Yours, Mine, and Ours: A Field Guide to Combining Finances (Without the Headache)

It’s not about a magic net worth number; it’s about the complexity of your life. Discover why high-earning professionals and business owners are moving away from DIY management and how to distinguish between a salesperson and a true fiduciary partner who is legally bound to put your interests first.

There is no "right" way to merge money with a partner, but there are efficient ways to do it. Here is how couples with successful careers navigate the emotional and logistical transition from separate to fully joint.

Stop spending your valuable time on administration.

A quick, 30-minute intro to see if we're a good fit.

Key Takeaways From This Article:

Hiring an advisor makes sense when your financial success creates gaps that DIY management can no longer effectively or efficiently fill.

Mind Over Math:

The friction in combining finances is rarely about the math; it is about autonomy, control, and the fear of judgment.

The "Roommate" Trap:

Keeping finances strictly separate can create a transactional dynamic that feels unromantic and exhausting over time for couples.

The Executive Shift:

As careers peak and time becomes scarcer than money, couples often merge finances simply to reduce "cognitive load" and administrative fatigue.

Legal Reality:

Changing titling on assets (ownership) is a major legal event. Do not conflate "feeling married" with "commingling inheritance/pre-marital assets" without legal counsel.

Let’s just get this out of the way immediately: There is no single "correct" way to combine finances with your romantic partner. The right way differs from couple to couple, and frankly, it differs for the same couple depending on the season of life they are in.

I get asked about this constantly. Usually, the question isn't prompted by a banking issue; it's prompted by a feeling. Maybe one partner feels like they are "subsidizing" the other. Maybe one feels controlled. Or maybe you are just tired of Venmoing your spouse for half the electric bill like they are a college roommate.

For executives, the emotional stakes are higher because the numbers are bigger. When you have two high-performing individuals, you deal with:

Autonomy:

You are used to calling the shots in your professional life; asking permission to buy a new watch feels regressive.

Disparity:

Often, careers in a dual income household don’t follow the same trajectory, and one income accelerates faster than the other, creating a Primary Earner vs. Support dynamic that can breed quiet resentment if not managed.

Today, let's look at the plumbing: spending, bank accounts, and credit cards; but through the lens of how these systems actually feel.

Some Different Approaches You Can Choose From

Imagine a spectrum. On one end, Total Autonomy. On the other, Radical Transparency.

Separate Accounts Without Tracking

Keep all accounts separate and trust that expenses will even out.

This is the "you grab dinner, I'll grab the movie tickets" approach.

Why it works: It preserves maximum autonomy. You never have to justify a purchase.

The catch: It relies entirely on feelings, not facts. Over time, the partner who handles the lifestyle expenses (dinners, vacations) can lead to resentment against the partner who pays for the living expenses (groceries, utilities), feeling that the split isn't actually fair.

Separate Accounts With Account Balancing

Keep accounts separate and “invoice” each other.

You use a spreadsheet or app to track expenses, reconciling at the end of the month.

Why it works: It provides safety and fairness. You know exactly where you stand.

The catch: It can erode romance by introducing a transactional component to the relationship. A romantic relationship is a partnership, not a vendor contract. If you are calculating who ate more of the pizza, you are missing the point.

Hybrid Model: Separate Personal & Joint Operating Accounts

Maintain separate accounts for personal use, plus a joint checking account for shared bills.

You fund a joint account for the mortgage/utilities, but keep your own "fun money" separate.

Why it works: This is often the largest psychological hurdle to overcome, but can be highly rewarding for couples who value both shared structure and personal autonomy. It creates a "We" regarding the household, but preserves the "Me" for personal choices. You avoid the "why did you spend that much on golf/shoes?" argument entirely.

The catch: The friction here is usually about contributions. If one of you earns $500k and the other earns $100k, do you constrain your lifestyle so that a 50/50 split feels fair? Or do you live a lifestyle based off of the higher earner and figure out what is a fair contribution by each partner?

Fully Joint Accounts

All accounts are joint.

All income hits one bucket; all expenses leave that bucket.

Why it works: This requires "Financial Intimacy." There are no secrets. It fosters a sense of being a single economic unit, which can be incredibly bonding and daunting at the same time.

The catch: Loss of identity. Some people feel belittled if they have to "explain" a purchase from the joint pot. It also carries the highest liability: if the relationship sours, the money is accessible to both parties equally.

Different Seasons of Life (And Why You Will Likely Change)

You won't pick one system and stay there forever. As your life gets more complex, your need for efficiency usually overrides your desire for separation.

The Trust-Building Phase (Dating/Living Together)

The feeling: "I love you, but I don't know if you're good with money yet."

The behavior: You keep things separate because you are protecting yourself. This can be healthy. You are establishing trust and observing each other's habits without risking your own financial security.

The "Cognitive Load" Phase (Marriage & Kids)

The feeling: "I am too tired to do math."

The behavior: This is usually where the shift happens for many households. You are managing teams at work, and toddlers at home. You do not have the mental bandwidth to calculate pro-rata shares of a utility bill. You merge finances not because it's romantic, but because it reduces administrative fatigue. Efficiency becomes the ultimate currency.

The "Income Disparity" Phase (The Executive Leap)

The feeling: "Is this our money, or my money?"

The behavior: Often in your 40s or 50s, one partner’s income explodes (equity events, a sizable promotion) while the other may downshift to focus on the home or stay steady.

If you keep separate accounts here, the power dynamic can get weird. One person wants to fly business class; the other can only afford economy.

This is where moving to "Joint" or "Pro-Rata Hybrid" becomes more useful to preserve the emotional health of the marriage. It signals that the win for one is a win for the family.

A Personal Perspective

When my wife and I started out, we were strictly in the separate camp. We didn't track joint expenses; we simply took turns paying for things: I’d buy the dinner; she’d buy the ice cream. It wasn't a system, it was just a distinct lack of one.

As we moved into the Cognitive Load season, maintaining separate silos became a job neither of us wanted. We shifted to joint accounts out of sheer laziness and a need for speed and accessibility.

But the real emotional shift happened when we stopped viewing money as a scorecard and started viewing it as fuel for a shared vision. We treated the household as a single business entity. This became crucial when our careers shifted: I started my practice, she began working from home to spend more time with our kids, and "mine vs. yours" became a laughable concept compared to "ours."

A Word of Caution: The Legal Reality

While I encourage you to find an emotional rhythm that works, never ignore the legal reality.

Titling is Ownership: Changing an account from "Individual" to "Joint" isn't just a settings change; it's a gift. In many cases, it makes that money 50% theirs immediately.

Pre-Marital Assets: If you are coming into a relationship with significant executive compensation, inheritance, or property, keep it separate until you have spoken to an estate attorney. You can share the fruit of the tree (spend the income) without chopping down the tree and splitting the wood (changing ownership of the principal).

The Core Issue

Combining finances is 20% math and 80% psychology.

If you are fighting about the logistics, you are probably actually fighting about control or fairness. If your current system feels heavy, it’s time to move to the next season. Just make sure you talk to a professional before you sign the paperwork.

You deserve a partner whose incentives are 100% aligned with yours.

Speak directly with a fiduciary. No sales pressure.

Other Recent Articles By Andrew:

Recent Publications Featuring Andrew:

Podcasts Featuring Andrew:

Investment advisory services are offered through Fiduciary Financial Advisors, a registered investment advisor. This content is for informational and educational purposes only and is not individualized investment, tax, or legal advice. Consider your objectives and circumstances before acting and consult qualified professionals (including an attorney) regarding legal and titling decisions.

The True Value of Professional Investment Management: Why It's Not About Beating the Market

TL;DR

Professional investment management isn't about beating the market, it's about making better decisions consistently. Research suggests advisors may add value over time through areas such as implementation, rebalancing, behavioral coaching, tax considerations, and withdrawal planning; the magnitude and timing of any benefit varies by investor and market conditions. The biggest value? Preventing costly emotional mistakes during market extremes. Even capable DIY investors often benefit from professional guidance while freeing time for what they actually enjoy.

Interested in exploring whether professional management might add value? Let's discuss your goals, current approach, and whether we might work well together.

Note: "bps" = basis points. See explanation below.

What Actually Motivates People to Hire Advisors?

Dimensional Fund Advisors research identified four reasons families hire advisors:¹

"I need help, I don't know what I'm doing." Financial management is complex.

"I need accountability." Humans make expensive mistakes during market extremes.

"I don't want to spend time on this." Even capable people prefer allocating time elsewhere.

"I want my spouse involved in our financial decisions." Equal partnership in money matters is critical.

Notice what's missing? "I want someone who can beat the market."

"I Don't Want to Spend Time on This"

Even if you possess every skill needed to manage investments effectively, you might reasonably prefer not to. Your time and mental energy may be better spent elsewhere.

Investment management might rank between "tedious chore" and "necessary evil" on your preferred activities list. Your calendar already bursts with obligations. Or perhaps having one partner shoulder the entire investment burden creates uncomfortable dynamics.

What if you could build a relationship with a trusted financial professional and simply know it's handled competently?

While you might be capable of DIY investing, choosing not to is valid.

