).

This is an important update for parents or grandparents saving for their children or grandchildren’s future. A major concern with 529 accounts has always been “what if my child/grandchild doesn’t end up going to college”? Previously this would have triggered income tax and a 10% penalty to distribute that unused money. Under these new rules, the balance could now be rolled over to a Roth IRA for the beneficiary of the 529 (in this example the child/grandchild).

This new rule creates a few major opportunities for savers:

You can take advantage of 529 account tax advantages to save for a child’s future education without as much concern you may be penalized in the future.

You could use a 529 as a “stealth Roth account” for a child to get savings growing tax-free for them long before they have an income that would allow you to fund an actual Roth IRA for them. An extra 15 to 20 years of compounding gains is a powerful thing!

In the “stealth Roth account” situation you may get the dual-benefit of state income tax deductibility as a bonus (this applies for states with income tax that allow a deduction for 529 contributions and assumes they won’t tax 529 conversions which is yet to be determined).

Open a 529 account for a child immediately and fund it with $1 or $25. This gets your 15 year conversion clock going (details on this below).

If your child received grants or scholarships that cover most of their costs they can be rewarded with a head start to their retirement savings by converting their 529 balance to a Roth IRA.

If you’re fortunate enough to be able to pay for your child or grandchild’s college out of pocket without using all of their 529 account, you could choose to transfer up to $35,000 to a Roth IRA for them instead of using it for college expenses.

Because this is the US Congress and tax code they couldn’t let it be toooo simple… there are some important rules to understand:

Funds must roll to a Roth IRA for the beneficiary of the 529 plan. If the 529 beneficiary is your child, that means it must roll to a Roth IRA for your child. Quick note - changing the beneficiary of a 529 is quite easy, congress and the IRS still need to clarify whether you could get around this provision by making you or your spouse the beneficiary of the account thereby allowing you to roll the 529 funds to a Roth IRA for you or your spouse.

Funds must be moved directly from the 529 plan to the Roth IRA, you can’t take the distribution as a check from a 529 and then separately go deposit to a Roth for the beneficiary.

The 529 plan must have been maintained for 15 years or longer before funds can be rolled over to a Roth IRA. Because of this requirement, I would strongly recommend most people open a 529 for a child when they are born and fund it with the minimum amount allowed (for example $1 or $25). This “starts the clock” toward the 15 year requirement in case you ever need to use this provision in the future.

The maximum amount that can be moved from a 529 plan to a Roth IRA during an individual’s lifetime is $35,000. This means you still don’t want to “overfund” a 529 account if you’re worried the beneficiary may not end up using the money for college.

Any contributions made in the past 5 years (and the earnings on those contributions) are not eligible to be moved to a Roth IRA. This doesn’t mean you can never move those funds, you just have to wait until they’ve been in the account for 5 years until you do.

Conversions from a 529 to a Roth IRA count toward the annual contribution limit for Roth IRAs ($6,500 for 2023). So only $6,500 could be converted in one year and no “regular” Roth contributions could be made if $6,500 was converted. If only $5,000 was converted during the year for example, the beneficiary could still make $1,500 in “regular” contributions for the year. This means to convert the full $35,000 lifetime limit would likely take 5 or more years.

Income limits do NOT apply for these conversions. Even if the beneficiary is over the income limit to make “regular” Roth IRA contributions, a 529 rollover to their Roth IRA would be allowed.

The beneficiary must have earned income equal to or greater than the converted amount. For example, if you want to convert $6,000 from a 529 to a child’s Roth IRA they must have at least $6,000 in earned income. If they only have $2,000 in earned income you can only convert $2,000. These are the same rules that apply for “regular” Roth contributions. Many kinds of income can qualify including summer jobs, babysitting, etc. If in doubt, consult a tax professional.

I know, that’s a lot of fine print and may be a bit confusing! I’d strongly suggest reaching out to an advisor if you think a 529 to Roth conversion may make sense for you or if you have questions about how this may impact you. I’m always available to answer questions by phone at 616.594.6205 and email at ryan@ffadvisor.com.

Artificial Intelligence Reveals the Secrets to Becoming a Successful Investor

Technology and why it is Important

My brother once asked me; would you rather be who you are today with the resources you currently have, or would you rather be John D. Rockefeller back in the early 1900s? Rockefeller was estimated to have a net worth of $24.7 billion, adjusted for inflation to 2021 dollars. After considering, I decided I would rather be who I am today with my current resources even though my net worth is just slightly lower than $24.7 billion because the average person today lives a far more luxurious life than the richest person in the world did a century ago. We have:

Indoor plumbing

Air conditioning for our homes and vehicles

Penicillin to literally save our lives

Fast reliable planes that transport us around the world

The Internet and WiFi

Computers that automate many tasks for us

Amazon delivers almost anything to our doorstep within 2 days

Miniature supercomputers in our pockets that have Apps to do almost anything

I bring this up to remind us to remain grateful/humble for the things we do have instead of being jealous or resentful of the things we do not have. Some people get scared of new technology instead of embracing how it can improve our lives.

