Welcoming a New Family Member: A Personal and Financial Journey

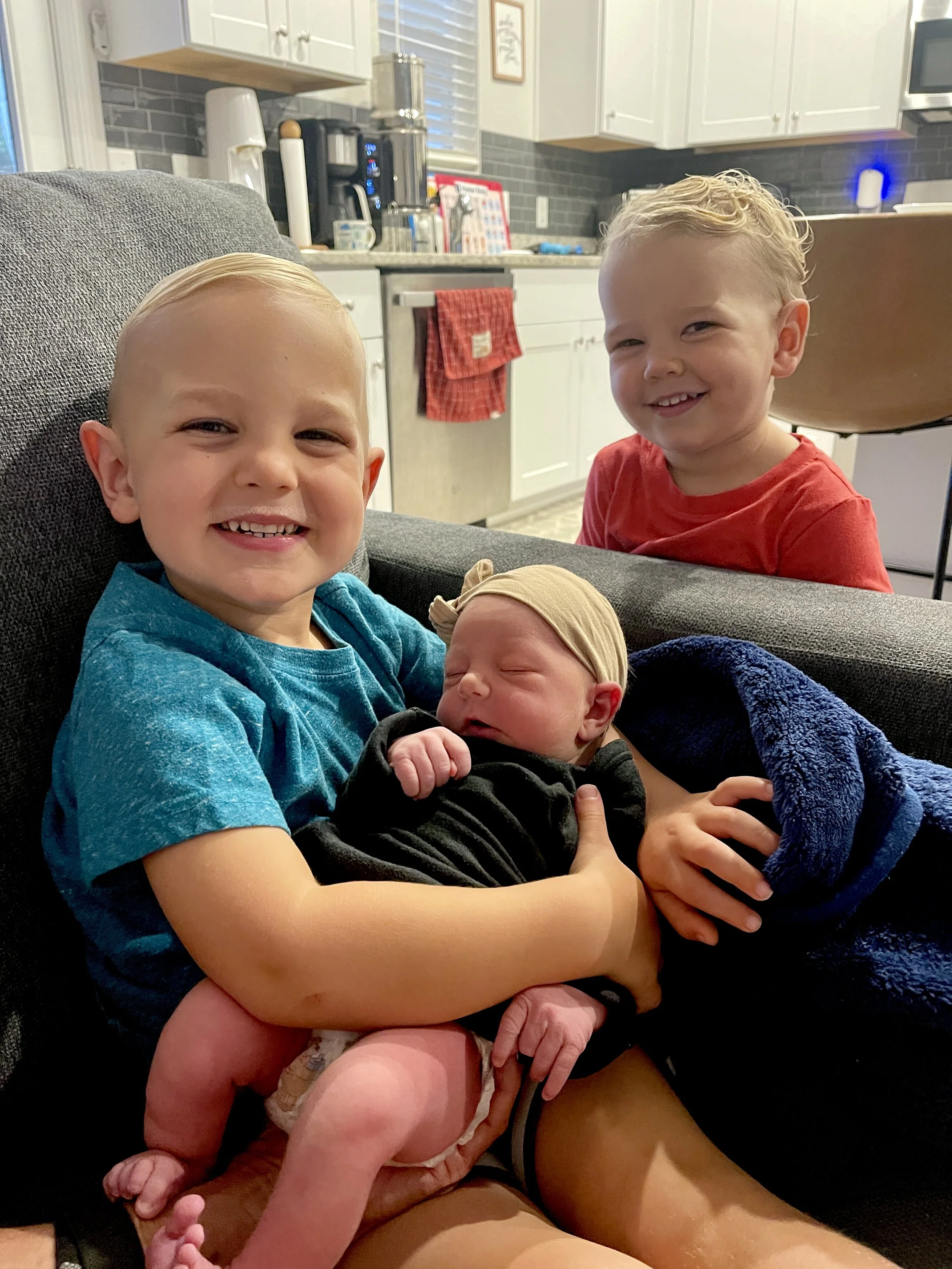

As many of you know, my family just grew in exponential joy and also chaos — we welcomed Lucy Joy Daniels into our lives earlier this month. It’s an incredible, joyful milestone, full of excitement. Beyond the diapers and sleepless nights, though, I’ve been reflecting on the reality of the importance of thoughtful financial planning to protect and provide for our expanding family.

Having helped many clients through similar life transitions, I want to share some important steps I’m taking personally — and that you might consider if you’re welcoming a new child or family member yourself.

1. Open a 529 College Savings Plan

Education costs can feel overwhelming, and starting early is one of the best ways to ease that burden. Opening a 529 plan for your child is a smart, tax-advantaged way to save for future college expenses — and it can be used for K-12 tuition or educational credentials as well. Even small, consistent contributions over time can make a meaningful difference down the road. Each state has its own plan - let’s talk about which one makes the most sense for you.

2. Update Beneficiaries

One of the most common oversights when expanding your family is forgetting to update beneficiary designations on retirement accounts, life insurance policies, and other financial accounts. Ensuring your new child is included where appropriate helps guarantee your assets go to the right people without unnecessary complications.

3. Consider a Trust or Detailed Estate Plan

As our family grows, so does the complexity of protecting our legacy. A basic will might not be enough to cover everything you want for your child’s future. Establishing a trust or updating your estate plan can provide clear instructions on guardianship, asset management, and distribution — offering peace of mind that your child will be cared for as you intend.

4. Review Your Life Insurance Coverage

Welcoming a child often means reevaluating your life insurance needs. If something were to happen to you, would your current policy provide enough to maintain your family’s lifestyle and meet future expenses? It’s worth reviewing your coverage, potentially increasing your policy, or adding new policies to ensure your family is financially protected.

5. Review Employee Benefits

Don’t forget to take a close look at your employer's benefits as well. With a new family member, you might be eligible to make changes or enroll in plans such as:

Health Coverage: Add your new child to your health insurance plan to ensure their medical needs are covered.

Dependent Day Care Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax dollars for child care expenses, helping reduce your taxable income.

Hospital Indemnity Plans: These supplemental insurance plans can provide cash benefits for hospital stays and related expenses, offering an extra layer of financial protection. **This is often an overlooked benefit when you know you’ll be giving birth in the future year. If you are pregnant, this is a way to help put a few thousand dollars into your pocket**

6. Other Important Financial Updates

Emergency Fund: Reevaluate your emergency savings to ensure it can handle new expenses.

Budget Adjustments: Review your monthly budget to accommodate new costs and savings goals.

Aligning Your Financial Plan With Your Goals

A new family member often means your goals and priorities might shift—or, in some cases, become even more clearly defined. It’s essential to take a moment to reflect on whether your financial goals are changing or staying the same, and to make sure your financial plan is singing the same song.

Your plan should be thoughtfully designed and properly implemented to support your evolving needs, providing both flexibility and security as your family grows.

Recent Articles Written by Kristiana:

Fiduciary Financial Advisors, LLC is a registered investment adviser and does not give legal or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. The information contained herein has been obtained from a third-party source which is believed to be reliable but is subject to correction for error. Investments involve risk and are not guaranteed. Past performance is not a guarantee or representation of future results.

Fiduciary Financial Advisors does not give legal or tax advice. The information contained does not constitute a solicitation or offer to buy or sell any security and does not purport to be a complete statement of all material facts relating to the strategies and services mentioned.