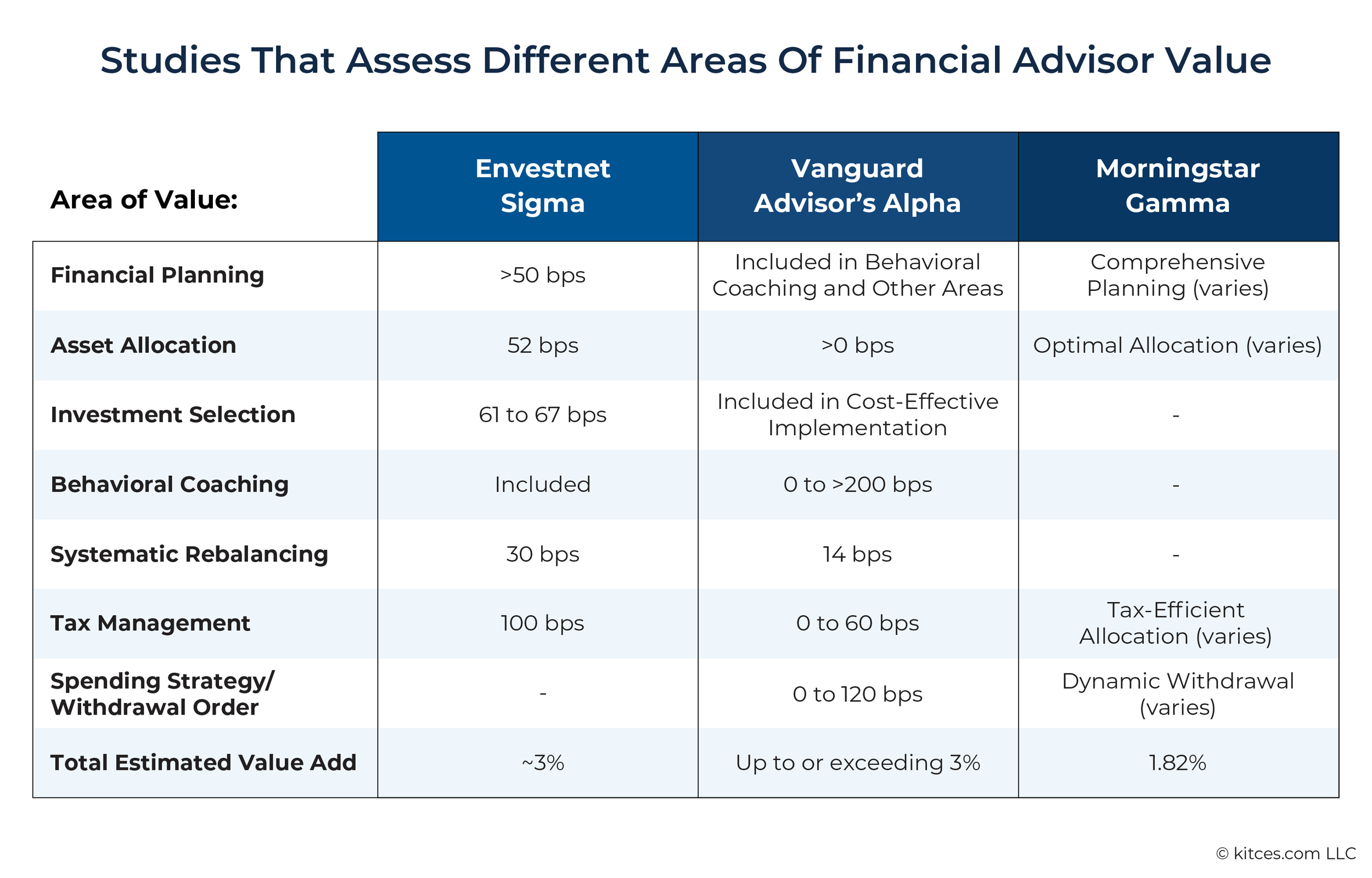

The Research: Quantifying Adviser's Alpha

Vanguard research suggests that following certain practices may improve investor outcomes over time, though results vary and are not consistent year to year.2 This isn't predictable annual outperformance, it's irregular value-add peaking when investors are most tempted to abandon well-designed plans.

Investment management encompasses vastly more than choosing funds. The real value lies in everything around those choices.

A Quick Note on Basis Points

"Basis points" (bps) measure small percentages:

1 basis point = 0.01%

100 basis points = 1%

So "~150 basis points" means approximately 1.5% annually. "34-70 basis points" means 0.34% to 0.70%.

Why use basis points? These small differences compound dramatically over decades. A 50 basis point (0.50%) annual advantage can mean tens or hundreds of thousands of dollars over 30 years.

The Four Pillars of Value

Dimensional organizes the value proposition into: Competence, Coaching, Convenience, and Continuity.¹

1. Competence: Technical Expertise That Matters

Cost-Effective Implementation: 34-70 Basis Points

Average investors pay 57-79 bps annually in fund expenses. Those using low-cost funds pay just 16-20 bps. This 34-70 bps differential compounds relentlessly over decades.³

Understanding Your Portfolio Composition

Many investors contributing for years without a coherent philosophy end up with suboptimal portfolios. The most common pattern I see: significant overconcentration in the S&P 500 through multiple index funds, target-date funds that hold S&P exposure, and individual holdings that overlap with the index.

When we review these portfolios, clients often realize for the first time that they have virtually no exposure to smaller U.S. companies, international markets, or meaningful fixed income allocation. Everything is essentially the same 500 large-cap U.S. stocks, held multiple times across different accounts.

Your portfolio's composition (asset allocation and market exposure) is your returns' primary driver. It's about intentionally accessing different sources of expected return across size (large vs. small), geography (U.S. vs. international vs. emerging), and asset classes (stocks vs. bonds vs. real estate).

Heavy concentration in the S&P 500 is an implicit bet that large-cap U.S. stocks will keep outperforming everything else. That might work. Or not. But it should be conscious, not accidental.

Beyond knowing what you own, you need to know why. Your investment strategy should connect directly to actual financial goals.

We examine both sides: return drivers (asset allocation, market exposure, emphasizing higher expected return areas) and cost drags (implementation costs, taxes, expense ratios). We evaluate every holding: keep, sell, or donate, ensuring each serves a deliberate purpose aligned with your timeline and goals.

Your net returns come from assembling these components thoughtfully. Not just picking "best" funds, but how everything works together.

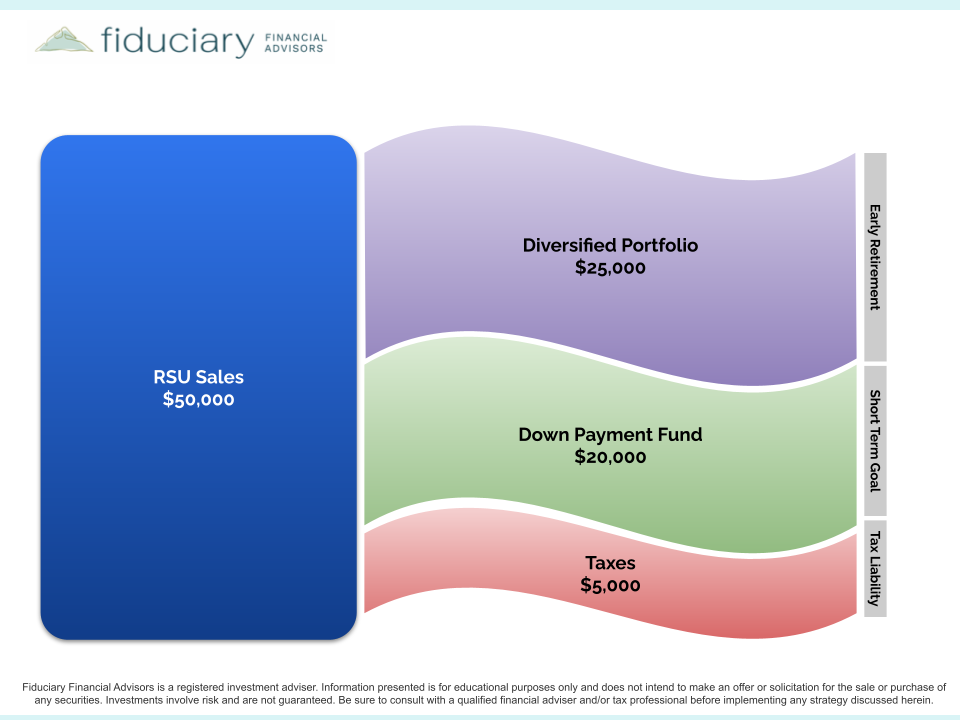

Converting Idle Cash Into Working Capital

Cash accumulation where it shouldn't be is widespread: substantial balances in checking/savings without purpose, RSU proceeds languishing, or money transferred to investment accounts but never deployed. We systematically review and invest these idle positions.

Disciplined Rebalancing: 26-86 Basis Points

Market movements push portfolios from target allocations. A portfolio designed with a certain stock/bond mix will naturally drift as different asset classes perform differently. Rebalancing primarily controls risk.⁴ A portfolio that's drifted to hold more stocks than intended has taken on more volatility and downside exposure than originally planned.

The challenge? Rebalancing is psychologically uncomfortable, selling winners and buying losers when instincts scream otherwise.

Calibrating Risk to Timeline

Risk is the probability of insufficient funds when needs arise. Someone purchasing a home in five years needs dramatically different allocation than someone two decades from retirement.

We construct appropriate equity/fixed income/cash combinations based on your timeline and risk tolerance. Vanguard research shows simple portfolios (like 60/40 index funds) deliver returns comparable to complex endowment portfolios.⁵ Simplicity has genuine advantages.

Tax Optimization: 0-110+ Basis Points

The goal: minimize lifetime tax burden, not this year's bill. Sometimes accepting higher current taxes positions you for dramatically lower lifetime taxes.

Strategies include:⁶

Strategic asset placement (tax-efficient equities in taxable accounts, bonds in retirement accounts)

Loss harvesting during declines

Gain harvesting during low-income years

Replacing tax-inefficient funds

Donating appreciated securities versus cash

Retirement Withdrawal Strategies: 0-153 Basis Points

For retirees with multiple account types, withdrawal order significantly impacts lifetime taxes. Informed strategies add 0-153 bps annually while extending portfolio longevity.⁷

And Many More

Research suggests over 100 distinct ways advisors add value across planning domains.¹³ Effective advisors go deep on services most relevant to their clients' needs.

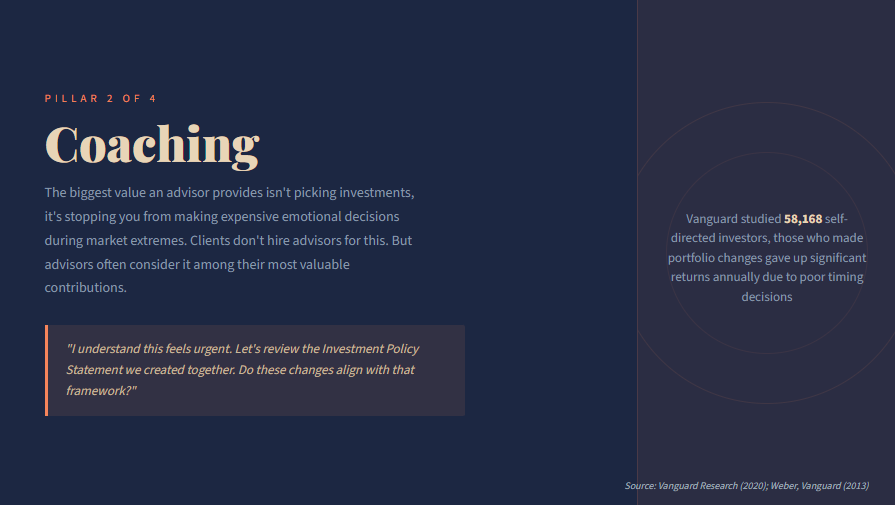

2. Coaching: The Behavioral Advantage (The Biggest Value-Add)

Behavioral coaching adds approximately 150 basis points annually, the single most valuable service advisors provide.⁸

Here's a paradox: clients don't hire advisors for emotional guidance. Yet advisors recognize this as among our most valuable contributions.

Vanguard analyzed 58,168 self-directed investors: those who made portfolio changes sacrificed 104-150 bps due to poor market timing.⁹ European analysis revealed investors consistently underperforming their own fund holdings, a persistent "behavior gap."¹⁰

The pattern: when markets surge, investors extrapolate gains indefinitely and increase risk. When markets crash, fear drives capitulation at exactly the wrong moment.

An advisor's function during these periods is rational perspective: "I understand this feels urgent. Let's review the Investment Policy Statement we created together. Do these changes align with that framework?"

Clients engage advisors not from lack of intelligence, but recognizing the value of accountability.¹¹ Advisors aren't immune to emotion, we've developed systematic processes prioritizing rational analysis over emotional reaction.

Building relationships before market extremes enables advisors to function as behavioral circuit breakers.

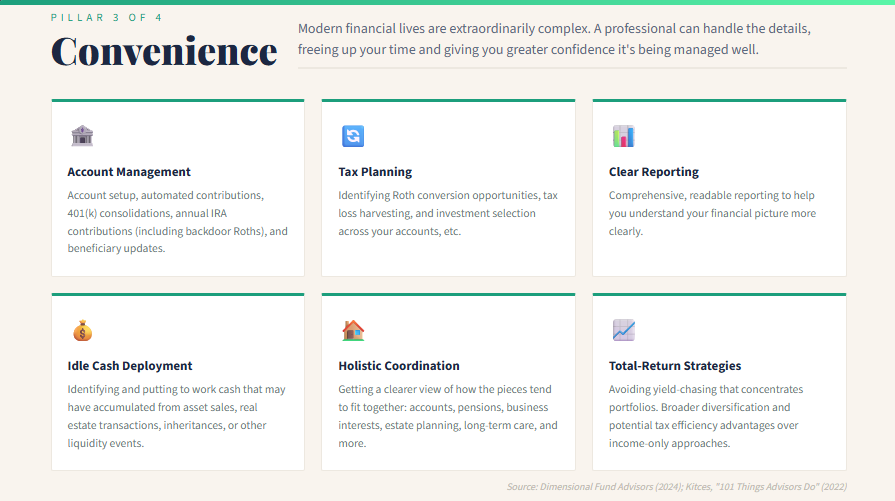

3. Convenience: Integrated Management and Peace of Mind

Modern financial lives are extraordinarily complex: multiple accounts, former employer plans, pensions, business interests, estate planning, tax optimization, long-term care.

Families engage advisors to spend time with family rather than managing portfolios, gain professional oversight, ensure continuity for spouses/children, and have someone seeing how all pieces fit together.

Navigating Administrative Complexity

We help navigate (often handling directly) tasks like: account establishment, automated contributions, 401(k) consolidation, Roth conversions, annual IRA contributions including backdoor Roths, investment selection in employer plans/HSAs, beneficiary updates, trust funding, among many other administrative details that would otherwise consume your time and attention.

Clear, Comprehensive Reporting

Quality reports help you understand your portfolio without needing an advanced degree.

Total-Return vs. Income-Only Strategies

With suppressed bond yields, many retirees' portfolios don't generate sufficient income. The temptation: chase yield through high-yield bonds or dividend strategies.

The problem? These typically concentrate portfolios, reduce diversification, and often expose principal to greater risk than disciplined total-return strategies.¹²

Total-return approaches (considering both income and appreciation) can provide broader diversification, potential tax efficiency advantages, and may support portfolio sustainability depending on the investor’s circumstances.

4. Continuity: Family, Legacy, and Multigenerational Planning

Professional advisors facilitate spouse involvement, children's financial education, wealth transfer, philanthropy, multigenerational planning, and legacy creation.

For many families, this broader coordination represents the deepest value.

Systematic Ongoing Reviews

Well-designed portfolios provide initial value. Ongoing oversight ensuring strategy remains appropriate, provides equal or greater value over time. Regular reviews catch drift before it becomes problematic.

The Quantified Value

Research shows:

Value varies by circumstances, but cumulative effects meaningfully improve outcomes.²

The Bottom Line

The true value isn't about "delivering" returns or picking winning stocks.

It's about making better decisions consistently, avoiding behavioral mistakes during emotional moments, creating clarity amid complexity, ensuring money serves your goals, maintaining discipline when instincts scream otherwise, and handling administrative minutiae.

Investment selection is part of professional management. But comprehensive planning, behavioral coaching, tax optimization, administrative execution, and coordinated oversight typically create the most significant impact.

The question isn't "Can I manage investments myself?"

It's: "Would I make consistently better decisions (and feel genuinely confident) with a professional partner? Would I rather spend my time and energy on things I enjoy?"

For many, research and experience strongly suggest yes. And unlike beating the market, those are areas where we aim to provide support and a disciplined process, based on each client’s circumstances.

Interested in exploring whether professional management might add value? Let's discuss your goals, current approach, and whether we might work well together.

Sources and References

¹ Lupescu, Apollo. "Communicating the Value of Your Advice." Dimensional Fund Advisors Applied Communications Workshop, November 13, 2024.

² Kinniry, Francis M. Jr., Colleen M. Jaconetti, Michael A. DiJoseph, Yan Zilbering, Donald G. Bennyhoff, and Georgina Yarwood. "Putting a Value on Your Value: Quantifying Adviser's Alpha." Vanguard Research, June 2020.

³ Ibid. Analysis based on asset-weighted expense ratios across mutual funds and ETFs available in Europe as of December 31, 2019.

⁴ Ibid. Vanguard research on portfolio rebalancing showing value-add of 26-86 basis points depending on market conditions and geography.

⁵ Based on 2019 NACUBO-Commonfund Study of Endowments, as cited in Kinniry et al., "Putting a Value on Your Value: Quantifying Adviser's Alpha."

⁶ Kinniry et al., "Putting a Value on Your Value: Quantifying Adviser's Alpha." Asset location value-add ranges from 0-110 basis points depending on jurisdiction and individual circumstances.

⁷ Harbron, Garrett L., Warwick Bloore, and Josef Zorn. "Withdrawal Order: Making the Most of Retirement Assets." Vanguard Research, 2019, as cited in Kinniry et al.

⁸ Kinniry et al., "Putting a Value on Your Value: Quantifying Adviser's Alpha." Behavioral coaching estimated at approximately 150 basis points annually.

⁹ Weber, Stephen M. "Most Vanguard IRA Investors Shot Par by Staying the Course: 2008–2012." Vanguard Research, 2013, as cited in Kinniry et al.

¹⁰ Kinniry et al., "Putting a Value on Your Value: Quantifying Adviser's Alpha." Analysis of European investor returns versus fund returns showing median negative gaps across categories.

¹¹ Bennyhoff, Donald G. "The Vanguard Adviser's Alpha Guide to Proactive Behavioural Coaching." Vanguard Research, 2018, as referenced in Dimensional Fund Advisors communications.

¹² Kinniry et al., "Putting a Value on Your Value: Quantifying Adviser's Alpha." Discussion of total-return versus income-only investing strategies for retirees.

¹³ Van Deusen, Adam. "101 Things That Advisors Actually DO To Add Value (Beyond Just Allocating A Portfolio)." Kitces.com, November 28, 2022. Available at: https://www.kitces.com/blog/advisors-add-value-proposition-financial-planning-ideal-clients-target-persona-differentiation/

¹⁴ Tharp, Derek. "Quantifying (More Accurately) The Real Impact Of A Financial Advisor's Costs On Their Clients' Nest Eggs." Kitces.com, October 23, 2024. Available at: https://www.kitces.com/blog/financial-advisor-costs-fees-aum-fee-only-high-new-worth-ramit-sethi-facet/

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark in the United States, which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Financial Wellness Isn't Optional, It's Foundational

You track your steps. You hit the gym. You meal prep. You've mastered the wellness routines that optimize your physical and mental health. But there's one dimension of wellness you might be overlooking.

The Hidden Health Crisis No One Talks About

Money is the leading factor negatively affecting Americans' mental health, ahead of politics, world news, climate change, and even physical health concerns.4 Let that sink in for a moment.

The statistics paint a sobering picture:

Nearly 70% of Americans say financial uncertainty has made them feel depressed and anxious, an 8-percentage point increase from just two years ago 9

Over 50% of Americans feel stressed or anxious about their finances multiple times per week, with overall financial stress intensity rated at 3.2 out of 5 2

83% of Americans report financial stress driven by inflation, rising living costs, and recession concerns7

56% say financial stress affects their sleep, 55% their mental health, 50% their self-esteem, 44% their physical health, and 40% their relationships at home 5

Perhaps most troubling: 60% of people have avoided seeking mental health care due to financial constraints. 7 The very stress that's damaging their wellbeing prevents them from getting help.

This isn't just about feeling worried. Nearly 4 in 10 Gen Z and Millennials report feeling depressed and anxious on at least a weekly basis due to financial uncertainty. 9 Financial stress has become a chronic condition, one that compounds over time if left untreated.

Why Financial Wellness Gets Left Behind

You probably wouldn't hesitate to invest in a gym membership, therapy, or organic groceries. These feel productive, healthy, empowering (right?). But financial planning? Why does that feel overwhelming, complicated, shameful, or uncomfortable?

Here's the reality: We often learn our money mindset from our families. You likely absorbed attitudes, fears, and behaviors about money long before you understood what money actually was. Many of those patterns may not be serving you anymore, but they could still be running in the background, influencing your financial decisions. (These are sometimes called "money scripts," a whole topic we could explore another time.)

And unlike organizing your closet or meal prepping for the week, you may not see the results of financial planning immediately. There's no before-and-after photo. No dopamine hit from a perfectly labeled container.

That's probably why only 48% of Americans have emergency funds that would cover three months of expenses, even though this is considered the baseline for financial security.3 It may also explain why nearly 1 in 4 households lived paycheck to paycheck in 2025, despite total household debt reaching $18.59 trillion.6

What True Financial Wellness Actually Looks Like

Financial wellness isn't about making as much money as possible. It's about using money as a tool to make your overall life better.

It means:

Financial security - The ability to handle an emergency without panic

Strategic debt management - A manageable debt load skewed toward "good" debt like a mortgage, not high-interest credit cards crushing your monthly budget

Aligned spending - Money flowing to the right places at the right times, supporting what matters most to you

Freedom from anxiety - Confidence that you're making sound decisions, not constant worry about what you might be missing

This isn't about restriction. It's about abundance. Making conscious choices that create the life you actually want to live.

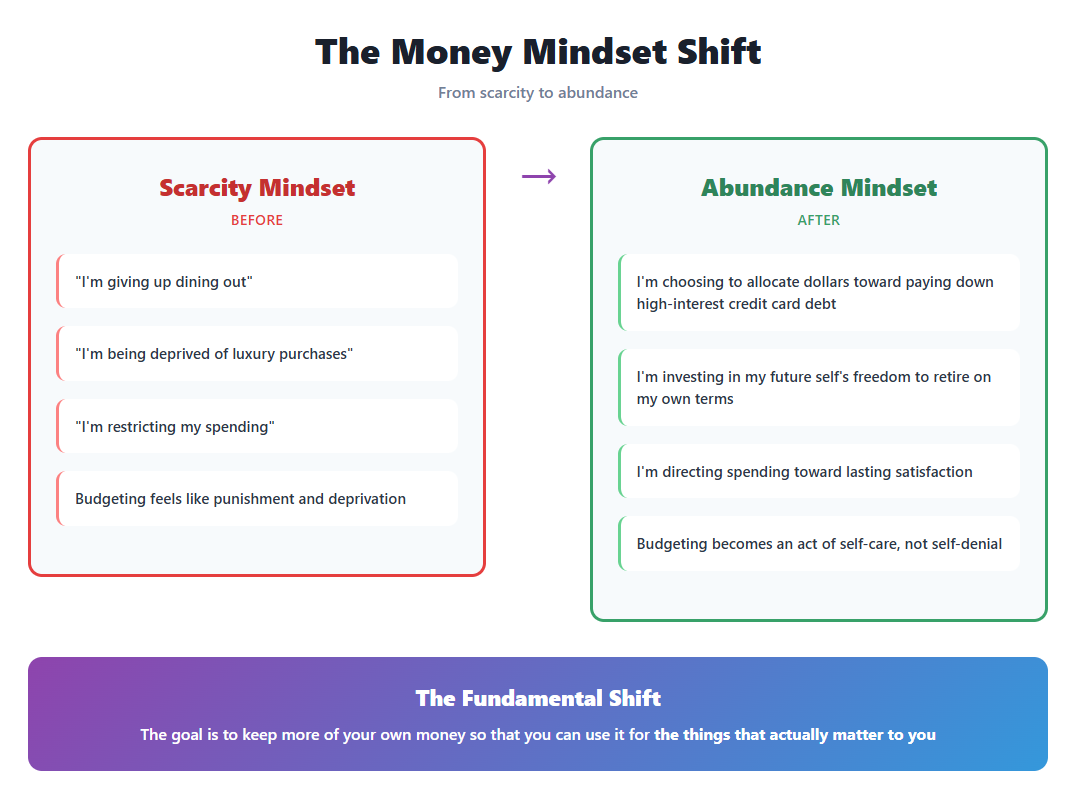

The Money Mindset Shift That Changes Everything

Most people approach budgeting as punishment. A list of things they can't have. A constant reminder of scarcity.

But here's the reframe: Your goal is to spend as much of your money as possible over the course of your life (on the things that actually matter to you).

Budgeting, saving, and investing are simply techniques to smooth out spending across earning years and non-earning years. The purpose isn't deprivation, it's ensuring your lifestyle remains at the level you want, both now and in retirement, while avoiding the trap of high-interest debt that can sabotage your financial future.

This shift from scarcity to abundance mindset transforms everything:

You're not "giving up" dining out. You're choosing to allocate those dollars toward paying down that 21% credit card balance6that's costing you thousands in interest

You're not being "deprived" of luxury purchases. You're investing in your future self's freedom—whether that's eliminating debt, taking a sabbatical, or retiring early

You're not "restricting" your spending. You're directing it toward what brings you lasting satisfaction instead of fleeting dopamine hits that often end up on high-interest credit cards

When you understand this, budgeting becomes an act of self-care, not self-denial.

Breaking the Silence: Why Talking About Money Matters

Money remains one of our last cultural taboos. We'll discuss our relationships, our therapy sessions, our trauma, but our credit card debt? Our salary? Our fear that we're falling behind? Those topics remain off-limits.

This silence keeps you stuck.

The majority of people whose mental health is negatively impacted by money cite inflation and rising prices as the culprit 4, but they're likely suffering alone, convinced everyone else has it figured out.

In relationships, financial silence is toxic. Shame over debt or unequal wealth sabotages progress toward shared goals. One partner quietly panics while the other remains oblivious. Resentment builds. Trust erodes. (An objective third party could help navigate these conversations, right?)

In friend groups, financial transparency creates both reassurance and knowledge. How did they handle that situation? What professionals helped them? What strategies actually worked? This information is invaluable, but only if people are willing to share it.

The irony? 78% of Gen Z say financial responsibility is an important attribute when choosing a significant other, and 66% don't feel pressured by friends to spend beyond their means.8 The younger generation is already normalizing these conversations. It's time the rest of us catch up.

The Six Pillars You Can't Afford to Ignore

Financial wellness isn't about mastering one thing. It's about creating a comprehensive system across six critical areas:

1. Cash Flow & Emergency Planning

Beyond just "spending less than you earn," this means understanding your patterns, optimizing your savings rate, and maintaining 3-6 months of living expenses for true emergencies. Only 20% of lower-income adults report being in excellent or good financial shape currently, 1 but this isn't about income level. It's about having a plan.

2. Strategic Debt Management

The average credit card interest rate crossed 21% in 2025, making high-interest debt incredibly expensive.6 Should you consolidate? Pay down aggressively? Use a home equity loan? The answers depend on your specific situation and goals.

3. Investment Strategy

Your portfolio should reflect your timeline, goals, and risk tolerance, not last quarter's hot stock. Are you properly diversified? Are tax implications part of your strategy? Research from major financial institutions consistently shows that diversification across asset classes reduces portfolio volatility and risk without necessarily sacrificing returns.12

4. Multi-Year Tax Planning

This isn't about filing your return. It's about maximizing tax-advantaged accounts, planning for retirement distributions, and, if you're a business owner, structuring your affairs for maximum efficiency. While the tax code is complex, strategic planning could help optimize your tax situation.

5. Comprehensive Risk Management

Health insurance, life insurance, disability coverage, umbrella policies, and long-term care: each serves a different purpose. 27% of adults had trouble paying for medical care in the past year.3 The right insurance protects you from catastrophic financial loss.

6. Estate Planning

Who cares for your children if something happens to you? Who makes healthcare decisions? How do your assets transfer, and what are the tax implications? These aren't comfortable conversations, but they're essential ones.

Why Going It Alone Isn't Working

You likely know much of this intellectually. You probably understand you should have a budget, pay down debt, invest for retirement, get proper insurance, and create an estate plan.

But here's what the research shows about people who try to do it themselves:

They make expensive mistakes. Behavioral mistakes may reduce wealth significantly.15 Common errors include market timing, panic selling during downturns, chasing performance, and failing to rebalance portfolios systematically.

They let emotions drive decisions. Behavioral mistakes may reduce wealth significantly.15 When markets drop, panic sets in. When they soar, greed takes over. Both can undermine long-term returns.

They don't know what they don't know. Tax strategies, estate planning nuances, insurance gaps, investment allocation. These are complex domains where missteps can have long-term consequences.

They run out of time and energy. U.S. employees 56% spend 3 or more work hours per week dealing with personal financial issues.5

The Measurable Value of Professional Guidance

The financial advice industry has been rigorously studied. The data is clear and consistent:

Leading research from Vanguard, Morningstar, and Russell Investments has examined the potential value professional advisors may add through their "Advisor's Alpha" and "Gamma" frameworks.10,17,13These studies explore how tax optimization, behavioral coaching, strategic asset location, disciplined rebalancing, and comprehensive planning could contribute meaningful value over time by supporting better decision-making and helping clients avoid costly mistakes.

Beyond portfolio optimization:

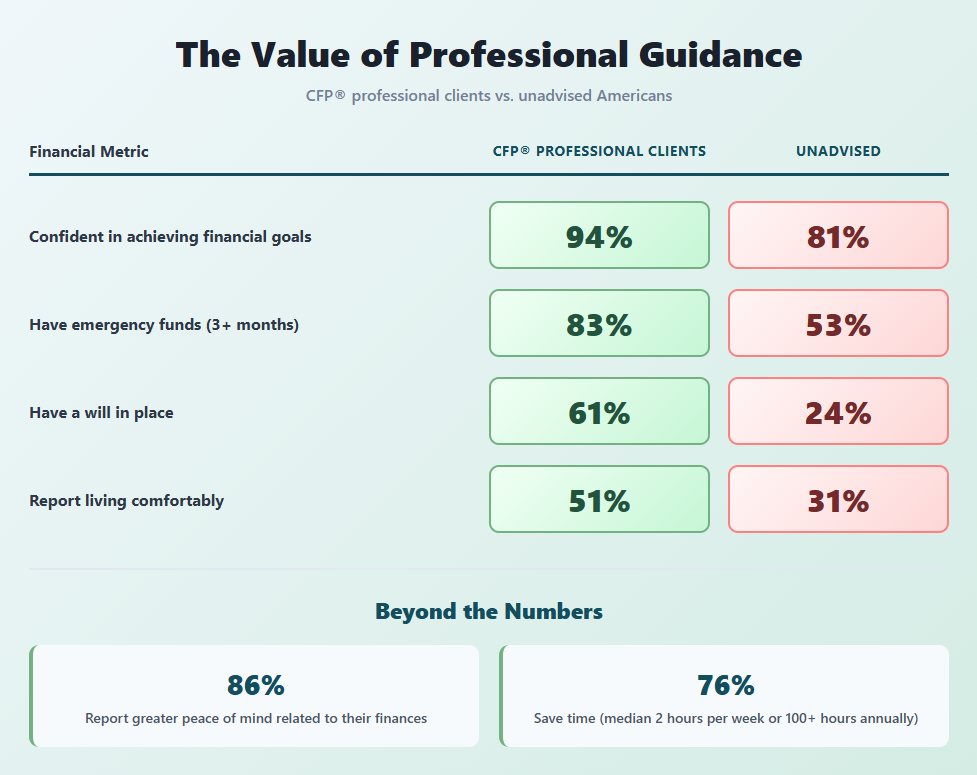

94% of households advised by CFP® professionals feel confident in their ability to achieve their financial goals, compared to 85% of those working with other advisors and 81% of unadvised Americans.11

CFP® professional clients are significantly more prepared: 83% maintain emergency funds covering three months of expenses (versus 68% with other advisors and 53% unadvised), and 61% have a will in place (versus 46% with other advisors and 24% unadvised).11

Half (51%) of people who work with a CFP® professional report living comfortably, compared to 40% with other advisors and 31% of unadvised households.11

Advised investors report greater peace of mind related to their finances: 86% feel more peace of mind, with 60% experiencing less anxiety, worry, sadness, and disappointment, and instead feeling more confident, satisfied, secure, and proud.16

Working with an advisor may also save time: 76% report time savings, with a median of two hours per week (over 100 hours annually) that can be redirected toward activities like leisure, time with family, and exercise.16

The Emotional ROI You Can't Ignore

Over half of consumers who work with CFP® professionals report that financial advice positively impacted their mental health and family life.11 Given the financial stress we discussed earlier, consider what addressing it might mean: the potential for better sleep, less anxiety, improved relationships, greater confidence, and more time with your family.

Research also shows that clients of CFP® professionals report higher quality of life scores compared to those who work with other financial planning professionals or manage finances independently.11 Investors with human advisors perceive meaningful progress toward their financial goals compared to managing finances on their own.14

This isn't just about money. It's about reclaiming your mental bandwidth, your emotional energy, and your time.

Can you quantify peace of mind? Can you put a price on knowing you've made sound decisions that keep your goals on track? Can you measure the value of not lying awake at 3 AM worrying about money?

The Real Cost of Waiting

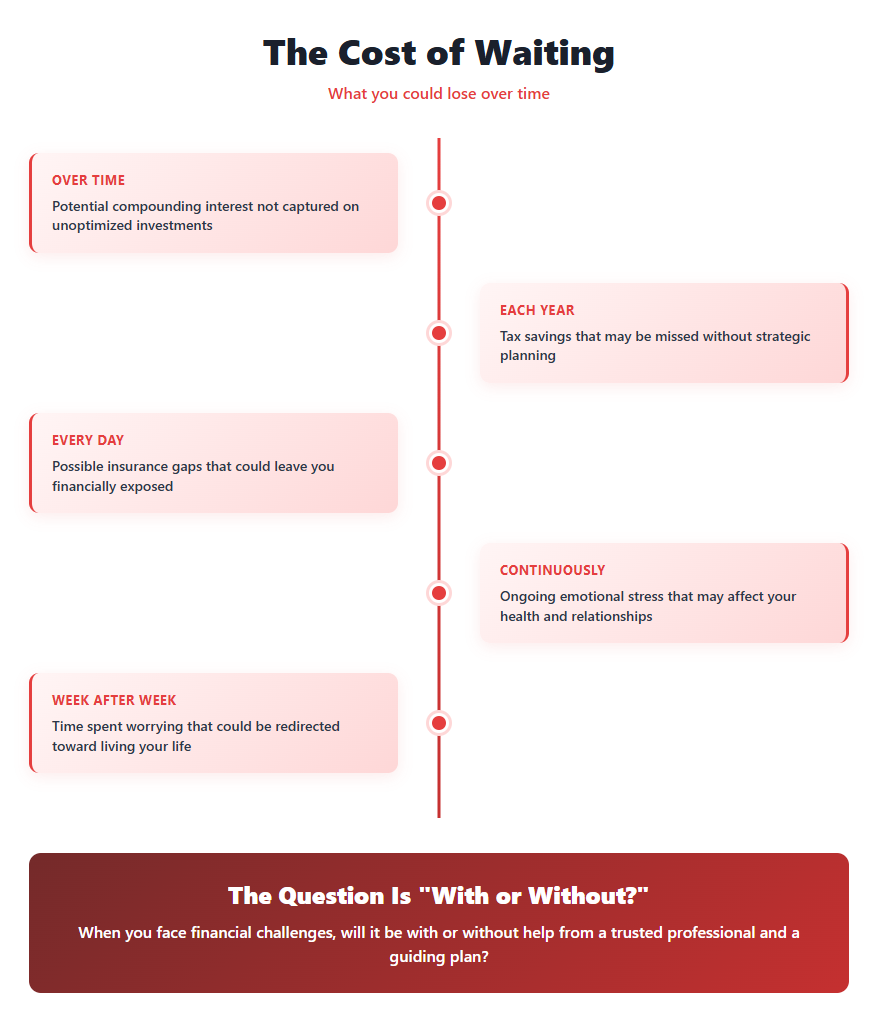

Each month without a comprehensive financial plan may mean:

Potential compounding interest not captured

Tax savings that may be missed

Possible insurance gaps that could leave you exposed

Ongoing emotional stress that may affect your health and relationships

Time spent worrying that could be redirected toward living your life

Near the end of 2024, only 73% of adults reported doing okay financially or living comfortably, down from 78% in 2021.1 The trend suggests challenges for many Americans.

Meanwhile, 28% of adults expect their financial situation to be worse a year from now, up significantly from 16% who said this in 2024.3

The environment presents ongoing challenges: inflation, rising costs, economic uncertainty. The question is whether you'll face them with a plan or without one.

What Makes Financial Wellness Different From Every Other Form of Organization

When you organize your closet, you feel satisfied for a few weeks. Then life happens, and you're back to chaos.

When you establish financial wellness with a competent advisor, you create a system that:

Compounds over time with ongoing adjustments rather than constant upkeep

Adapts to your life instead of becoming obsolete

Streamlines future decisions rather than adding complexity

Builds on itself instead of needing to start from scratch

A good financial advisor should quarterback your entire financial life, not just help you create a budget. This means coordinating your investments, taxes, insurance, and estate plan. Working with your CPA and attorney to ensure nothing falls through the cracks. Monitoring and adjusting as markets change, laws change, and your life changes.

If your current advisor isn't providing this level of comprehensive guidance, it may be worth considering whether you're getting the value you deserve.

Most importantly, the right advisor should transform financial planning from a source of anxiety into a source of confidence.

From Overwhelmed to In Control: What Working Together Looks Like

If you're thinking, "I need to do something about this," here's what taking action actually involves:

Step 1: An Honest Conversation

No judgment, no sales pressure. Just a candid discussion about where you are, where you want to be, and what's standing in your way. Many people find this conversation provides helpful clarity as a starting point.

Step 2: Comprehensive Assessment

We examine all six pillars of financial wellness together. Where are the opportunities? Where are the vulnerabilities? What's working, and what's quietly undermining your goals?

Step 3: Your Customized Plan

Not a template. Not generic advice. A written financial plan that addresses your specific circumstances, values, and goals, with clear action steps and realistic timelines.

Step 4: Implementation & Ongoing Partnership

You don't get a binder to put on a shelf. Your advisor helps you execute the plan, automate what can be automated, and adapt as your life evolves (by the way, this is how I work with clients). Regular check-ins ensure you stay on track and adjust course when needed.

This is what financial wellness actually looks like: not perfect budgets that fail after two weeks, but sustainable systems that support the life you want to live.

The Bottom Line: Financial Wellness Is Wellness

You can't exercise your way out of financial stress. You can't hydrate your way to retirement security. You can't sleep your way to financial freedom (especially if you're stressed about your finances 5). And ignoring it won't make it disappear.

Physical health, mental health, and financial health are interconnected. 73% of clients who work with CFP® professionals generally feel they can cope well with any health issues compared to 64% of unadvised consumers.11 Financial wellness doesn't just reduce money stress: it makes you more resilient across all areas of life.

The cultural narrative tells you that needing help with money is a sign of failure. That's backwards.

You wouldn't think twice about hiring a trainer to optimize your physical health or a therapist to support your mental health. Your financial health deserves the same level of professional attention, especially since it impacts other dimensions of your wellbeing.

Your Next Step

Financial wellness isn't about having definitive answers. It's about asking the right questions and working with someone who can help you find answers that fit your life.

The choice isn't between managing everything yourself or delegating everything to someone else. It's between struggling alone with uncertainty or partnering with a professional who can provide clarity, strategy, and peace of mind.

Ready to make financial wellness part of your overall wellbeing?

Schedule your complimentary financial wellness consultation (below)

Let's transform financial stress into financial confidence, together.

Sources and References

Federal Reserve. (2025). Report on the Economic Well-Being of U.S. Households in 2024. https://www.federalreserve.gov/publications/2025-economic-well-being-of-us-households-in-2024-overall-financial-well-being.htm

Motley Fool Money. (2024). Financial Stress, Anxiety, and Mental Health Survey. https://www.fool.com/money/research/financial-stress-anxiety-and-mental-health-survey/

Pew Research Center. (2025). More Americans now say personal finances will be worse a year from now. https://www.pewresearch.org/short-reads/2025/05/07/growing-share-of-us-adults-say-their-personal-finances-will-be-worse-a-year-from-now/

Bankrate. (2025). Money and Mental Health Survey. https://www.bankrate.com/banking/money-and-mental-health-survey/

PwC. (2023). Employee Financial Wellness Survey. https://www.pwc.com/us/en/services/consulting/business-transformation/library/employee-financial-wellness-survey.html

CoinLaw. (2025). Household Financial Stress Statistics 2025. https://coinlaw.io/household-financial-stress-statistics/

LifeStance Health. (2025). 2025 Study: How Financial Stress ("Stressflation") Impacts Americans' Mental Health. https://lifestance.com/insight/financial-stress-impact-mental-health-statistics-2025/

Bank of America. (2025). Better Money Habits Financial Education Study. https://newsroom.bankofamerica.com/content/newsroom/press-releases/2025/07/confronted-with-higher-living-costs--72--of-young-adults-take-ac.html

Northwestern Mutual. (2025). Planning & Progress Study. https://news.northwesternmutual.com/2025-06-03-Nearly-70-of-Americans-Say-Financial-Uncertainty-Has-Made-Them-Feel-Depressed-and-Anxious,-According-to-Northwestern-Mutual-2025-Planning-Progress-Study

Vanguard. Putting a Value on Your Value: Quantifying Vanguard Advisor's Alpha. https://advisors.vanguard.com/advisors-alpha

CFP Board. (2026). Trust. Confidence. Impact: 2025 Financial Planning Longitudinal Study. https://www.cfp.net/news/2026/01/cfp-professional-advised-americans-experience-greater-financial-preparedness

Vanguard. Framework for Constructing Globally Diversified Portfolios. https://investor.vanguard.com/investor-resources-education/portfolio-management/diversifying-your-portfolio

Russell Investments. Value of an Advisor Study. Referenced in multiple industry analyses of advisor value-add through holistic financial planning.

Vanguard. Why Clients Prefer Financial Advisors Over Robo Advisors. https://advisors.vanguard.com/advisors-alpha/advice-that-clients-value

Covenant Wealth Advisors. (2025). The True Value of a Financial Advisor: What You Need to Know. https://www.covenantwealthadvisors.com/post/value-of-a-financial-advisor-what-you-need-to-know

Vanguard. (2025). Advice Pays in Peace of Mind and Time. https://corporate.vanguard.com/content/corporatesite/us/en/corp/who-we-are/pressroom/press-release-advice-pays-in-peace-of-mind-and-time-vanguard-survey-reveals-hidden-value-of-financial-advice-07072025.html

Blanchett, D. and Kaplan, P. (2013). Alpha, Beta, and Now...Gamma. Morningstar. https://www.morningstar.com/financial-advisors/gamma-action

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark in the United States, which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The Smart Money Moves You're Probably Not Making: Roth Strategies

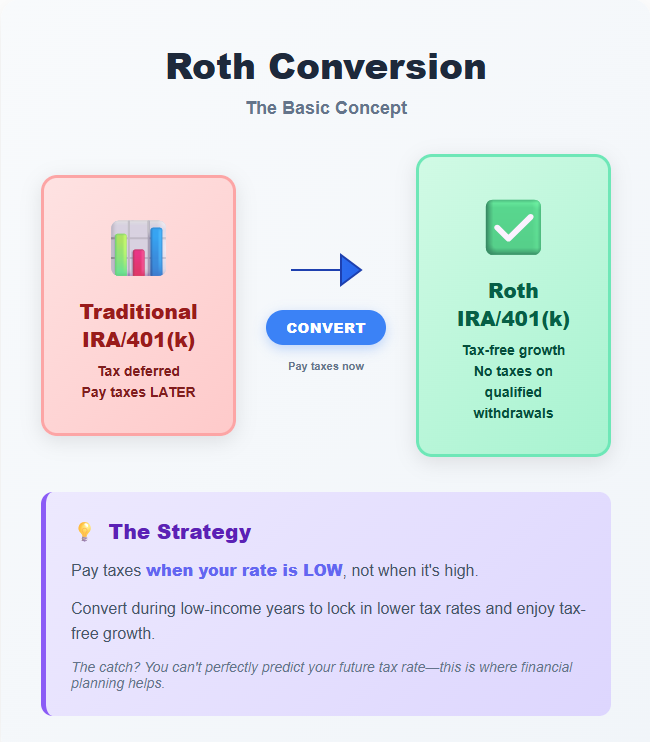

Roth Conversions

The first strategy I’m going to talk about is called a Roth conversion, and here's the simple version: you move money from your traditional retirement account (where you'll pay taxes later) into a Roth account (where qualified withdrawals may be tax-free). Yes, you pay taxes now when you convert, but you may pay less overall depending on your tax rates, timing, and other factors.

The idea is simple: pay taxes when your rate is low, not when it's high. The catch? You can't perfectly predict your future tax rate. (This is one area where doing a financial plan can shine).

The Basics: Two Types of Retirement Accounts

Traditional 401(k)/IRA: You get a tax break now, pay taxes later when you withdraw in retirement.

Roth 401(k)/IRA: No tax break now, but your money grows tax-free forever. Qualified withdrawals are generally tax-free (withdrawals on growth before you are 59½ are not tax-free).

Roth conversion: Moving money from traditional → Roth. You pay taxes on the amount you convert this year, but then it's tax-free as it grows in the Roth account.1

When NOT to Convert

Skip Roth conversions if:

You'll be in a lower tax bracket later. If retirement income will be much lower than now, wait and pay less tax later.

You need the money within 5 years. There's a 5-year waiting period to avoid penalties on the converted funds.5

You don't have cash to pay taxes. Don't use the retirement money itself to pay the increased tax bill; in part, this defeats the purpose (especially for those under 59½, where the tax withholding will be penalized as an early distribution).

Your health insurance costs are affected more than the tax benefit of the conversion. Conversions count as income and can reduce ACA subsidies, and may push you into a higher IRMAA bracket if you are on Medicare.6

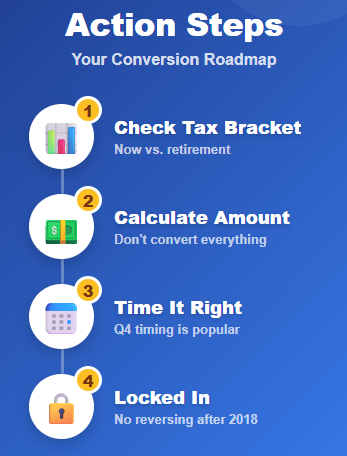

Quick Action Steps

Check your current tax bracket. Will it be higher or lower in retirement?

Determine how much. You don't have to convert everything, and should base the amount you convert on your tax estimates.

Time it right. Many people wait until Q4 to see their full-year income before converting.

Remember: no take-backs. You can't reverse a Roth conversion after 2018 tax law changes.10 Make sure you're confident before doing it.

You can convert a little each year or a lot—whatever makes sense for your situation.2

There’s More: Mega Backdoor Roth

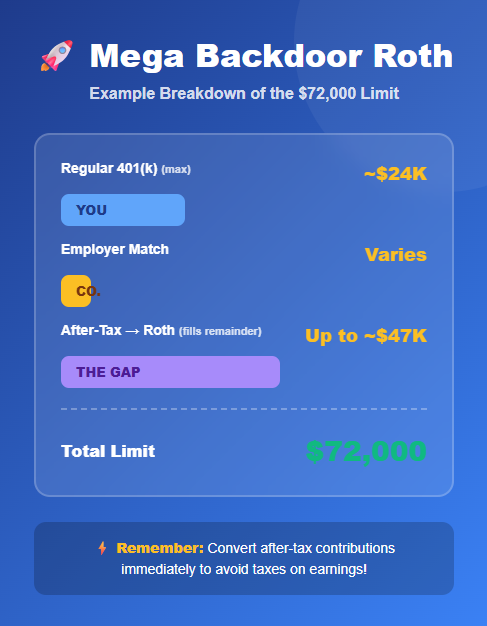

The second Roth strategy applies if you max out your 401(k) and want to save even more tax-free. The mega backdoor Roth lets you contribute up to $47,500 extra (in 2026) to a Roth account.11,12

How it works:

Regular 401(k) limit (ignoring the additional ‘catch-up’ for those 50+): $24,500

Total contribution limit (including employer match): $72,000

The gap between these? You can fill it with "after-tax contributions"

Then immediately convert those to Roth

Requirements:

Your employer's 401(k) must allow after-tax contributions

Your plan must allow in-service conversions or withdrawals13,14

Common at big companies

Example: You contribute $24,500, your employer adds $4,500 match. That's $29,000 total. You can add another $43,000 as after-tax contributions and convert to Roth, giving you nearly $72,000 in retirement savings for the year.

Tax tip: Convert the after-tax contributions frequently to avoid taxes on earnings. Many plans do this automatically.15

Check with your HR department to see if your plan offers this option.

Benefits of Roth Accounts

Beyond saving on taxes, Roth accounts give you:

No forced withdrawals. Traditional IRAs have ‘Required Minimum Distributions’ (RMDs) which require you to start taking money out once you reach the required age.3 Roth accounts don't.

Flexible retirement planning. Roth withdrawals don't count as taxable income, so they won't increase your Medicare costs or affect Social Security taxes.4

Better for heirs. Your beneficiaries inherit Roth accounts tax-free.

Bottom Line

Using Roth accounts effectively may save you thousands in taxes over your lifetime, but the key is timing.

Best candidates for Roth Strategies:

Between jobs or careers

Early retirees (ideally before Social Security & RMDs)

Anyone in an unusually low tax year

High earners who can do a mega backdoor Roth

Now that you know these options exist, pay attention to your income each year. When you spot a low-income window, you may have an opportunity to convert at a lower rate if it aligns with your tax and planning considerations.

Next step: Talk to a financial planner with experience with software to see if a conversion makes sense for your situation this year, or in the near future.

This article is for educational purposes only and should not be considered tax or financial advice. Individual circumstances vary, and you should consult with a qualified financial planner or tax professional before making decisions about Roth conversions.

Sources and References

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Vanguard. "Is a Roth IRA conversion right for you?" Vanguard Investor Resources & Education. https://investor.vanguard.com/investor-resources-education/iras/ira-roth-conversion

Internal Revenue Service. "Retirement topics - Required minimum distributions (RMDs)." Updated January 29, 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

Charles Schwab. "Required Minimum Distributions: What's New in 2026." https://www.schwab.com/learn/story/required-minimum-distributions-what-you-should-know

Lord Abbett. "Quick Answers: The Five-Year Rule and Important Info on Roth IRA Conversions." August 7, 2024. https://www.lordabbett.com/en-us/financial-advisor/insights/retirement-planning/quick-answers-the-five-year-rule-and-important-info-on-roth-ira-.html

Vision Retirement. "Roth IRA Conversions: Rules, Restrictions, and Taxes." January 2026. https://www.visionretirement.com/articles/investing/basics-of-roth-ira-conversions

Fidelity. "Qualified Charitable Distributions (QCDs)." https://www.fidelity.com/retirement-ira/required-minimum-distributions-qcds

Internal Revenue Service. "IRS releases tax inflation adjustments for tax year 2026, including amendments from the One, Big, Beautiful Bill." October 9, 2025. https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2026-including-amendments-from-the-one-big-beautiful-bill

Tax Foundation. "2026 Tax Brackets and Federal Income Tax Rates." February 11, 2026. https://taxfoundation.org/data/all/federal/2026-tax-brackets/

Internal Revenue Service. "Publication 590-B (2026), Distributions from Individual Retirement Arrangements (IRAs)." https://www.irs.gov/publications/p590b

Internal Revenue Service. "Retirement topics - 401(k) and profit-sharing plan contribution limits." Updated January 2026. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

Empower. "Mega Backdoor Roth: How It Works and Its Benefits." 2026. https://www.empower.com/the-currency/money/mega-backdoor-roth

Fidelity. "What is a mega backdoor Roth?" February 28, 2025. https://www.fidelity.com/learning-center/personal-finance/mega-backdoor-roth

NerdWallet. "Mega Backdoor Roths: How They Work, Limits." Updated February 2, 2026. https://www.nerdwallet.com/retirement/learn/mega-backdoor-roths-work

Internal Revenue Service. "Rollovers of after-tax contributions in retirement plans." https://www.irs.gov/retirement-plans/rollovers-of-after-tax-contributions-in-retirement-plans

Are Your Portfolio and Retirement Plan Up To Date?

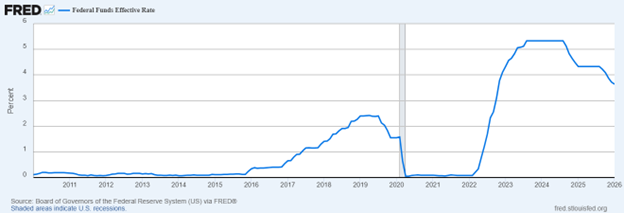

Markets have delivered strong gains in recent years. A strong equity run may have boosted your portfolio but it may also have increased your overall risk exposure. Interest rates remain elevated compared to the pre-2022 era, but have been on the decline since the last peak (shown in the FRED graphic below)¹.

As we move into 2026, it’s worth reviewing both your investment strategy and your retirement savings plan to ensure they remain aligned with your long-term goals.

Revisit Your Diversification

Consider the following:

Are you diversified across sectors and industries?

Do you include international exposure?

What is your balance among large-, mid-, and small-cap stocks?

What is your philosophy when it comes to growth and value stocks?

Has market performance caused your allocation to drift beyond your intended targets?

If equities now represent a larger share of your portfolio than planned, rebalancing may help realign risk.

Rebalancing and Tax Implications

Rebalancing restores your target allocation and can help manage portfolio risk. While doing so, consider tax efficiency:

Capital losses offset capital gains.²

Up to $3,000 in excess net losses may offset ordinary income annually.²

Selecting higher cost-basis shares when selling can improve after-tax outcomes. At the same time, you will need to pay attention to short-term vs. long-term capital gains.

If you have accounts with different tax types, you may also consider implementing an ‘asset location’ strategy.

The Role of Cash

Cash serves as a stability buffer, not a growth engine. Maintaining three to six months of living expenses in liquid savings can provide flexibility and a liquidity buffer for unexpected events.³

At the same time, holding excessive cash may hinder long-term growth. Ensuring your emergency funds are earning competitive yields while remaining accessible can improve overall efficiency.

If you have more cash than what’s needed for your emergency fund, you don’t have to get it invested all at once. Dollar-cost averaging, investing gradually over time, can reduce the risk of poor timing decisions during volatile periods.

Retirement Savings: 2026 Contribution Limits

The IRS has increased retirement plan contribution limits for 2026.⁴

2026 Limits

401(k), 403(b), 457(b), TSP: $24,500⁴

Catch-up (age 50+): $8,000⁴

Enhanced catch-up (ages 60–63): $11,250⁵

IRA contribution limit: $7,500⁴

IRA catch-up (age 50+): $1,100⁴

Individuals age 50 or older may contribute up to $32,500 to a 401(k), while those ages 60–63 may contribute up to $35,750, before employer matching.

Additionally, under SECURE Act 2.0, certain higher-income earners are required to make catch-up contributions on a Roth (after-tax) basis beginning in 2026.⁵

If your income has increased, consider raising your contribution percentage. Incremental increases can have a significant long-term impact due to compounding.

Saving by Career Stage

Early Career:

Start early and contribute at least enough to receive your employer match. With decades ahead, a higher equity allocation may be appropriate depending on risk tolerance.

Mid-Career:

Maximize tax-advantaged contributions as income grows to enhance tax efficiency and accelerate savings. Monitor employer stock exposure to avoid concentration risk.

Approaching Retirement:

Take full advantage of catch-up provisions. Gradually adjusting risk exposure may make sense, but maintaining some growth allocation remains important for long retirements.

The Big Picture

Preparing for 2026 isn’t about predicting markets. It’s about maintaining discipline:

Diversify thoughtfully.

Rebalance regularly.

Use tax-efficient strategies.

Maximize retirement contributions.

Adjust your plan as your goals change.

Strong markets can build wealth. Consistent, informed planning helps preserve it.

Notes

Taken from https://fred.stlouisfed.org/series/FEDFUNDS#, using a date range from January 1st 2010 thru January 1st 2026

Internal Revenue Service. Topic No. 409 Capital Gains and Losses. IRS, 2024.

Consumer Financial Protection Bureau. Emergency Savings and Financial Stability. CFPB, 2023.

Internal Revenue Service. “401(k) Limit Increases to $24,500 for 2026; IRA Limit Increases to $7,500.” IRS Newsroom, 2025.

U.S. Congress. SECURE 2.0 Act of 2022, Pub. L. No. 117-328, 2022.

Moving Across the Country: From For Sale to Fully Settled

Moving is one of life’s bigger transitions—emotionally, logistically, and financially. Whether you’re relocating for a new job, upsizing for a growing family, downsizing into retirement, or chasing a new lifestyle, the ripple effects of a move go far beyond the moving truck.

Since my husband and I were married almost 12 years ago, we’ve moved quite a bit. We’ve lived in Indiana, Florida, Michigan, California, South Carolina, and Idaho all within that time frame. It’s been a gift to chase career dreams and adventure as a family, but it doesn’t come without difficulty.

Most recently, we made a move that reshaped my family’s life: relocating from Charleston, South Carolina to Boise, Idaho. On paper, it might have looked straightforward. In reality, it held financial decisions, emotional transitions, and logistical implications — all at once.

As a financial planner and someone who has lived this personally, I want to share both the practical money considerations and the less-discussed emotional and community impacts of moving. With the right strategy, a relocation can become an opportunity to strengthen—not derail—your financial foundation.

1. Understand the True Cost of Moving

Many people underestimate how expensive relocating really is. Beyond movers or truck rentals, total costs often include:

Realtor commissions and closing costs

Home repairs, staging, or cleaning

Storage fees

Travel and lodging

Temporary housing

Utility deposits and installation fees

New furniture or appliances

Overlapping rent or mortgage payments

Pro Tip:

Build a full moving budget before committing. Add a 10–20% buffer for surprises. If your move is job-related, confirm which expenses are reimbursed—and understand the tax treatment of those benefits. (Pro tip: not all states consider reimbursement of moving expenses nontaxable!)

2. Cash Flow Is King During a Move

Relocations tend to compress expenses into a short period of time. Even financially positive moves can feel stressful if cash flow gets tight.

Common pressure points include:

Carrying two housing payments at once

Paying for a move before a home sale closes

Delayed security deposit refunds

Employer reimbursement delays

Pro Tip:

Stress-test your emergency fund. Timeline planning with your cash flow can become critical.

3. The Housing Decision Has Long-Term Impact

Housing affects far more than your monthly payment. Property taxes, insurance, HOA dues, utilities, maintenance, and commuting costs all shape long-term cash flow.

Key questions to ask:

Is this payment sustainable if income changes?

Are property taxes materially different from my current state?

Will utilities or insurance costs increase?

How long do I realistically plan to stay?

4. State Taxes Can Make a Big Difference

Crossing state lines can dramatically alter your tax picture. Differences may include:

State income taxes

Capital gains treatment

Property and sales taxes

Estate or inheritance taxes

A move from a low-tax state to a higher-tax state (or vice versa) can meaningfully impact your ability to save, invest, or spend.

Pro Tip:

Run a side-by-side comparison of your current and future tax burden before moving—especially if you’re a high earner, business owner, retiree, or receive equity compensation. Taxes usually don’t decide the move for you, but they can’t be overlooked!

5. Job Changes and Benefits Transitions Add Complexity

If your move involves a new employer, benefits may change more than expected:

Health insurance plans and networks

Retirement plans and vesting schedules

Bonuses, equity, or compensation structure

6. Insurance Needs Shift When You Relocate

Relocating should trigger a full insurance review:

Homeowners or renters insurance

Auto insurance (rates vary widely by zip code)

Umbrella liability coverage

Health insurance provider networks

Pro Tip:

Always re-shop auto and home insurance within 30 days of a move—premiums can change dramatically based on location.

7. The Emotional Cost Is Real—and Often Underestimated

This part never shows up in spreadsheets.

Leaving Charleston meant leaving familiar routines, close friendships, and a place that felt like home. Even when a move is intentional and exciting, there’s often a quiet grief that comes with it.

What helped:

Giving ourselves permission to feel unsettled

Maintaining old relationships intentionally

Remembering that hard is not the same thing as bad.

Major transitions take time—emotionally and financially.

8. Rebuilding Community Is Part of the Plan

Community doesn’t magically appear—it’s built.

Let your financial planner concentrate on the numbers. You’ll be spending energy getting plugged in and finding your people.

Community may not show up on a balance sheet, but it’s what makes a city feel like home.

Pro Tip:

Keep a list of the wins, the prayers answered, and the ways that your move came together. You’ll be grateful for the written reminder of the good when you have a hard day.

A move is more than a change of address—it’s a financial and personal reset point. When planned carefully, relocation can align your lifestyle, values, and long-term goals. Without planning, it can quietly create financial drift.

If you’re preparing for a move or have recently relocated, this is one of the best times to revisit your income, expenses, savings, insurance, tax strategy, and overall financial plan.

If you’d like help integrating a move into your broader financial plan, let’s connect. Working with a fiduciary financial planner can bring clarity, strategy, and peace of mind during one of life’s biggest transitions.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.

Did that all just happen in a week?

That all just happened in one week!

Did that all just happen in a week?

Last week was truly a crazy week in financial markets. At risk of recency bias, during my career the past week is only rivaled by weeks in March of 2020 when the full force of Covid was being felt in financial markets. We witnessed a few of the following noteworthy events:

Wal-Mart and Costco both hit all-time valuation highs, with Wal-Mart joining the $1trillion dollar valuation club.

Microsoft declined nearly 7% over the week, while Amazon plunged by more than 12%.

Since its peak in August, Microsoft has shed nearly 1.2 trillion in market capitalization as of this writing.

Software makers cratered as Anthropics Claude Code demonstrated strong capabilities in the legal, security, and financial fields.

AMD, Oracle, Intuit, and CrowdStrike all declined more than 10% for the week.

Salesforce, Workday, Qualcomm, and many other tech names are more than 25% off their 52-week highs.

Gold and silver continued to be volatile with the white metal opening the week right around $79 an oz, rising to $92.02, falling to a low of $63.90, and finishing the week at $77.53.

Bitcoin fell more than 13% on Thursday alone but rallied back swiftly on Friday. It remains nearly 50% off its October high near $69,000 as of this writing.

Broad international indices continue the momentum started last year and continue to outperform the S&P 500

Even more astonishingly, the wipsaw volatility of the markets during the week did not deter the Dow Jones from finishing above 50,000 for the first time in its history.

A few observations and conclusions from the current market:

The market has sped up, full stop.

Of course, there are long-term trends that persist, but tread lightly. The speed of markets is altering their character and historical patterns.

Be careful of narratives.

Just a short time ago, the most popular narrative was the non-stop talk of the AI bubble. Do you really believe we can have large, well-known stocks getting taken to the woodshed during a bubble?

AI can be both overhyped and underappreciated.

Solve the logical puzzle: Investors' skepticism is growing that all the AI data center investments will not yield profitable ventures, while there is incredible angst that these investments will lead to mass layoffs. So which one is it? Consider flight, a truly revolutionary innovation for humanity, when considering airlines, an incredibly terrible business in a capitalist society. Will AI take a similar route?

Has Bitcoin lost the chip on its shoulder?

Bitcoin has lightened the wallet of many a short seller looking to declare its early demise. Could this time be different? With institutional adoption, a friendly SEC and White House all in, and even Harvard allocating, have the lines of computer code run out of haters? Were the haters the catalysts to higher highs after each pullback?

I’ve always felt the strongest argument for Bitcoin is that more demand exists than supply; thus, price higher. The other arguments have all shifted shape too many times to keep track of what is currently in vogue. The most recent argument is global fiat currency debasement. Look no further than a gold versus Bitcoin chart to see that one debunked. Let’s see how the computer code does when it moves from a 1-year drought to a 3, 5, or 10-year drought. You can certainly poke fun at institutions (self-confession here) for holding international stocks like Nestle and Toyota over the past 10 years while they watched Apple and Google grow to mammoth proportions. The difference is that during that time, Toyota and Nestle still stitched together reliable cars and sold the world delicious candy bars at a profit. What happens to computer code that languishes for 10 years, consuming Argentine levels of electricity and delivering no cash flows? An experiment we may all witness.

Diversification adds another championship to its vast collection

The free lunch is free again. For the past 10-15 years, an investor could have picked from a buffet of 5-10 large tech companies and have beaten almost every active mutual fund, hedge fund, and private equity manager charging extortionate fees. The last 18 months, especially this past week, have thrown that investment thesis into crisis. International markets have dwarfed U.S. market returns since the beginning of last year. Small-caps and stogey, non-tech energy, materials, and staples names have joined the outperformance party. Remember, the way to know you have some form of diversification in your portfolio is the ability to point to an investment and say, “Why the h%$^ do we own this?”

Don’t be strangers and let me know what you think. I appreciate you reading. Be well, enjoy the coming spring, and invest for the long-run!

rob

Robert A Barcelona

Chief Investment Officer and Senior Financial Advisor

Market Commentary: Q1 2026 Looking At 2025

2026 Q1 Market Commentary

From Shutdown to New Year: Staying Focused in a Changing Market

In the final months of the year A prolonged government shutdown delayed key data, interest rate expectations evolved, and global events added to the news flow. Even so, markets continued to function, and long-term investors were once again reminded of the value of staying the course rather than focusing on headlines.

As we move from the fourth quarter into the start of 2026, the environment highlights an important truth: markets adapt, and a disciplined, diversified approach remains a reliable investment approach.

Limited Data, But a Functioning Economy

The government shutdown temporarily paused many official economic reports. As a result, some data for September, October, and November arrived at different times than normally expected. In the meantime, private-sector sources such as ADP provided alternative insights into employment trends.

According to the ADP National Employment Report, U.S. private-sector employment declined by 32,000 jobs in November 2025, with most losses coming from businesses with fewer than 50 employees.¹ While notable, this represents a single data point within an economy that continues to adjust.

Interest Rates and the Federal Reserve

The Federal Reserve continued to move cautiously. In late October, it lowered its key interest rate to a range of 3.75%–4%. Then A further 0.25% cut followed in December, which markets had largely anticipated.

Importantly, the Fed signaled that it is not in a hurry to cut rates further. Inflation has eased, and the labor market, while slower, continues to grow. This deliberate approach reflects an effort to balance economic support with long-term stability.

Looking ahead, interest rate decisions in 2026 remain uncertain, particularly as Federal Reserve leadership changes later in the year, along with mounting pressure from the current administration to cut rates. For long-term investors, this reinforces the importance of building portfolios that are not dependent on predicting short-term policy decisions.

Productivity: A Positive Trend

One encouraging development has been stronger productivity. In the third quarter of 2025, U.S. worker productivity rose 4.9%, driven by higher output without a corresponding increase in hours worked.²

These gains likely reflect a combination of factors, including technology adoption, automation investments made in recent years, and possibly workers staying in their roles longer. While productivity data can fluctuate quarter to quarter, this trend is constructive for long-term economic health.

Markets and Volatility

U.S. stock markets delivered solid returns over the year, even though the path was uneven. Volatility was higher at times, particularly earlier in the year, as investors reacted to trade policy changes and other uncertainties around tariffs. When viewed over the full year, however, market performance appeared far less dramatic than daily headlines suggested.

This serves as a reminder that short-term market swings often feel more stressful in real time than they appear in hindsight — and that long-term investors are generally better served by staying invested rather than reacting to market swings.

A Global Perspective: Diversification at Work

One of the most interesting stories of the year came from outside the U.S. In contrast to recent years, international stocks outperformed U.S. stocks. Developed international markets rose 31.9%, emerging markets gained 33.6%, and global stocks increased 22.3% for the year.³

These results highlight the benefits of global diversification. Market leadership shifts over time, often unexpectedly. In 2025, investors with exposure beyond the U.S. experienced higher returns in certain international markets than investors concentrated solely in the U.S.

Performance also varied by investment style. Value stocks performed well outside the U.S., while growth stocks continued to lead in the U.S. Large-company stocks outperformed smaller companies overall, though international small-cap value stocks were among the strongest performers. Over longer periods, U.S. small-cap value has also delivered competitive returns, even during extended periods of large-cap dominance.

The takeaway is not to chase what performed best this year, but to maintain broad diversification across regions, company sizes, and investment styles.

Bonds and Other Assets

Bonds played an important role in 2025. U.S. Treasury bonds returned 6.3%, and the broader U.S. bond market posted its best annual gain since 2020. Global bonds also delivered positive returns.⁴ For diversified portfolios, bonds provided income for some investors and, in some periods, helped moderate portfolio volatility, though bond prices and yields can fluctuate.

Gold also attracted attention as prices rose sharply during the year. While some investors tout gold as a hedge, history shows that its price movements have often been volatile and have not consistently tracked inflation or economic growth.⁵ As with any asset, its usefulness depends on how it fits within a broader, diversified portfolio rather than on short-term price movements.

The Long-Term Investor’s Checklist

Lets revisit the basics:

Are your goals still clear or have they changed?

Is your portfolio aligned with your comfort level for risk, and in alignment with your goals?

Does your financial plan help you stay disciplined during market ups and downs?

A sound financial plan is built around long-term goals. It evolves as life changes, but it does not require constant adjustments in response to headlines.

There were also practical planning opportunities. Investors aged 60 to 63 were eligible for enhanced “super catch-up” retirement contributions, allowing higher savings before new rules take effect in 2026. Year-end tax planning — including charitable giving and tax-loss harvesting — also offered ways to support long-term outcomes. A new Senior deduction for those age 65+ may also offer additional planning opportunities thru 2028.

Looking Ahead

As the new year begins, uncertainty remains — as it always does. Interest rates may continue to shift, markets will rotate, and headlines will come and go. None of this changes the core principles of successful long-term investing.

Over time, diversification, cost awareness, and patience may help support long-term investing goals, though outcomes vary and losses are possible. Rather than trying to predict what comes next, focusing on factors within your control—allocation, savings, and discipline—can be constructive.

2025 Market Returns

Equities

The Dow Jones Industrial Average 14.92%

S&P 500 Index (US Large Caps) 17.88%

Russell 2000 Index (US Small Caps) 12.81%

MSCI All Country World ex USA IMI Index (net div.) (International) 31.96%

MSCI Emerging Markets Index (net div.) 33.57%

Dow Jones Global Select REIT Index 8.59%

Fixed Income

Bloomberg U.S. Aggregate Bond Index 7.30%

Bloomberg Municipal Bond Index 4.25%

3 Month US Treasury Bill 4.40%

Bloomberg U.S. Treasury Bond Index 7-10 Years 8.40%

Footnotes

¹ According to the ADP National Employment Report, U.S. private-sector employment declined by 32,000 jobs in November 2025, with job losses concentrated among businesses with fewer than 50 employees.

² The U.S. Bureau of Labor Statistics reported that nonfarm business sector labor productivity increased 4.9% in the third quarter of 2025, with output rising 5.4% while hours worked increased 0.5% on an annualized basis.

³ International equity performance data is based on MSCI indices. In 2025, the MSCI World ex USA Index gained 31.9%, the MSCI Emerging Markets Index rose 33.6%, and the MSCI All Country World Index increased 22.3%. MSCI indices are not available for direct investment.

⁴ Bond market returns reflect widely used benchmarks. In 2025, U.S. Treasuries returned 6.3%, the Bloomberg U.S. Aggregate Bond Index rose 7.3%, and the Bloomberg Global Aggregate Bond Index (hedged to U.S. dollars) gained 4.9%. Data sourced from the U.S. Department of the Treasury and Bloomberg Finance LP.

⁵ Gold prices rose above $4,000 per ounce in 2025. Historical analysis shows that gold prices have experienced significant volatility and have shown limited long-term correlation with inflation or U.S. economic growth.

Dear 2025: Progress, Perspective, and Planning for What Matters

Dear 2025,

As you come to a close, I find myself reflecting not just on the numbers, the charts, or the goals we set back in January—but on the lessons, the people, and the quiet moments of growth in between. You were a year that stretched me, surprised me, and deeply blessed me.

You reminded me that financial planning is never really about money.

It’s about the new baby that turned a spreadsheet into a story about protection and possibility.