Artificial Intelligence

One upcoming technology is Artificial Intelligence (AI). Just as I am not a billionaire, I am also not a computer programmer, so I don’t know how the technology works but find it interesting that AI is now able to write articles/blog posts. It will be interesting to see what the pros and cons of AI will be as technology advances. Below are two responses the AI wrote when I prompted, “Write a blog post on how to be a successful investor.” Let me know what you think about the AI’s advice! (I used the website https://openai.com/)

AI’s First Response

Investing can be a great way to grow your wealth over time. It can also be intimidating for many people, especially those who are new to it. Whether you are just getting started or you’ve been investing for years, there are some key steps you can take to be a successful investor.

1. Develop an Investment Plan. Before you begin investing, it’s important to create an investment plan. This plan should include your goals, what types of investments you’d like to make, how much you are willing to invest, and your timeline for achieving your goals. This plan should be regularly updated as your goals and circumstances change.

2. Diversify Your Portfolio. Diversification is an important part of any successful investment strategy. Investing in different types of assets, such as stocks, bonds, mutual funds, and real estate, can help you reduce your risk and increase your potential returns.

3. Research Your Investments. It’s important to do your homework before investing. Research the companies or funds you’re considering investing in, and make sure you understand the risks and potential rewards.

4. Monitor Your Investments.

AI’s Second Response

Are you looking to become a successful investor? Investing can be a great way to make money, but it can also be a huge risk. To be a successful investor, you need to have a clear investment strategy and understand the risks associated with investing. Here are some tips to help you become a successful investor.

1. Educate Yourself: Before you start investing, you need to take the time to educate yourself. Do your research and learn about different types of investments and the associated risks. You should also learn the basics of financial markets, such as how stocks and bonds are traded.

2. Set Goals: Before you start investing, you need to set some goals. What are your long-term and short-term goals? Are you looking to make regular income or grow your wealth over the long-term? Knowing your goals will help you decide which investments are best suited to your needs.

3. Create a Plan: Once you’ve set your goals, you should create a plan to reach them. This plan should include a timeline of when you should invest, how much money you should invest, and what types of investments you should consider.

4. Diversify: To reduce the risk of losses, it's important to diversify your investments. Don't put all your eggs in one basket - diversify across different asset classes, such as stocks, bonds, and cash.

“The future is already here. It’s just not evenly distributed yet.”

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

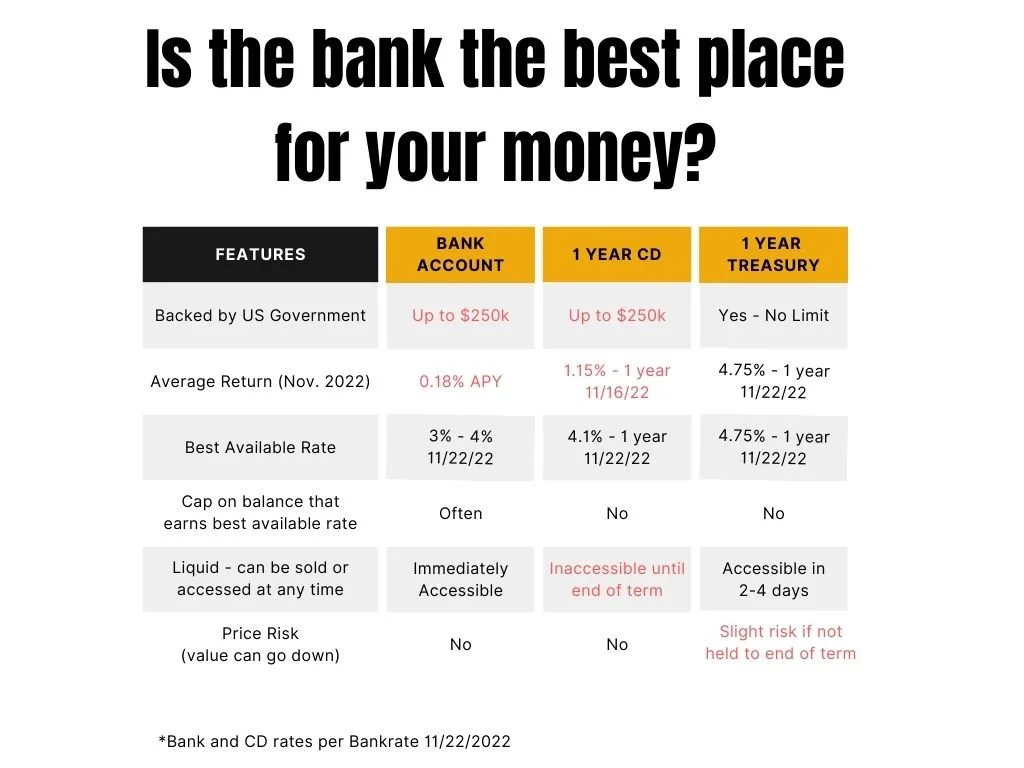

Inflation Is MUCH Lower Than You Think

The media and the average person misunderstand and misinterpret inflation for two important reasons:

They focus on the ANNUAL reported inflation number which tells you what has happened over the past year but not where inflation is headed.

The SHELTER component of inflation which measures rents and home prices makes up about one third of overall inflation but lags real-time housing data by up to 12 months.

The most recent inflation report that was published on 12/13/2022 makes an excellent illustration of these two points. Understanding the nuance of inflation reports and where we are headed rather than where we have been is key for setting expectations for how much further and how quickly the Fed will continue to raise interest rates as well as how long rates will remain elevated.

The media and the average person misunderstand and misinterpret inflation for two important reasons:

They focus on the ANNUAL reported inflation number which tells you what has happened over the past year but not where inflation is headed.

The SHELTER component of inflation which measures rents and home prices makes up about one third of overall inflation but lags real-time housing data by up to 12 months.

The most recent inflation report that was published on 12/13/2022 makes an excellent illustration of these two points. Understanding the nuance of inflation reports and where we are headed rather than where we have been is key for setting expectations for how much further and how quickly the Fed will continue to raise interest rates as well as how long rates will remain elevated.

Annual CPI (consumer price index) tells us how much prices have gone up over the past year as a whole.

This is the figure most often reported by the media. As shown in the line chart below, this figure peaked in June of 2022 at just over 9% and has been trending downward ever since to its current level of 7.1% (as of November 2022). This annual figure is calculated by taking all of the monthly increases for the past year (each of the bars in the bar chart below) and adding them together. For example, if you take all of the bars in the bar chart and add them together, you get that 7.1% current ANNUAL inflation.

This is great for telling us what happened over the past 12 months, but it’s a very bad way to measure what is happening right now. On the way up, the annual figure lags the real-time situation making it harder to see inflation heating up, and on the way down it lags the real-time situation making it hard to see inflation cooling down. Later we’ll see how the lag in rent and home price data makes this problem even worse.

A better way to understand what is happening right now is to ignore the ANNUAL number and instead ANNUALIZE the most recent 3-6 months of data. A couple of examples. If you take the most recent 6 months of data (June through November) you get a 4.5% annualized inflation rate. That’s much lower than the 7.1% figure for the past 12 months. If you take 5 months of inflation data (July through November) you get a 2.4% annual inflation rate. If you take the last 3 months of data you get a 3.6% annualized rate. These examples tell us that for the past 3 to 6 months we have been MUCH closer to the Feds official target of 2% annual inflation than most people believe.

It works the other way too - if you had taken the last four months of data when inflation peaked in June, you would have had an annualized inflation rate of 11.4%! This is much higher than the reported 9.1% annual figure.

Chart of annual cpi from bls cpi bulletin december 2022

chart of monthly cpi from bls cpi bulletin december 2022

Looking through this lens and understanding how annual inflation data lags what is happening right now shifts the narrative surrounding inflation. It didn’t just burst onto the scene a year ago and it hasn’t remained “stubbornly high” as the Fed has taken measures to push it back down to an acceptable range. According to the data, what actually happened was:

Inflation accelerated quickly as our economy reopened following the pandemic, particularly after the vaccine rollout in early 2021. The 3 month annualized rate (red line below) reached its first peak at 9.2% in June of 2021 while the annual rate that is broadly reported (blue line below) had just surpassed 5%. The Fed and many economists believed inflation would be transitory and inflation was not yet a “mainstream” topic.

Inflation remained elevated through it’s eventual peak in June 2022 but it wasn’t resisting the Fed’s efforts, the Fed just wasn’t doing anything. As the annual inflation rate caught up to the 3-month figure and gas prices spiked in January 2022, inflation became a hot mainstream topic (as evidenced by google search data).

As the Fed began to raise interest rates (yellow line below) in earnest with it’s first 0.75% increase in July 2022, the 3-month annualized inflation rate plunged into the range of 3% to 4% while the annual rate has lagged substantially in the 8% to 9% range. Ignoring this dramatic near-term decline and focusing on the much higher annual number would lead you to believe the Fed has “a lot of work left to do” when in reality the work may be nearly finished and the (lagged) data just hasn’t caught up yet.

chart was created using data from bls cpi bulletins dec 2018 - dec 2022, fed funds rate data from st louis fed

Home and rent prices accounts for a massive one third of CPI - but the way they are measured lags reality by UP TO 12 MONTHS

This is according to a paper written by the Bureau of Labor Statistics in conjunction with the Cleveland Federal Reserve Bank. An excerpt from their paper explains how large of an impact this has and why it’s such a big deal: